People don’t pick a bank because of an ad. They pick one because someone they trust told them, “Switch to this one, it’s actually good.” That’s word-of-mouth marketing, and it’s already happening around your bank whether you have a referral program or not.

A bank referral program doesn’t create that word of mouth. It captures and amplifies what’s already there, turning informal recommendations into trackable, repeatable growth. The banks that get this right treat their referral programs as ongoing operations, not one-time marketing campaigns.

Below, we’ll break down what the best bank referral programs look like (with real examples), what to have in place before you launch one, and the strategies that keep programs producing results long after launch day.

Note: If you’re interested in having creators and experts recommend you alongside customers, check out our guide to bank affiliate marketing.

What is a bank referral program?

A bank referral program encourages your customers to recommend your bank, credit union, or financial institution to people they know, and rewards them with a referral incentive whenever their friends start banking with you.

Ideally, financial referral programs also reward the newly referred person when they open an account, to further encourage the new business. And the best bank referral programs are automated with software, so it’s easy to track who was responsible for each referral.

Why bank referral programs work

Referral programs are a popular way for businesses in all industries to acquire new clients through the power of word-of-mouth marketing. Instead of marketing with your bank’s own campaign messages, financial referral programs motivate your existing customers to spread the word about your bank to their friends and family.

And these recommendations are trusted: A study by Nielsen revealed that 84% of people see referrals as the most trusted and influential form of advertising.

The numbers back it up on cost, too. According to The Financial Brand, the average cost to acquire a new banking customer through traditional methods is $250-$400. With referral programs, that cost drops to $110-$175 per acquisition. That’s a significant efficiency improvement that directly impacts your bottom line.

Beyond acquisition cost, referral programs let you track the word of mouth that’s already happening. Instead of hoping recommendations happen organically, you can measure their impact and use data to improve your approach over time. Referred customers also tend to stick around longer, increasing customer lifetime value.

The Financial Brand further estimates that almost a third of banks and credit unions already have bank refer-a-friend programs. If your competitors are already tapping into this, a well-designed referral marketing program will boost both customer acquisition and retention.

Referral software for banks [Free Tools]

These referral tools for banks are a free and easy way to help you start your referral program.

Free Tools + Services:

- Create your own referral codes - [Referral Code Generator]

- Track referrals manually - [Manual Referral Tracker - Spreadsheet]

- Build referral links - [Referral Link Generator]

- Get best practices and actionable guidance - [Referral Program Workbook]

- Readiness Assessment - [Free Consult]

- Online referral software - [Free Trial]

Want a automated referral system for your bank business? Uncover referrals in plain sight to smooth out business lulls, without losing focus on your real day to day work helping customers.

Check out our referral program software - done right.

8 bank referral program examples

How to design an effective bank referral program? Look to the experts first. We’ve handpicked eight of the best bank and financial referral programs below, and included our thoughts on why they work.

1. Provident Bank

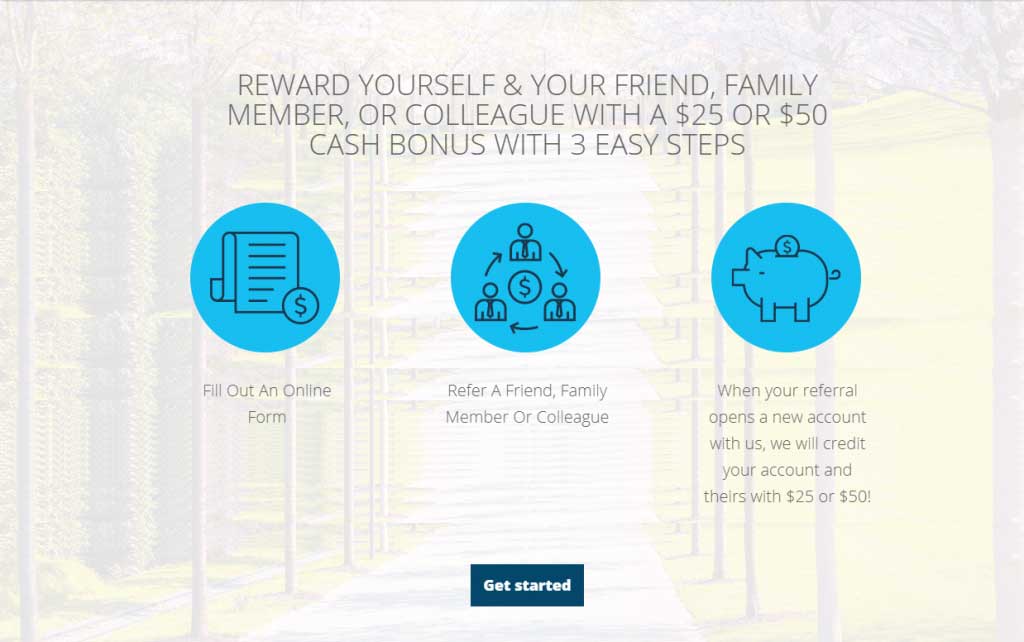

The Provident Bank referral program catches customer’s eyes by putting the call to action and reward front and center (“Refer-a-friend! And get $25 or $50”). Note how referring a friend who opens a higher-value business account earns higher rewards.

What makes this program shine is its three-step simplicity and instant gratification—customers get their reward immediately after their friend opens an account.

The emotional appeal is spot-on too. Provident’s emphasis on how referrals help build relationships, the focus on sharing to help a friend (“Pay it forward”), and the way the bank thanks customers for spreading the word, are also notable messages your bank should consider applying in its own referral program.

2. UMB

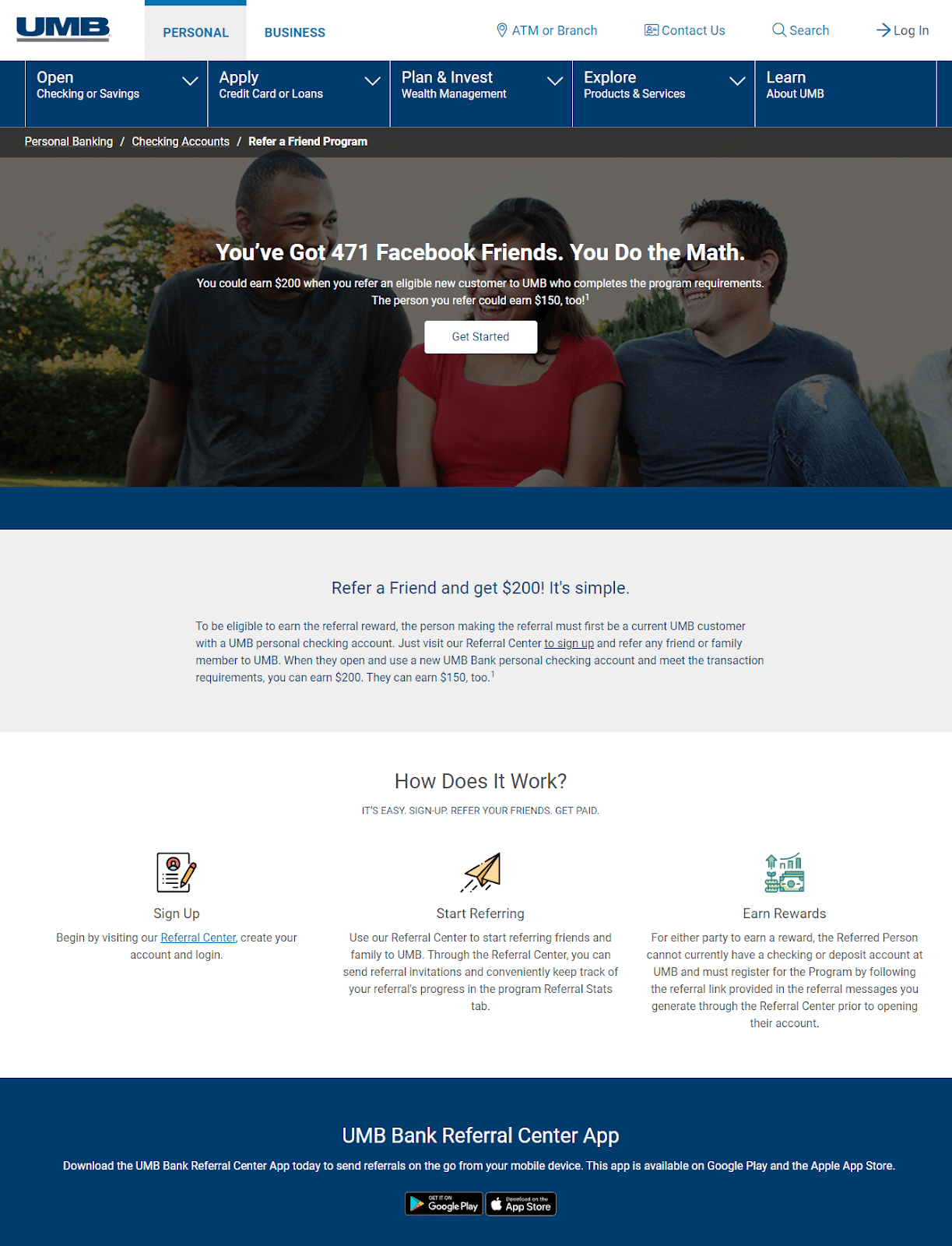

In one of the more creative bank account referral program headlines we’ve seen, UMB highlights the power of their customers’ networks, and the significant rewards referring them could bring in.

Those rewards? $200 for every eligible referral, with no limits on the rewards a customer could earn. We’ve done that math – a customer could earn over $90,000 if their 471 friends all open accounts and meet the requirements.

Referred friends get rewarded as well, as they earn $150 after they open and maintain an account.

The user experience is equally impressive. The call-to-action button is prominently placed above the fold, the process is broken down into clear steps with helpful images, and the dedicated referral app makes mobile sharing a breeze.

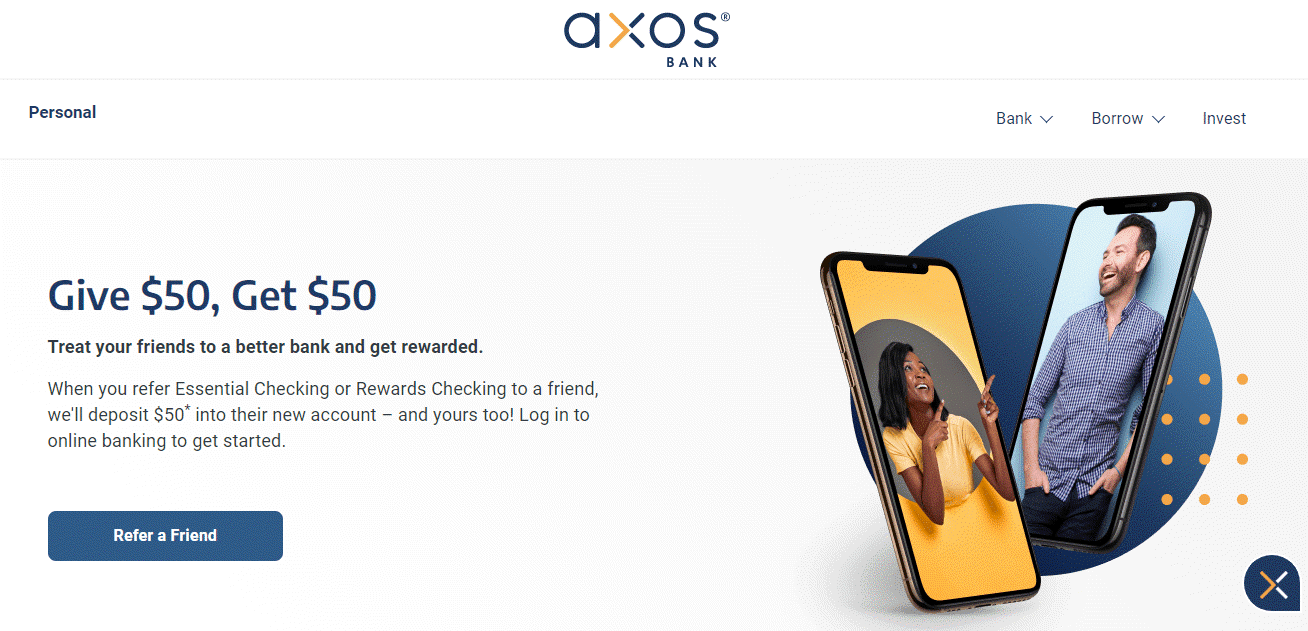

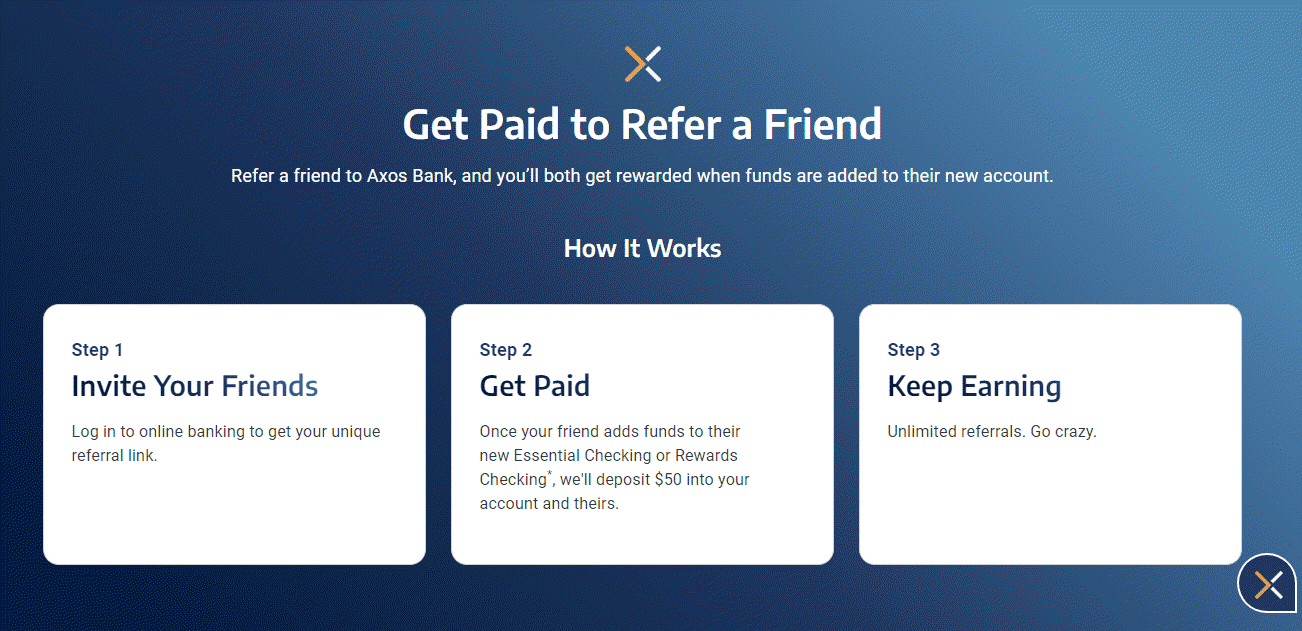

3. Axos Bank

Axos Bank makes their banking referral program simple, easy, and fun. The three-step process on that page concisely covers everything customers need to refer friends. Then, customers simply sign in, get their referral link, and share Axos anywhere.

We also love the equal, double-sided reward: when a referred friend signs up for an Essential Checking or Rewards Checking account, both the existing checking customer and the referred friend receive $50 deposited into their accounts.

The three-step process is crystal clear, and customers can keep referring and earning without limits. This “no ceiling” approach motivates high-volume referrals.

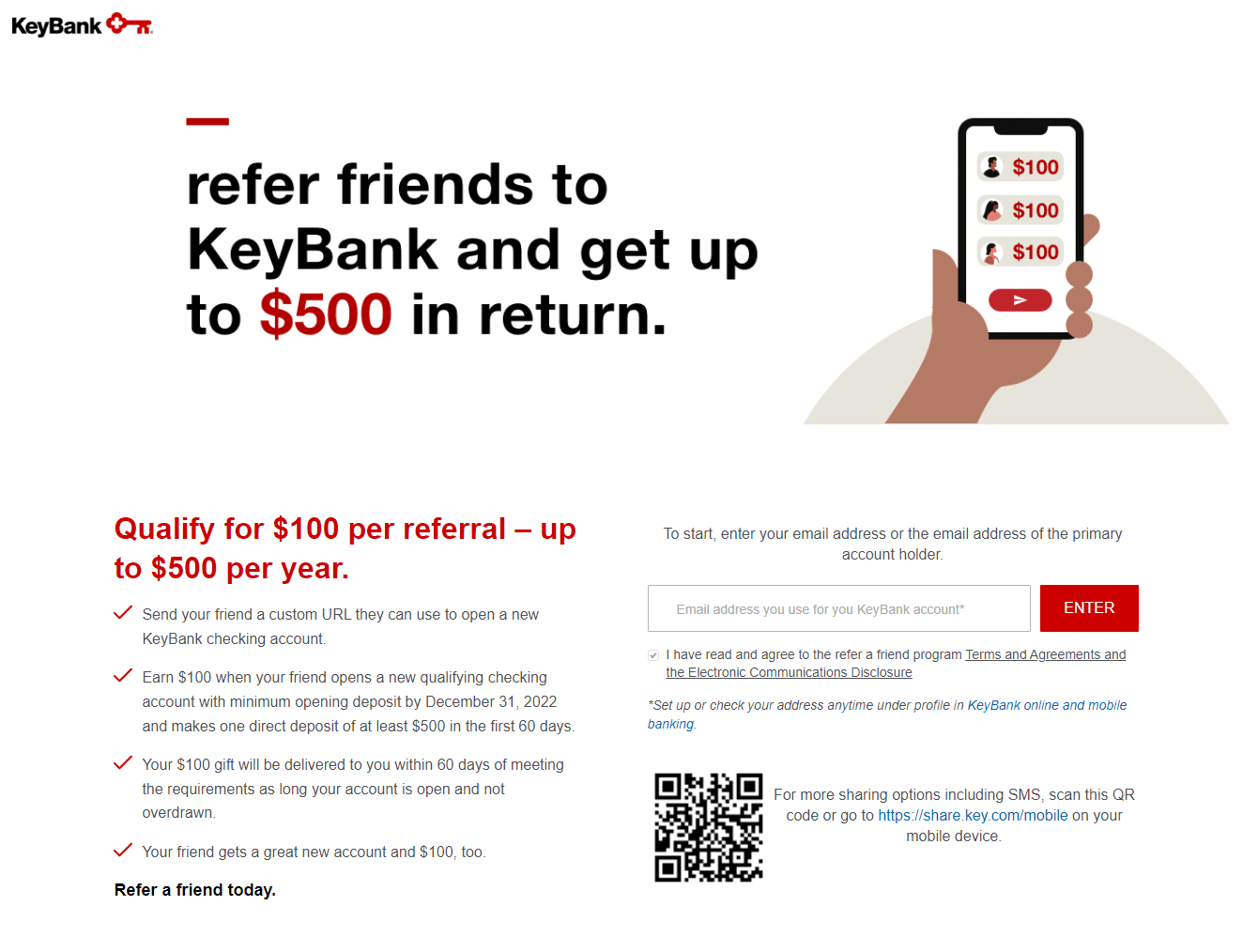

4. KeyBank

KeyBank offers a streamlined sharing process, no matter where customers are. Scanning the QR code opens up a mobile-centric referral page with several sharing options, including SMS sharing.

Their condensed terms checklist eliminates confusion, and the bold red call-to-action highlighting “up to $500 per calendar year” creates urgency and excitement.

KeyBank also smartly protects program quality by requiring a $500 deposit from new customers before paying out the $100 referral reward. This ensures they’re acquiring committed customers, not just account-openers.

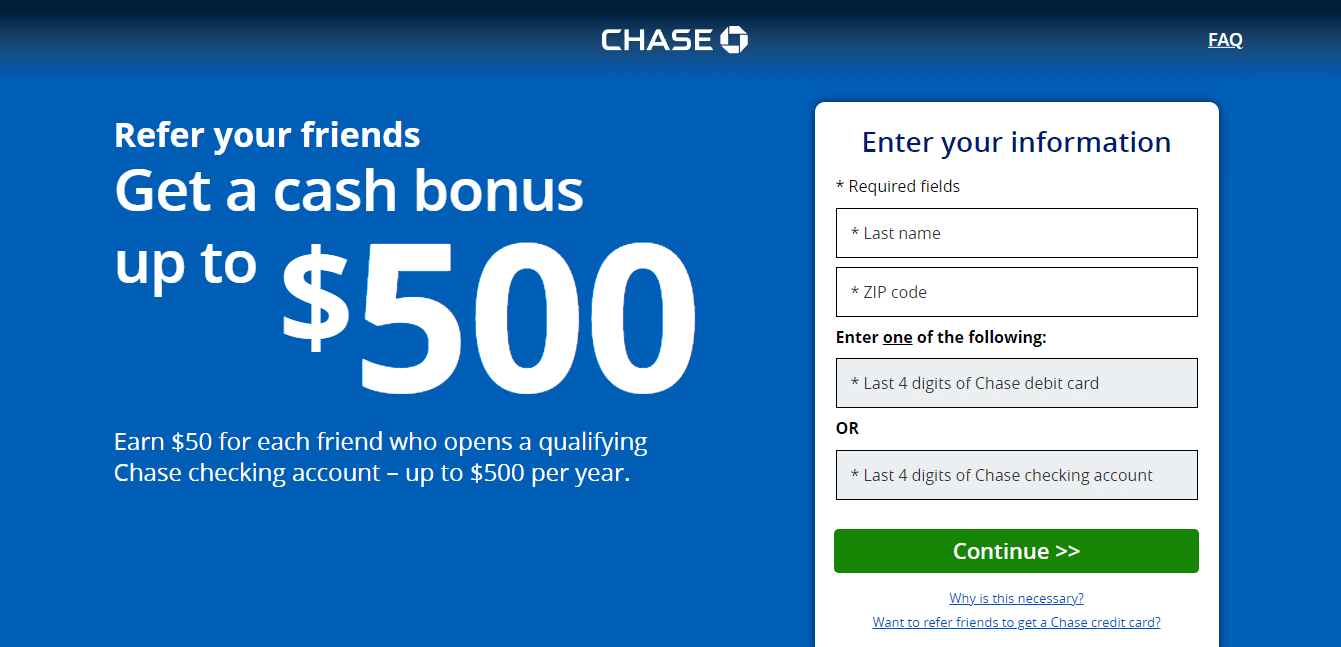

5. Chase Banking

Chase Banking cuts through the noise by putting their substantial rewards front and center: up to $500 per year in cash ($50 per successful referral). The large font size for the cash reward immediately grabs attention.

The three-step process shows that referring friends is simple, as well as rewarding for both the customer and their peers.

And if customers still have questions, Chase’s banking referral program FAQ clears everything up and removes any possible barriers to sharing.

If customers think their friends would be more interested in a credit card or rewards card (other popular offerings from Chase), they can select the separate, dedicated referral program for the exact card of their choosing. Chase links out to these programs on the banking referral page for convenience.

Pro tip: Notice a pattern in these bank referral program examples? Many of these programs explain the referral process in three easy steps. That’s a secret you can steal to streamline your own bank referral program page, and show customers how simple it is to share.

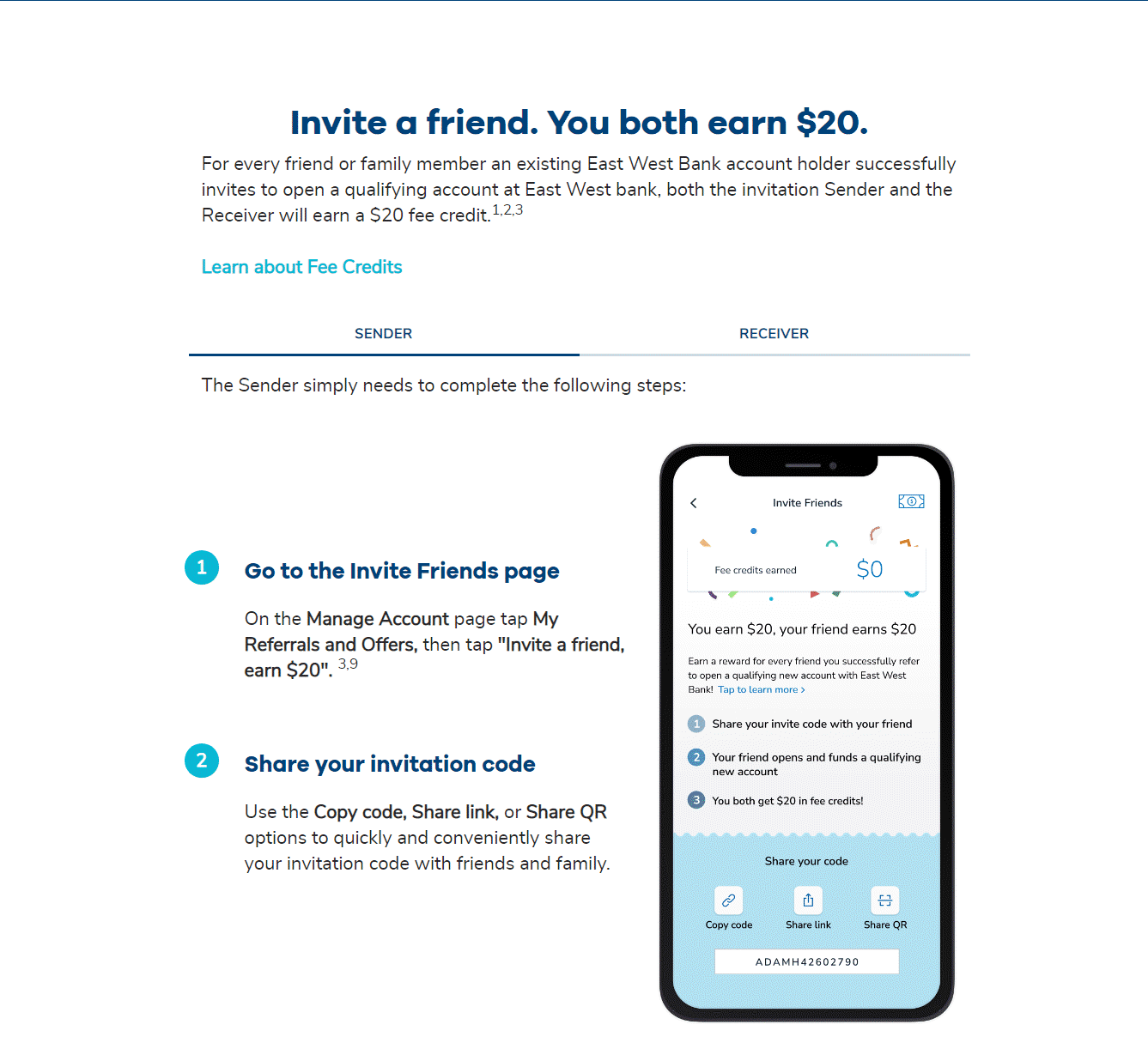

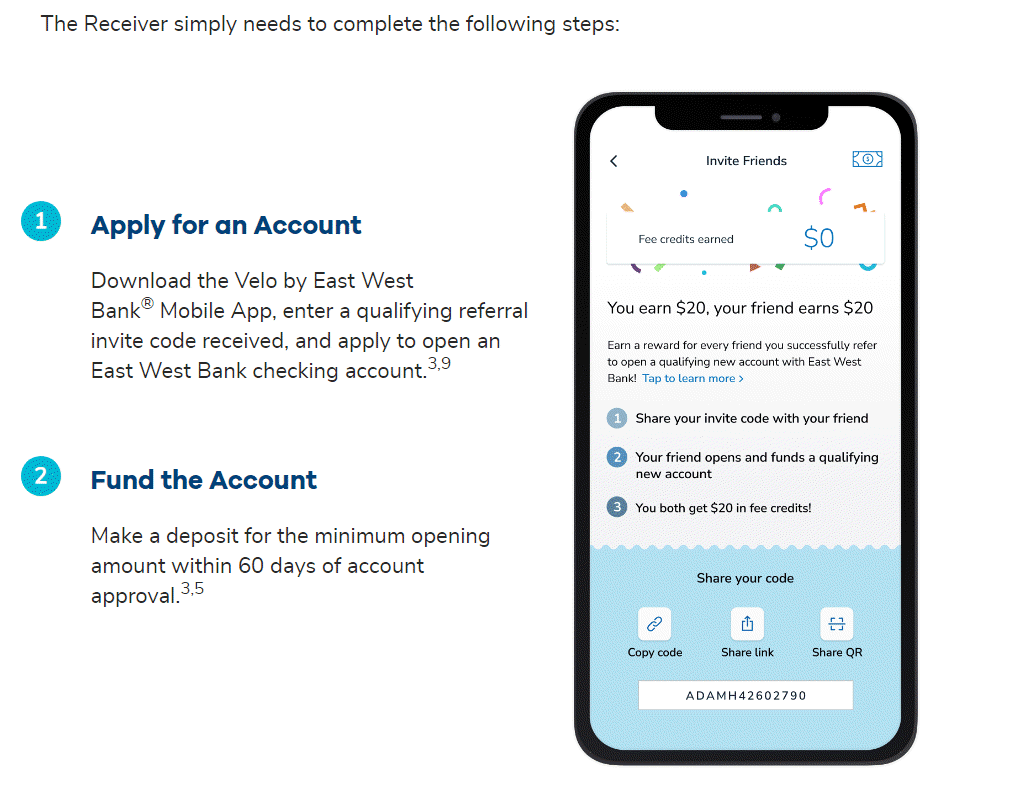

6. Velo by East West Bank

Velo by East West Bank offers online and mobile U.S. banking for people living outside of the United States. With just a single tap in the app, customers can share their referral link or even share a QR code for their friends to scan!

Once a referred friend opens and funds a qualifying account, Velo pays out $20 for both the referrer and friend, paid in Velo fee credits. They make sure the friend doesn’t miss out and they encourage account use (genius)!

And since Velo also explains what both sides need to do to earn the rewards, there’s a lot less friction. The existing customer can even show the page to their friend if the friend has any questions.

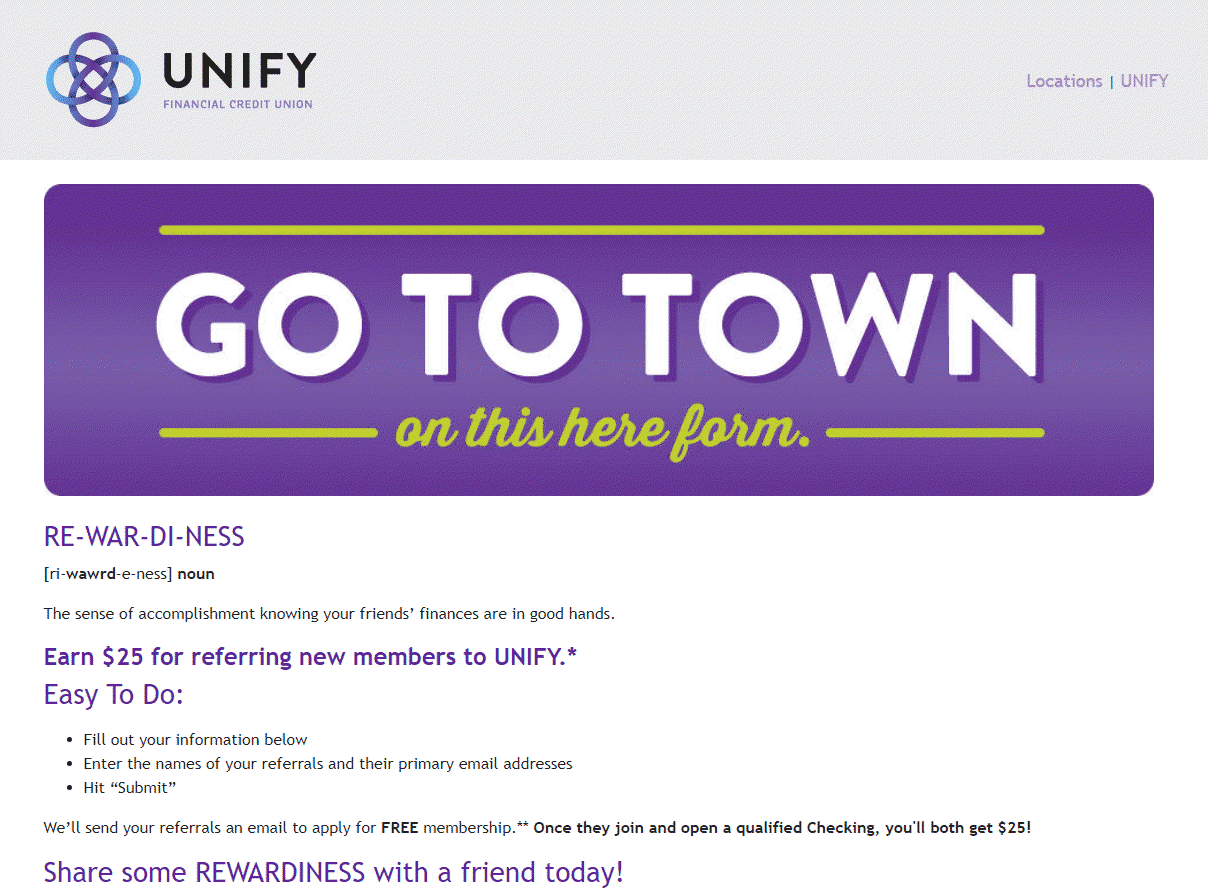

7. UNIFY Financial Credit Union

UNIFY Financial Credit Union draws customers in with a unique referral program catchphrase – “Rewardiness” – which they define as “the sense of accomplishment knowing your friends’ finances are in good hands.” This emotional appeal combines altruism with friendship to drive referrals. Consider combining a catchy slogan or phrase with an appeal to helping friends, as UNIFY did, to encourage more referrals.

The slogan and community-mindedness aren’t the only ways UNIFY’s program excels, though. A simple yet effective rewards structure (“For each new member you refer who opens an account, you both get $25!”), and a set of easy-to-follow steps go a long way in motivating customers to share UNIFY. Customers can even refer multiple friends in one click, by entering all their emails at once.

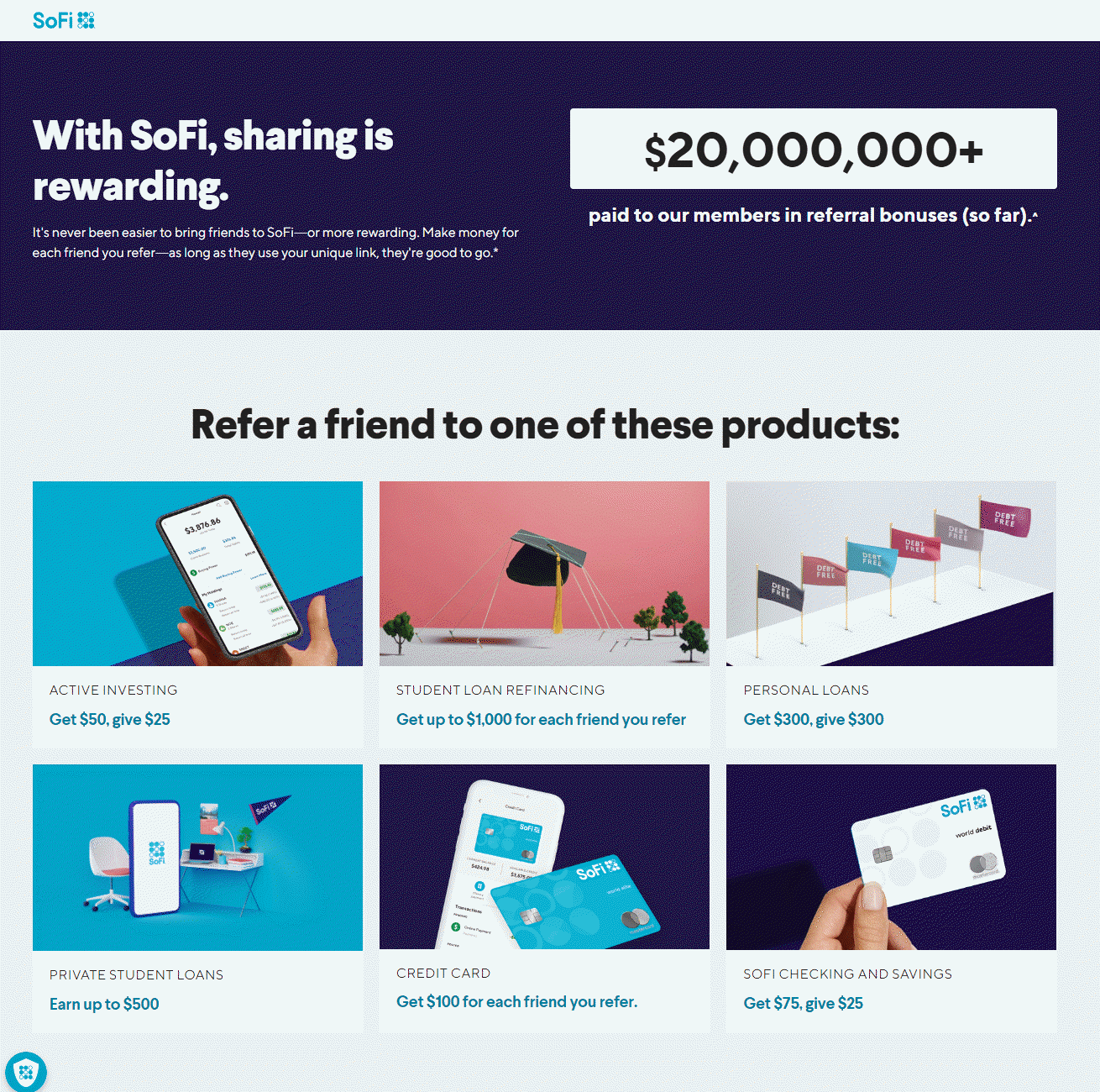

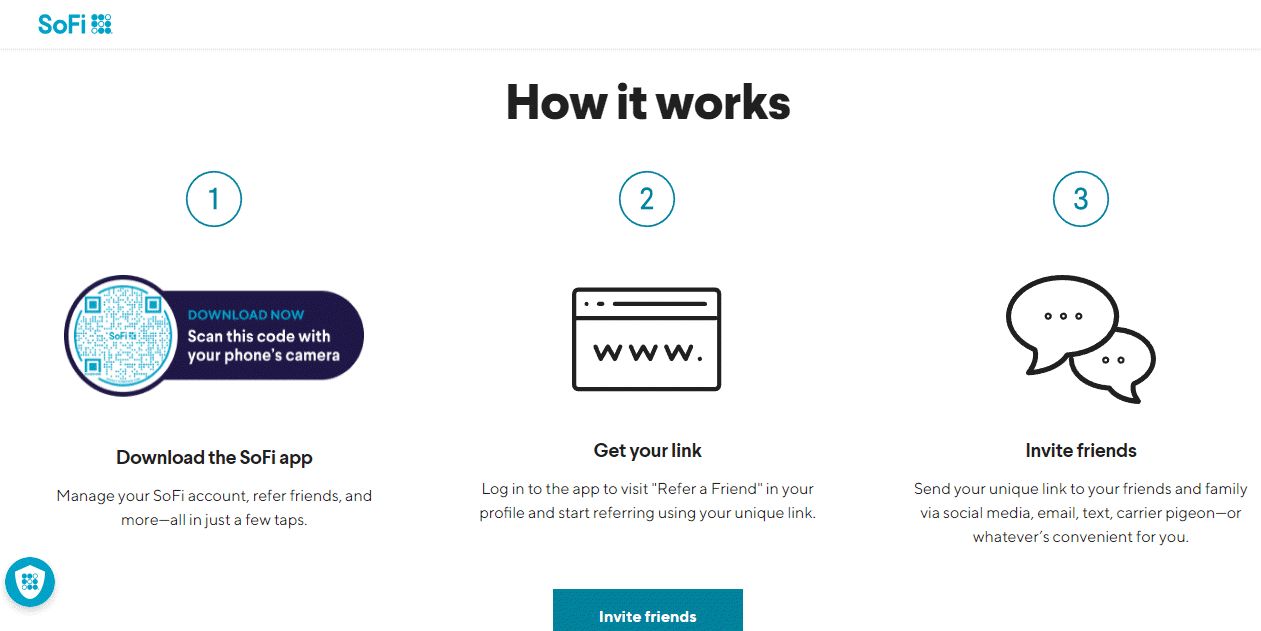

8. SoFi

Sharing really is rewarding with SoFi’s bank refer-a-friend program, as SoFi has paid over $20 million in cash bonuses across all of their different referral programs. SoFi customers can refer their friends to individual services of their choosing, including new personal checking accounts, savings accounts, a credit card, investment options, and loans, based on what they think their friends would benefit from most. And that amount displayed at the top of the page reassures customers that the rewards are real and attainable.

Via the SoFi app, customers can copy their unique referral link in just a few taps, then share in the method that’s most convenient for them (including email, SMS, and social media).

Referring friends is as easy as 1-2-3 thanks to SoFi’s quick explanation of how to participate in the program. And if customers have any more questions about the referral process, they can follow the link to the program’s FAQ page.

Is your bank ready for a referral program?

These examples are inspiring, but before you build a program, it’s worth asking: is your bank actually ready for one?

A referral program captures and amplifies word of mouth that already exists. It doesn’t create it. If customers aren’t already recommending your bank informally, launching a program won’t change that. You’d be building a system with nothing to capture.

What drives word of mouth for banks:

Customers talk about banks that stand out in at least one of these areas:

- Product: Your accounts, rates, or digital tools genuinely exceed expectations. Customers feel like they found something better than what’s out there.

- Service: When something goes wrong, you handle it fast and well. Great service recovery turns frustrated customers into your biggest advocates.

- Value: Customers feel they’re getting more than they’re paying for. Low fees, high rates, no hidden charges. The feeling of “this bank actually respects my money.”

- Story: Your bank has a personality and values that people connect with. Community banks and credit unions often win here because they stand for something local and tangible.

You don’t need all four. Being exceptional at even one can generate enough word of mouth to power a referral program.

The readiness signal: Customers refer your bank sometimes, but there’s no system to make it easy, track who was responsible for each referral, or thank them. You’re leaving money on the table.

What you need in place:

- Satisfied customers willing to recommend you. If your satisfaction scores are subpar, focus on improving your customer experience and customer service first. Your referral program is only as strong as the advocates willing to participate.

- An understanding of your customer base. Know what platforms they use, what motivates them, and how they communicate with friends. Creating buyer personas can help you target your program effectively and understand the leads you want to attract.

If both of these are in place, you’re ready. If not, shore up the foundation first. A referral program built on shaky ground won’t produce results.

How to run a bank referral program that lasts

As shown in the examples above, the design, rewards structure, and promotion of a bank referral program are the three places that make or break your program. The following program tips and best practices will help you create and run a bank referral program that works.

1. Treat it as operations, not a campaign

There’s a reason why the bank referral program examples we highlighted are ongoing, not time-sensitive.

You might have seen other banks give referral bonuses for a limited time. Don’t make this mistake. People will naturally refer friends to your bank when they know their referral will benefit a friend. Word of mouth happens organically, and you want to capture the benefits whenever you can.

If you only capture and reward referrals for a short time, and then deactivate the rewards structure, it won’t be worth the time and investment it takes to set up a referral program.

An ongoing bank refer-a-friend program allows you the opportunity to motivate multiple referrals from the same customer over longer periods and to build true advocates. You’ll also gain long-term, actionable data related to word of mouth.

Think of your referral program the way you think about other operations at the bank: it runs continuously, it’s woven into how your team works, and it gets better over time as you learn from the data.

2. Make sharing easy

The easier your program is to use, the more people will participate. Every extra click, form field, or moment of confusion dramatically reduces conversion rates. Sharing should take very few clicks or taps from access to reward.

The program’s terms must also be simple. Include concise benefits of sharing (both rewards and intrinsic benefits) on your program landing page. Condense the instructions into 3-4 simple steps, and include a clear referral call to action to get customers to take the next step.

Enable customers to share on multiple channels. Don’t limit your customer’s sharing options to just referral emails. Instead, give them the option to send referrals via social media, email, text message, and other mediums. The best way to broaden your customer’s sharing options is with a referral link that customers can copy and paste anywhere.

We also recommend pre-drafting messages for the customer to send to their friend, so they don’t have to think about what to say. Make sure the message sounds conversational and like the customer wrote it.

Be sure to include these links in all emails where you mention your referral program, including transactional emails and account update emails. Also consider integrating your referral program into your mobile banking app so customers can share directly from where they already manage their accounts.

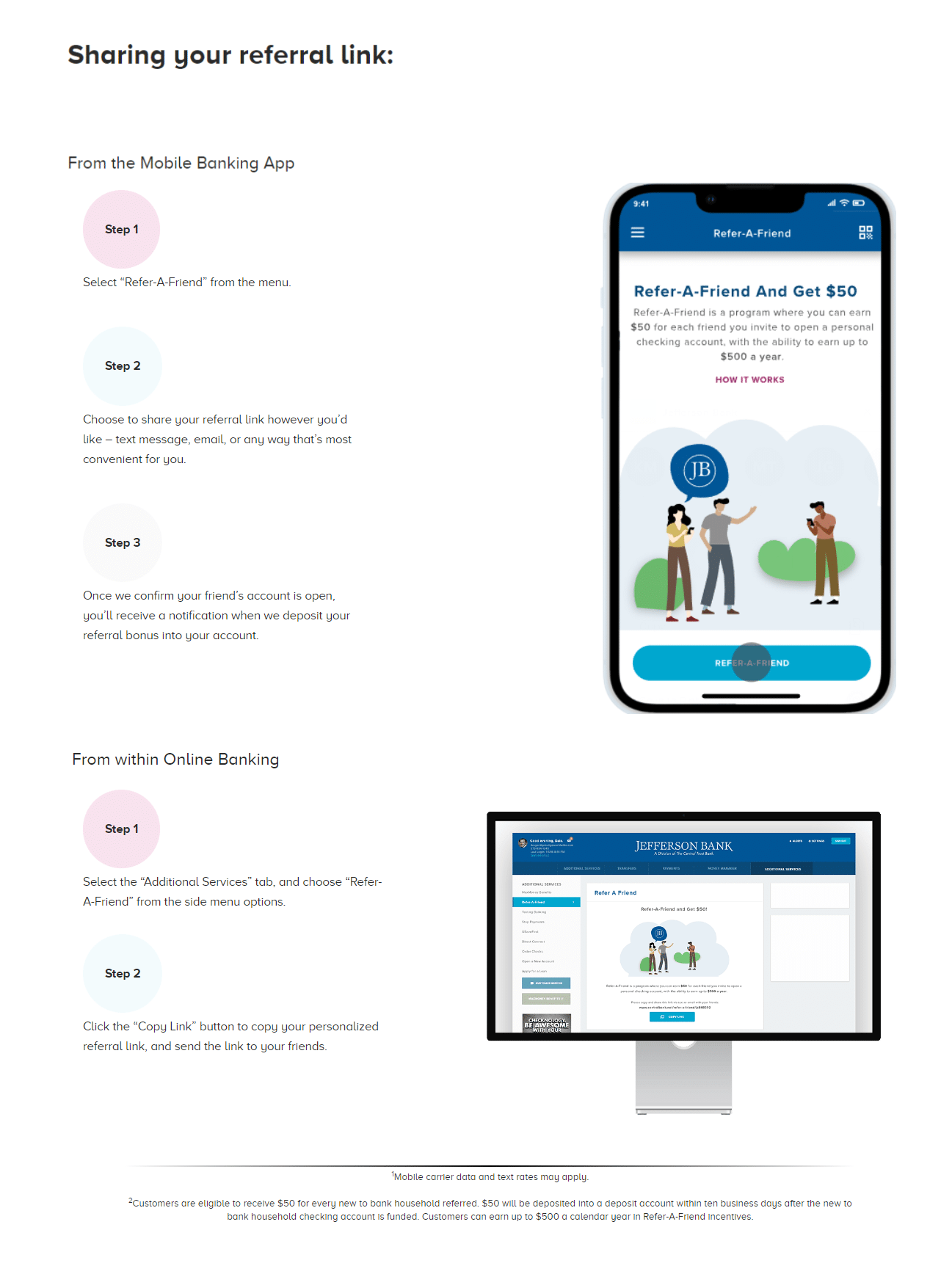

Jefferson Bank makes sharing easy, from both mobile and desktop. They show how simple the referral process is by breaking it down into steps, and let customers easily share their referral link from anywhere.

Learn more about how Referral Rock offers a streamlined referral experience to your customers >

3. Frame rewards around the friend, not the referrer

Most banks design their referral program rewards by asking, “What do we give the person who refers?” That’s the wrong starting point.

When the entire program centers on what the referrer earns, the whole thing feels transactional. The sharer feels like they’re selling their friend on something for personal gain. That’s not how people naturally recommend their bank.

Flip it. Frame the referral as a gift the sharer gives their friend. All messaging, from the program title to the emails to the offer itself, should center on what the friend gets. “Give your friend a $50 bonus when they open an account” lands differently than “Earn $50 for every friend you refer.”

The best bank referral programs give double-sided referral rewards to motivate everyone involved. Give rewards to both the referrer and their friend, but lead with the friend’s reward in your messaging.

Reward structure tips:

- For standard deposit accounts, $50 each for the referrer and friend often works well. Some banks choose to offer gift cards (or prepaid Visa/Mastercard gift cards), as these let the awardee spend the money on whatever they please.

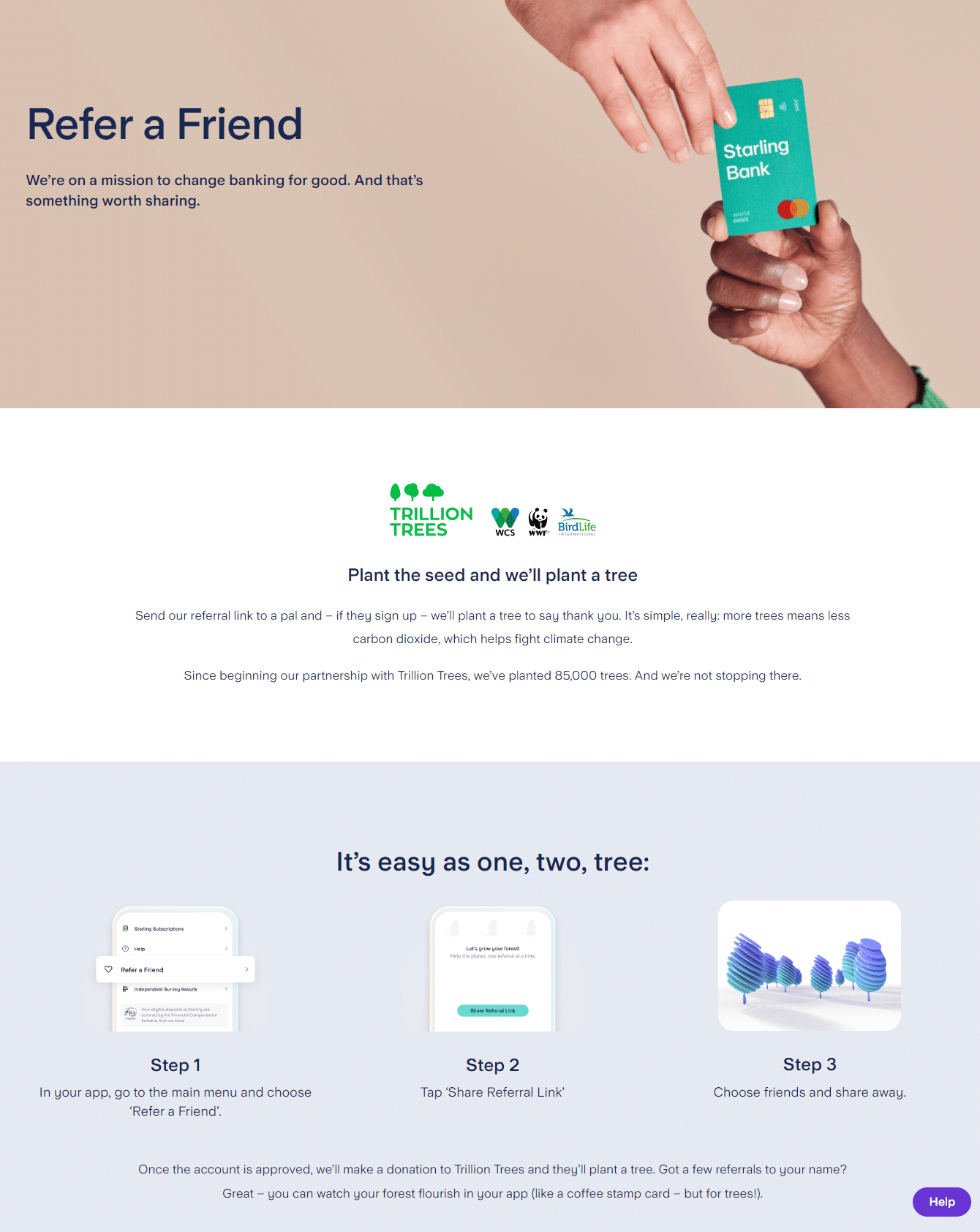

- If it aligns with your audience’s values, a charitable or altruistic reward may also work. Starling Bank rewards referrals by planting trees in the referrer’s name.

- The best practice is to reward the referrer immediately after someone they refer opens a new account, and to make that reward available for every successful referral.

- Depending on the actions you want new customers to take, you could also pay a second reward after the new customer makes qualifying direct deposits, meets certain balance requirements, or remains in good standing for a certain number of days. This is called a multi-step referral program.

- You might instead use tiered rewards to motivate multiple referrals. These increase in value after a member makes a certain number of referrals who go on to open accounts with you.

- Or, consider giving different levels of referral rewards based on the account type. You may decide that referrals for higher-level accounts (like business checking accounts) merit larger rewards.

Simplify the reward earning process. If customers have to meet complex requirements to receive their reward, they’ll likely lose interest.

Here’s more on how Referral Rock can help you optimize rewards >

4. Promote continuously across every touchpoint

Even if you create a program that follows all the other best practices, it won’t work if no one knows about it.

The more program members you have, the more chances you have to bring in successful referrals (and more revenue). So, promote your program, and the rewards on offer, within all your customer touchpoints. This isn’t a one-time announcement. It’s an ongoing part of how your bank communicates with customers.

The best promotional channels are the ones customers see regularly:

- Post signs in your branch, and on your ATMs, that advertise your program.

- Create a website banner or hero image that customers can easily find on your homepage. Link it directly to your referral landing page.

- Consider other subtle ways to promote your program on your website. For example, some banks add a link to their footer or menu. As long as customers can see it, and find it, they’ll be more likely to join your program.

- Add links to your referral program within your online banking portal so regular patrons can easily access it.

- Post about your referral program on your social media account. If you have multiple branches, make sure each branch promotes the program on their local social media accounts.

- Personally invite customers to join your referral program when they are happiest, such as right after a significant deposit, after a positive review, or after an account anniversary.

- Send mass emails about your program to all customers at once. We recommend sending dedicated emails monthly to quarterly, to reach newer customers and keep the program at the top of all customers’ minds.

- Promote your referral program in transactional emails, balance updates, newsletters, and other “regular” emails you send, with a short referral call to action.

- Lead into your referral program using your regular customer surveys. If someone gives you good feedback, direct them to your program.

Banks with the most successful referral programs promote consistently, on multiple channels. Referral program promotion is a long-term investment.

Find more referral program promotion strategies here.

5. Rely on referral software

Want an automated referral system for your bank? Uncover referrals in plain sight to smooth out business lulls, without losing focus on your real day to day work helping customers.

Manual tracking of referrals is a recipe for frustration, errors, and missed opportunities. The right referral software transforms your program from an administrative headache into a streamlined growth engine. Referral software tools allow you to track who was responsible for each referral, track which customers your referrals are coming from, and quickly distribute rewards. You’ll also have plenty of data on your referral program that you can use to measure success and refine your program structure.

Plus, referral software generates unique referral links for customers to easily share your program via social media and email.

Referral Rock software streamlines program design, tracking, rewarding, and promotion, making it a key tool for any bank that wants to run a successful referral program.

With Referral Rock, you can:

- Fully customize rewards: Select any reward type and structure you wish, including tiered and multi-step rewards.

- Track referrals seamlessly: Unique referral links for each customer let you track exactly where each referral came from. Plus, customers can track referrals they send with their own personal dashboards.

- Automate reward payouts: Send incentives right when they’re earned to keep customers happy. Automate multi-step payouts by connecting with your CRM.

- Automate promotions: Strategic, automated promotional emails keep customers engaged, and the passwordless links inside make sharing even easier.

- Integrate with key tools: Seamlessly integrate Referral Rock with over 50 tools, including your CRM.

- Collect program data: Measure your program’s success at a glance, and make informed adjustments and improvements.

- Set up quickly: Referral Rock lets you set up your program in days (not months), with expert support at every step.

Start with what’s already working

The word of mouth about your bank is already happening. A well-designed referral program gives you the system to capture it, track it, and make it easier for the customers who already want to recommend you.

Whether you’re ready to build a comprehensive program from scratch or want to start with something simpler, Referral Rock can help you accelerate the word-of-mouth you’re already getting and turn it into a sustainable growth channel. Ready to kick-start your word of mouth with a customer referral program?