Let’s face it: nobody’s scrolling Instagram hoping to discover a hot new checking account.

When it comes to banking, trust isn’t just important—it’s everything. And who do people trust more than slick marketing campaigns? Their friends and family who tell them, “This bank actually doesn’t suck!”

That’s why smart financial institutions aren’t just throwing money at billboards and commercials anymore. They’re investing in their most powerful marketing asset: their existing customers.

Bank referral programs (sometimes called financial referral programs or refer-a-friend programs) turn satisfied customers into enthusiastic salespeople—and unlike your marketing team, they work for free! Well, almost free… a strategically designed incentive can transform casual customers into referral-generating machines.

In this guide, we’ll unpack:

- Why bank referral programs are basically money-printing machines (when done right)

- The actual strategies behind the most successful financial referral programs

- 16 real-world examples that you can shamelessly steal from

- Step-by-step instructions for creating your own referral powerhouse

Ready to transform your customers into your most effective marketing channel? Let’s dive in!

What is a bank referral program?

A financial referral program, or bank referral program, encourages your customers to recommend your bank, credit union, or financial institution to their friends, colleagues, and family members.

When a customer recommends your bank to their friend, and that friend opens a new account with you, you reward the existing customer with a referral incentive to thank them for bringing in a new customer.

Often, financial referral programs also reward the newly referred person when they open an account, to further encourage the new business.

But here’s the secret that separates the good programs from the great ones: Ditch the paper forms! Instead, the best bank referral programs are automated with software, so it’s easy to track who was responsible for each referral (more on this below).

Why referral programs work for banks

Look, we all know that trust in traditional advertising is… let’s just say it’s seen better days. But referrals? They’re marketing dynamite, especially in the financial industry.

Referral programs are a popular way for businesses in all industries to acquire new clients through the power of word-of-mouth marketing. Instead of marketing with your bank’s own campaign messages, financial referral programs motivate your existing customers to spread the word about your bank to their friends and family.

And these recommendations are trusted: A study by Nielsen revealed that 84% of people see referrals as the most trusted and influential form of advertising.

The Financial Brand further estimates that almost a third of banks and credit unions already have bank refer-a-friend programs. If your competitors are already tapping into this goldmine, can you afford not to? Even if you think your bank’s marketing strategy is already working well, a well-designed referral marketing program will boost both customer acquisition and retention.

And if you’re interested in having creators and experts recommend you alongside customers, check out our guide to bank affiliate marketing.

Referral software for banks [Free Tools]

These referral tools for banks are a free and easy way to help you start your referral program.

Free Tools + Services:

- Create your own referral codes - [Referral Code Generator]

- Track referrals manually - [Manual Referral Tracker - Spreadsheet]

- Build referral links - [Referral Link Generator]

- Get best practices and actionable guidance - [Referral Program Workbook]

- Readiness Assessment - [Free Consult]

- Online referral software - [Free Trial]

Want a automated referral system for your bank business? Uncover referrals in plain sight to smooth out business lulls, without losing focus on your real day to day work helping customers.

Check out our referral program software - done right.

Top 10 bank referral program examples (bank refer-a-friend programs)

How to design an effective bank referral program? Look to the experts first. We’ve handpicked ten of the best bank and financial referral programs below, and included our thoughts on why they rock.

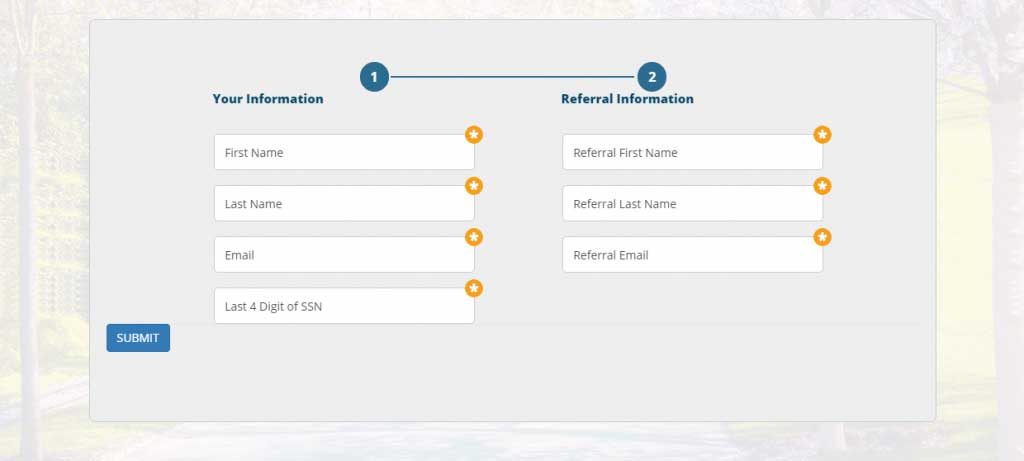

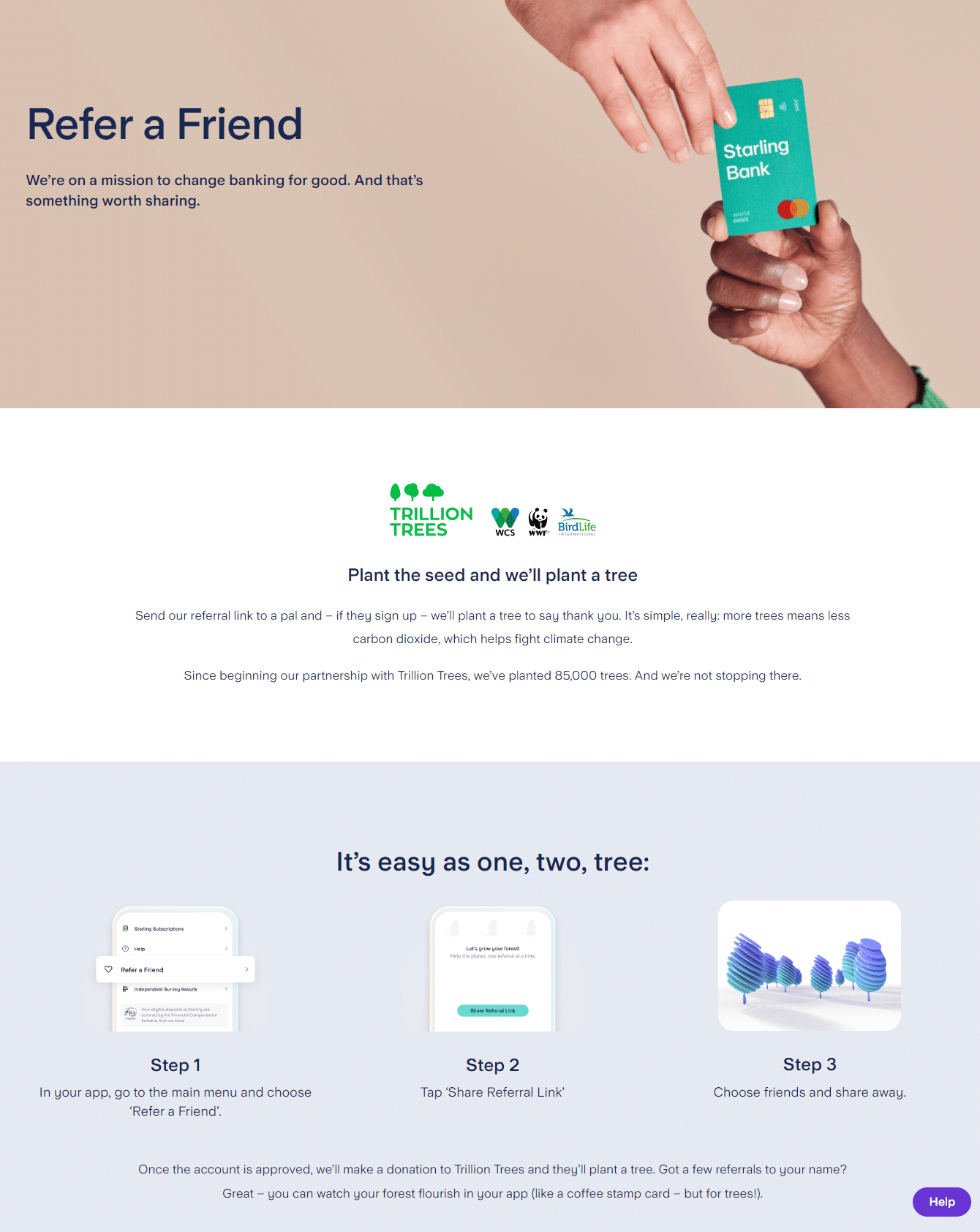

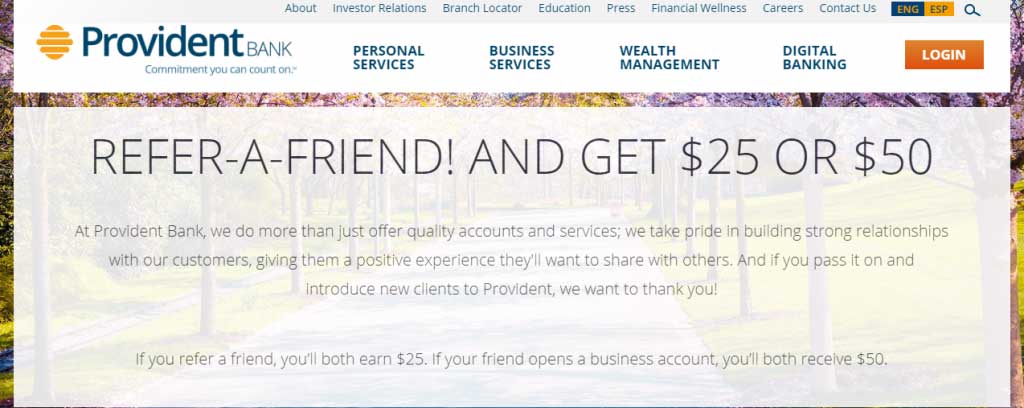

1. Provident Bank

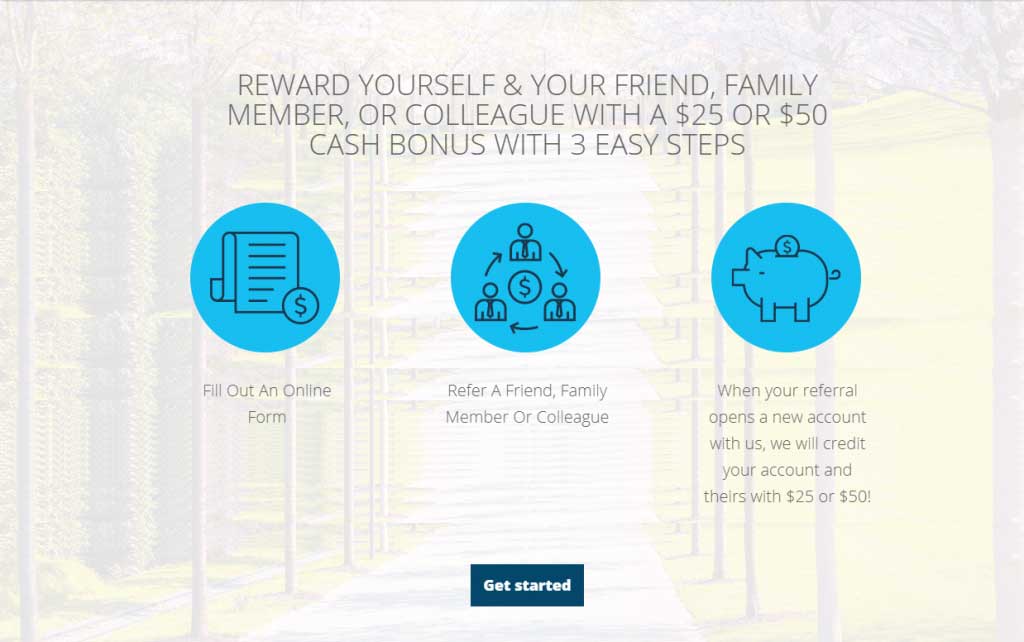

The Provident Bank referral program catches customer’s eyes by putting the call to action and reward front and center (“Refer-a-friend! And get $25 or $50”). Note how referring a friend who opens a higher-value business account earns higher rewards.

What makes this program shine is its three-step simplicity and instant gratification—customers get their reward immediately after their friend opens an account.

The emotional appeal is spot-on too. Provident’s emphasis on how referrals help build relationships, the focus on sharing to help a friend (“Pay it forward”), and the way the bank thanks customers for spreading the word, are also notable messages your bank should consider applying in its own referral program.

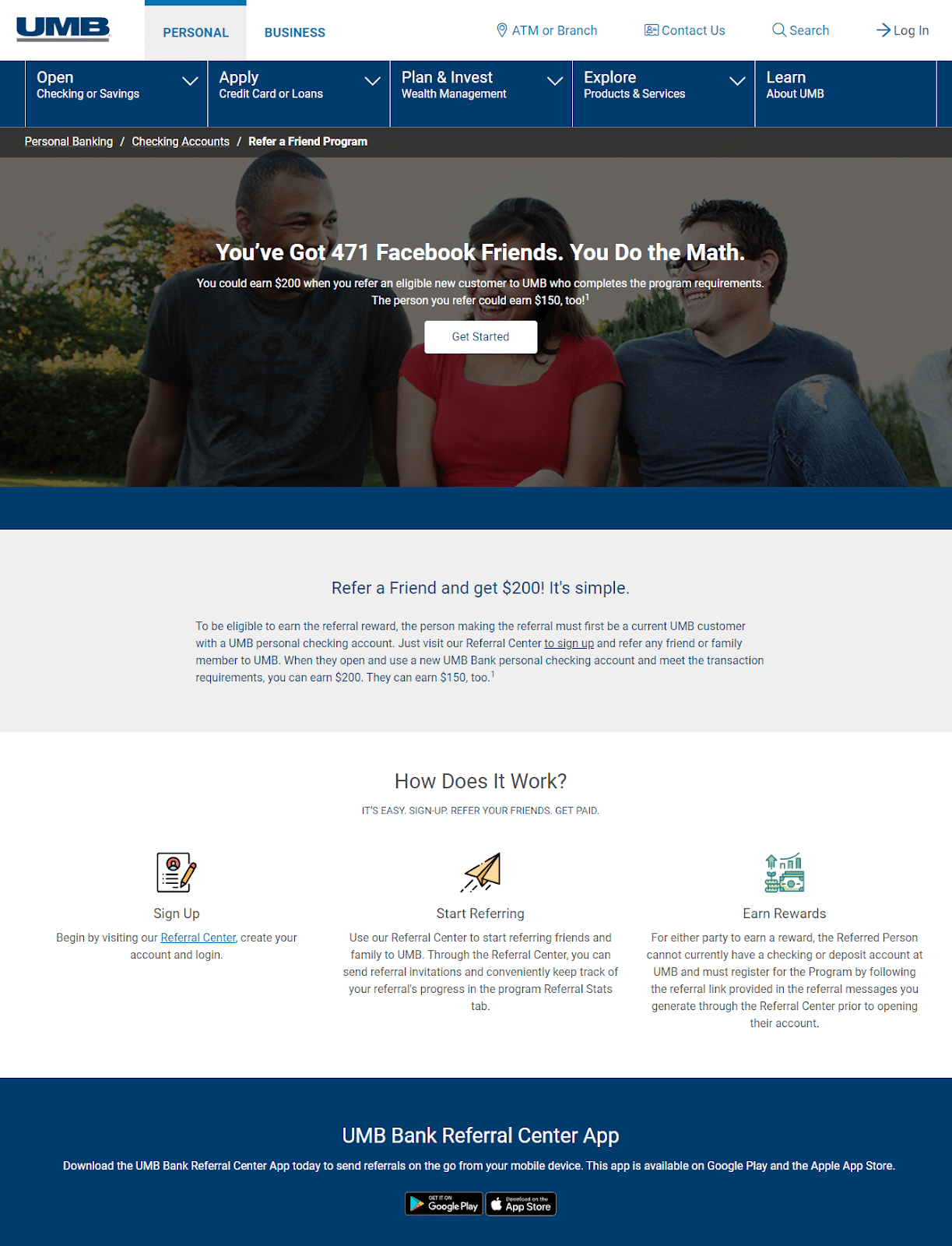

2. UMB

In one of the more creative bank account referral program headlines we’ve seen, UMB highlights the power of their customers’ networks, and the significant rewards referring them could bring in.

Those rewards? $200 for every eligible referral, with no limits on the rewards a customer could earn. We’ve done that math – a customer could earn over $90,000 if their 471 friends all open accounts and meet the requirements.

Referred friends get rewarded as well, as they earn $150 after they open and maintain an account.

The user experience is equally impressive. The call-to-action button is prominently placed above the fold, the process is broken down into clear steps with helpful images, and the dedicated referral app makes mobile sharing a breeze.

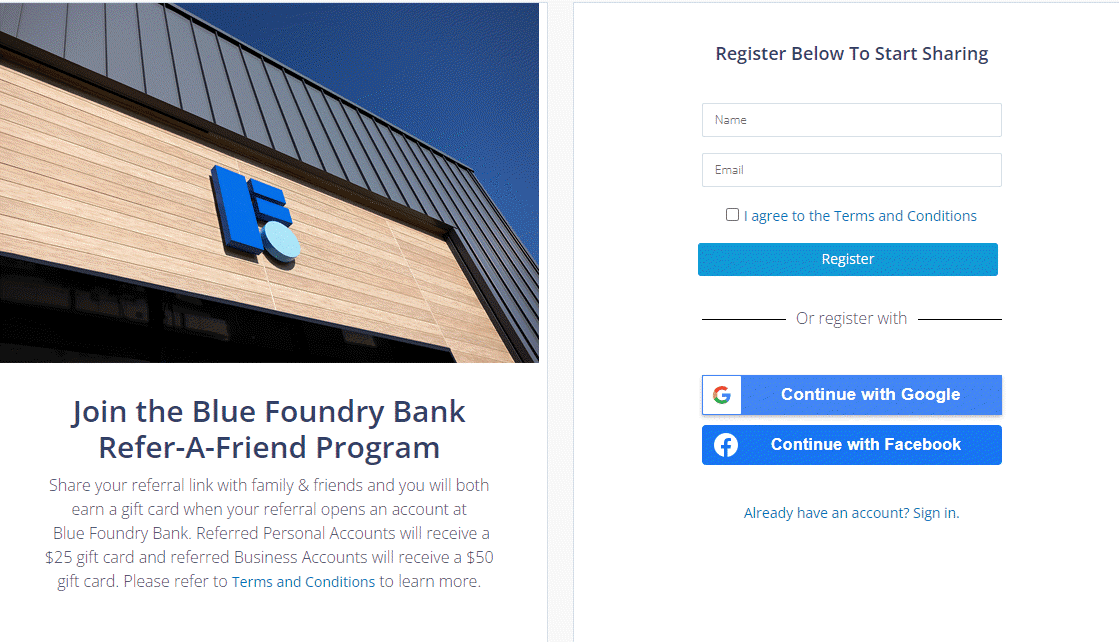

3. Blue Foundry Bank

Blue Foundry Bank makes their referral program easy to use. Customers can instantly register with Google and Facebook for instant sharing, and the gift card rewards mean customers get to choose how they spend their incentive. This one-click approach dramatically increases participation by eliminating friction.

Their reward structure is clever too—gift cards give customers freedom to choose their reward, and they’ve implemented tiered rewards based on account value ($25 for personal accounts, $50 for the more valuable business accounts)

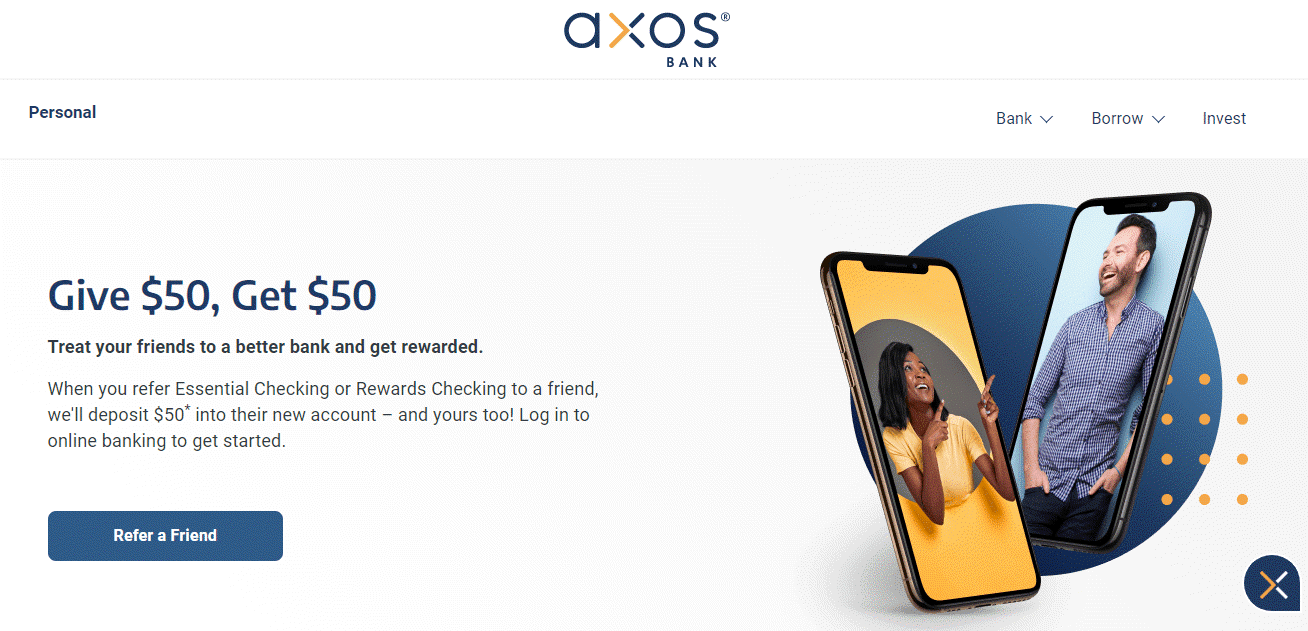

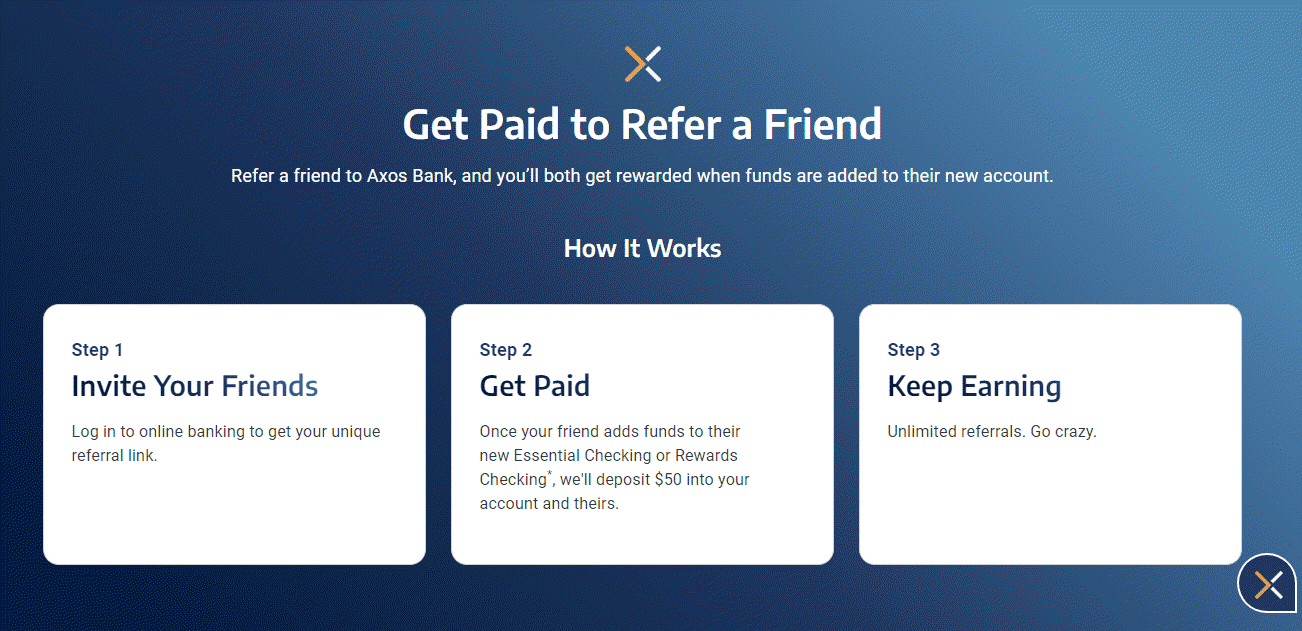

4. Axos Bank

Axos Bank makes their banking referral program simple, easy, and fun. The three-step process on that page concisely covers everything customers need to refer friends. Then, customers simply sign in, get their referral link, and share Axos anywhere.

We also love the equal, double-sided reward: when a referred friend signs up for an Essential Checking or Rewards Checking account, both the existing checking customer and the referred friend receive $50 deposited into their accounts.

The three-step process is crystal clear, and customers can keep referring and earning without limits. This “no ceiling” approach motivates high-volume referrals—why stop at just one friend when you could refer your entire contact list?

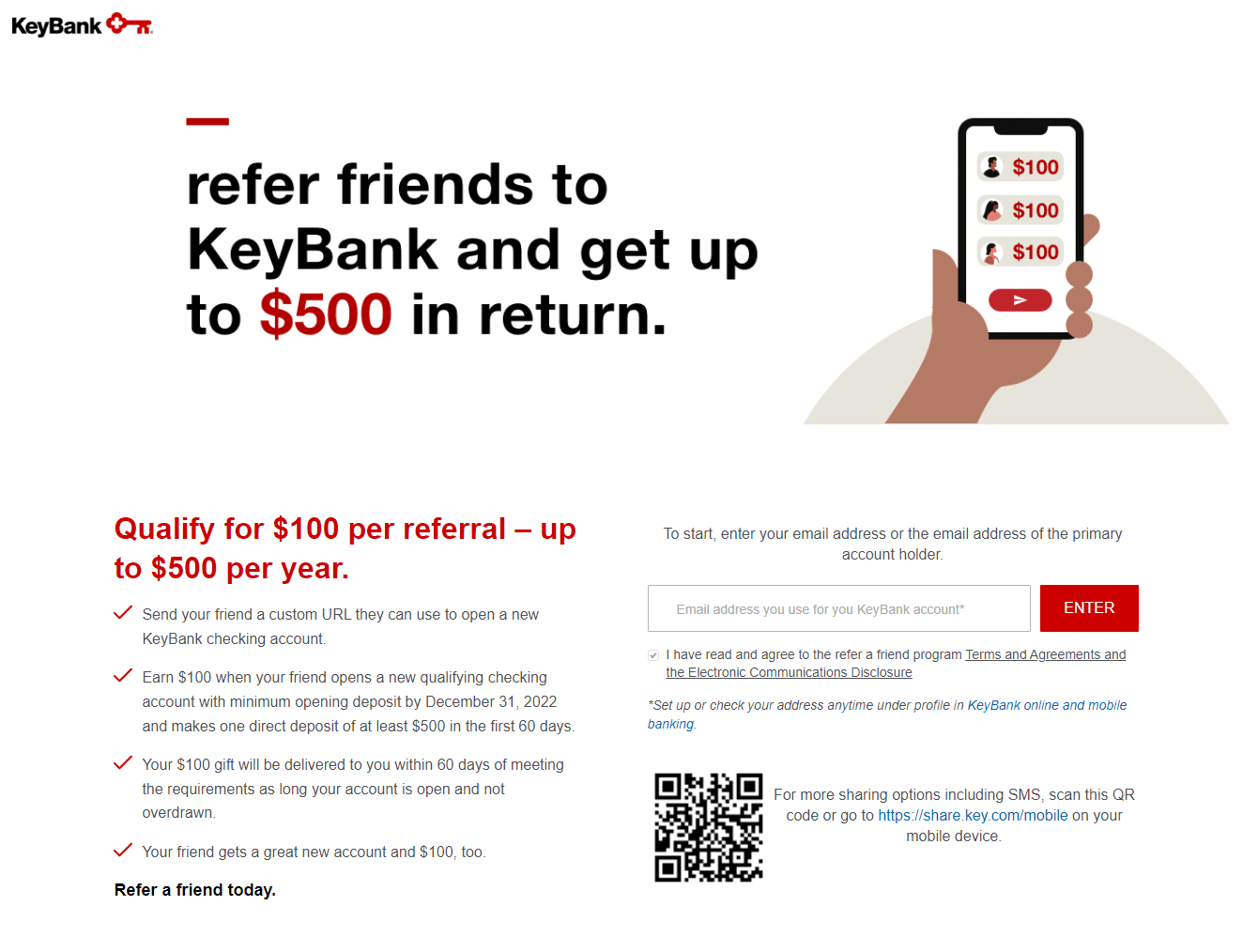

5. KeyBank

KeyBank offers a streamlined sharing process, no matter where customers are. Scanning the QR code opens up a mobile-centric referral page with several sharing options, including SMS sharing.

Their condensed terms checklist eliminates confusion, and the bold red call-to-action highlighting “up to $500 per calendar year” creates urgency and excitement.

KeyBank also smartly protects program quality by requiring a $500 deposit from new customers before paying out the $100 referral reward. This ensures they’re acquiring committed customers, not just account-openers.

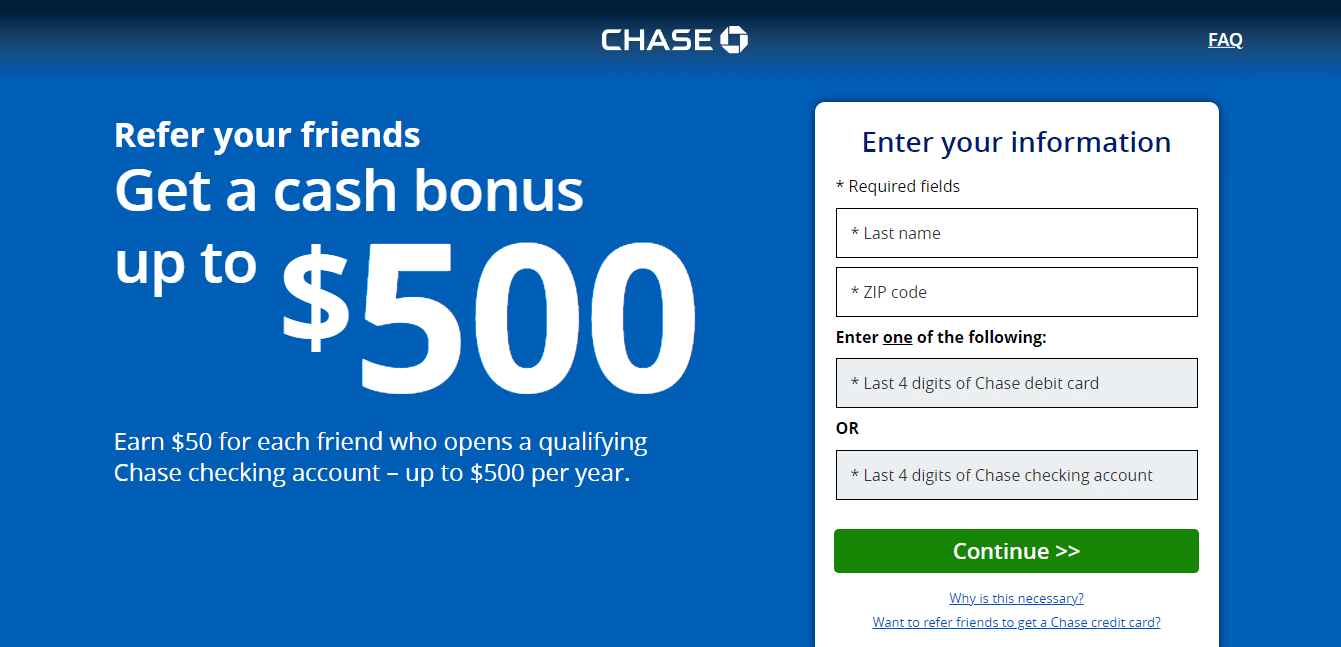

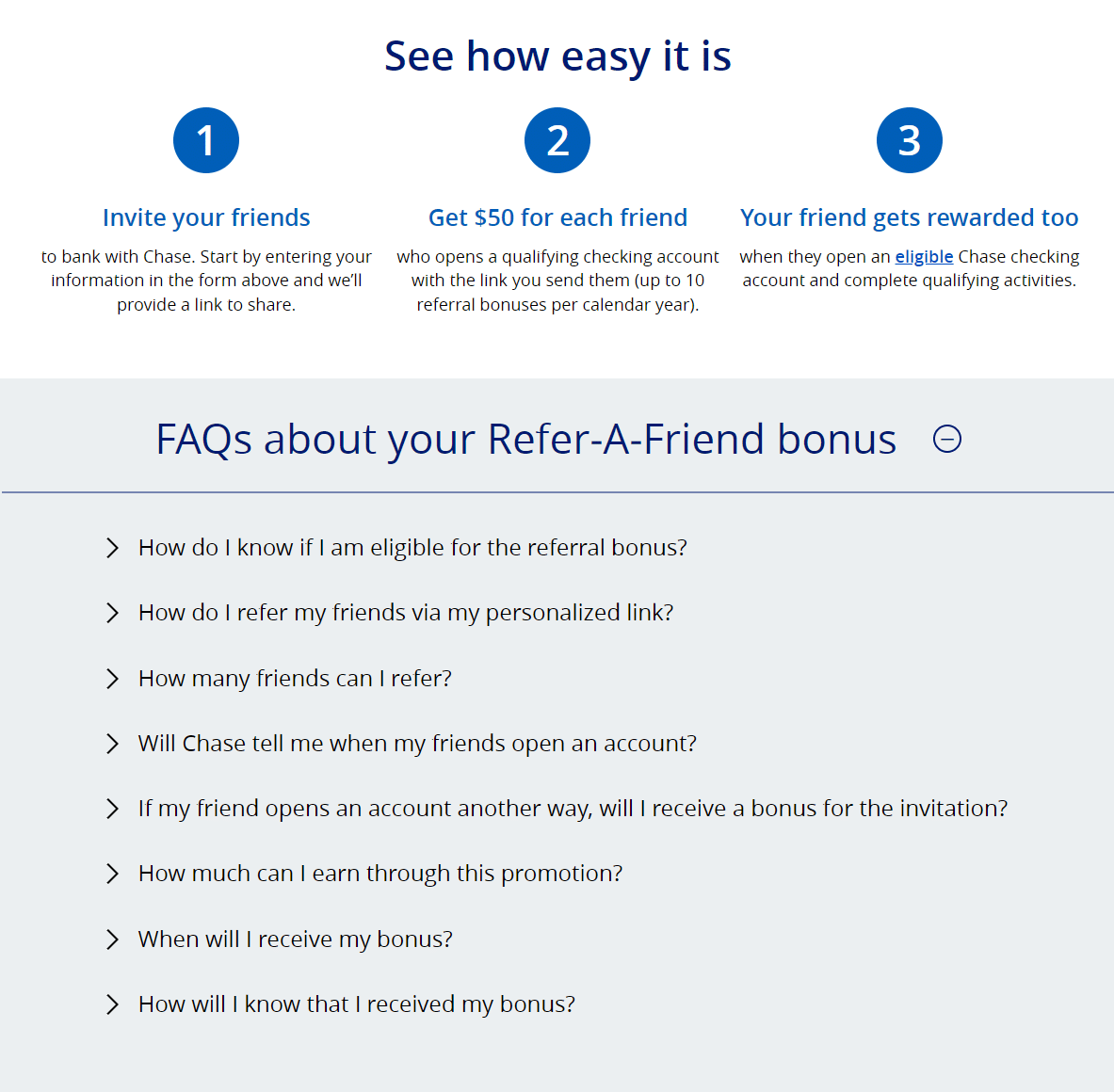

6. Chase Banking

Chase Banking cuts through the noise by putting their substantial rewards front and center: up to $500 per year in cash ($50 per successful referral). The large font size for the cash reward immediately grabs attention.

The three-step process shows that referring friends is simple, as well as rewarding for both the customer and their peers.

And if customers still have questions, Chase’s banking referral program FAQ clears everything up and removes any possible barriers to sharing.

If customers think their friends would be more interested in a credit card or rewards card (other popular offerings from Chase), they can select the separate, dedicated referral program for the exact card of their choosing. Chase links out to these programs on the banking referral page for convenience.

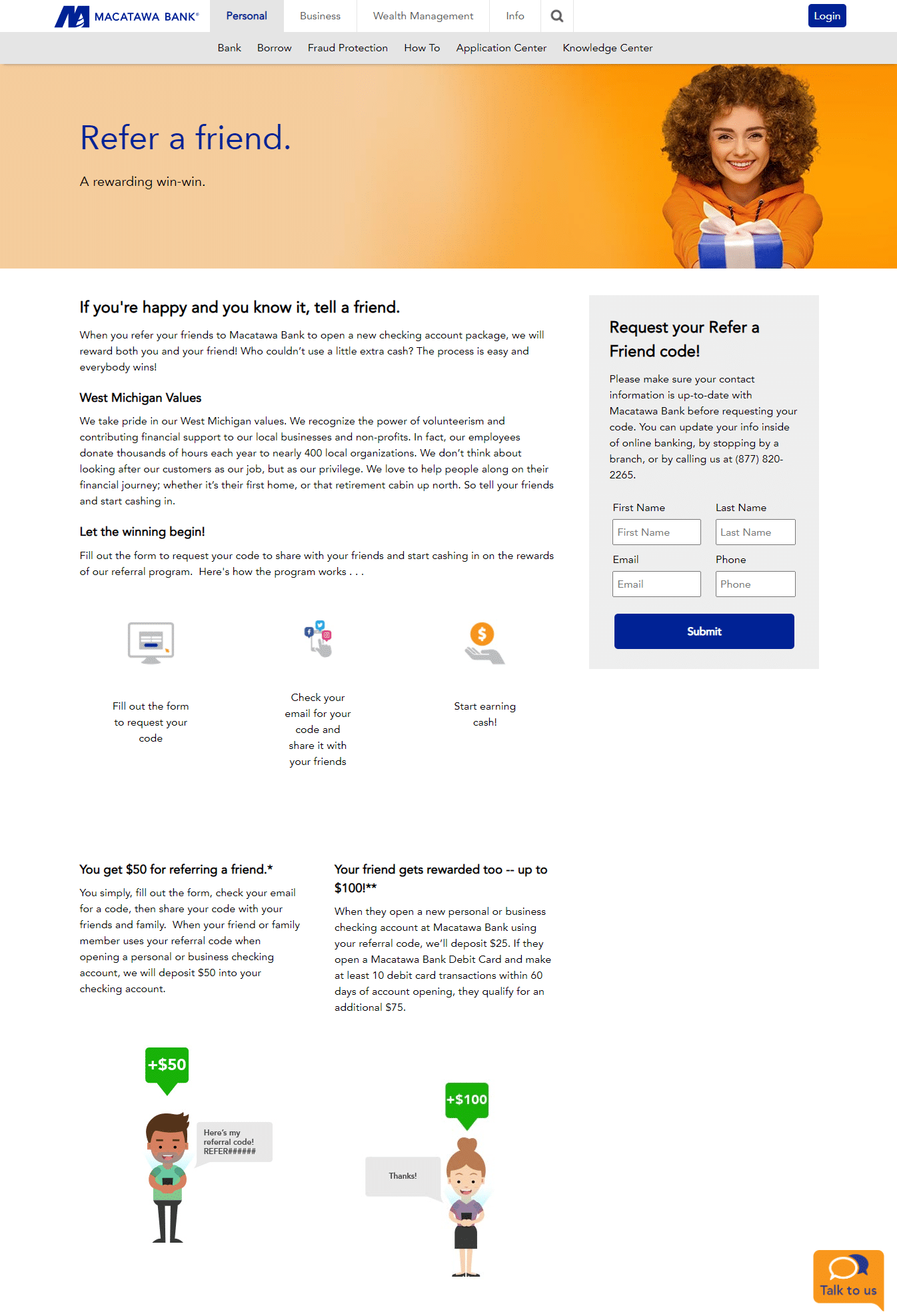

7. Macatawa Bank

The bright colors, creative taglines and compelling images on the Macatawa Bank referral program page drum up plenty of excitement about referring friends.

We love the program’s catchy headline “If you’re happy and you know it, tell a friend,” as that shows exactly what customers should do. And it’s true, everyone could use a little extra cash ($50 per successful referral, to be exact)!

Images are another key player on Macatawa’s referral program page. Through a graphic of friends texting back and forth, Macatawa shows just how easy it is to share the referral code. Other images illustrate the simple, three-step sharing process.

As Macatawa Bank is local to the West Michigan area, the section highlighting community values is especially effective.

This community focus is highlighted in the referred friend reward, as there’s up to $100 available to a friend who opens a new account. (That reward’s carefully crafted to encourage loyalty, as $25 is paid at the account opening, and the other $75 is earned for opening a debit card).

Pro tip: Notice a pattern in these bank referral program examples? Many of these programs explain the referral process in three easy steps. That’s a secret you can steal to streamline your own bank referral program page, and show customers how simple it is to share.

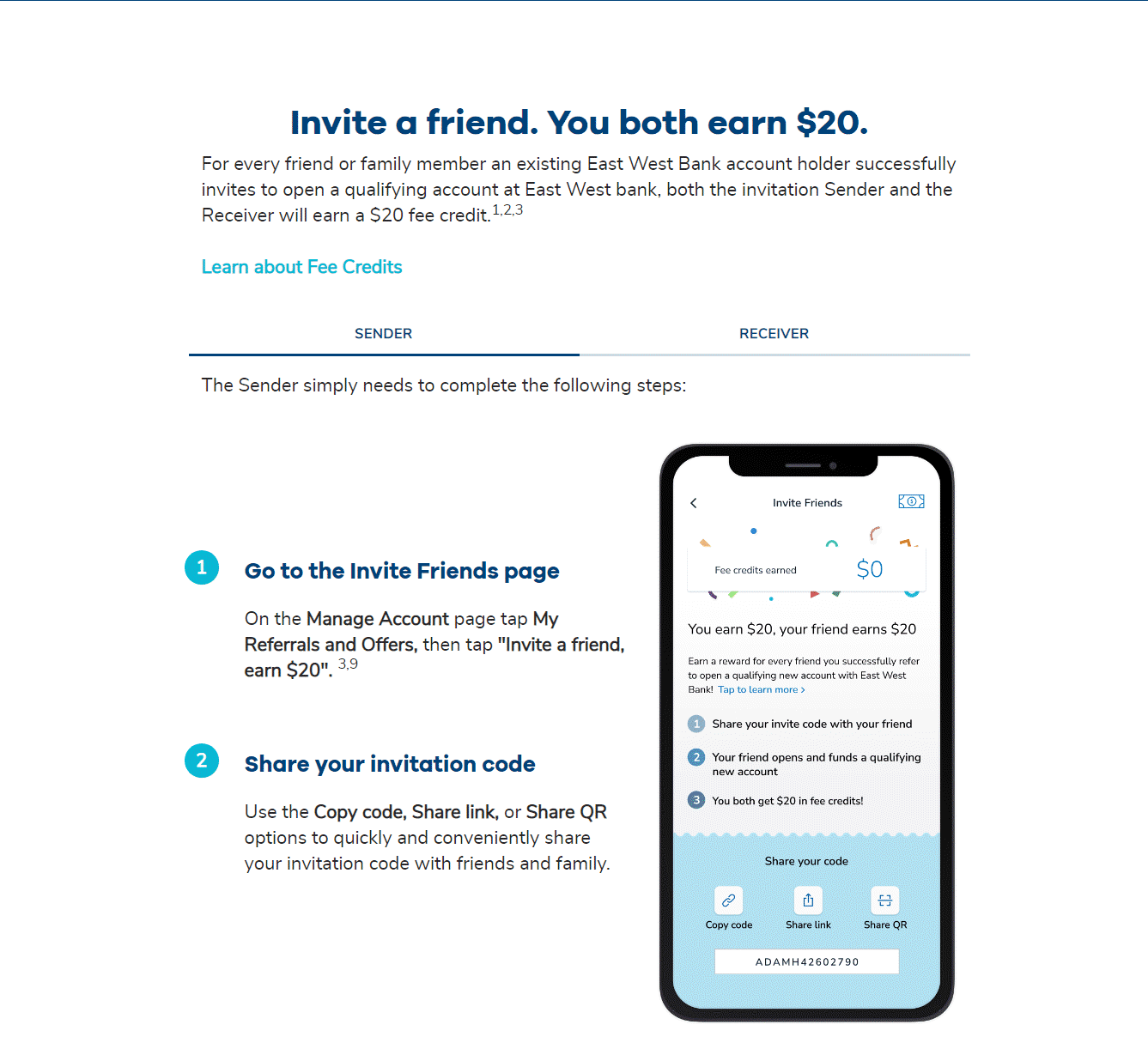

8. Velo by East West Bank

Velo by East West Bank offers online and mobile U.S. banking for people living outside of the United States. With their mobile focus, it makes sense that their bank refer-a-friend program is seamlessly integrated into their mobile app. With just a single tap, customers can copy their personal referral code or share their referral link directly. And if they prefer, they can even share a QR code for their friends to scan!

Once a referred friend opens and funds a qualifying account, Velo pays out a simple reciprocal reward of $20 for both the referrer and friend, paid in Velo fee credits.

Just like its stellar bank referral program counterparts, Velo explains the referral process in just a few easy steps. A big difference here, though, is that Velo also explains what the newly referred friend must do to earn the reward, from the newly referred friend’s perspective. That way, there’s less friction on both sides, and the existing customer can even show the page to their friend if the friend has any questions.

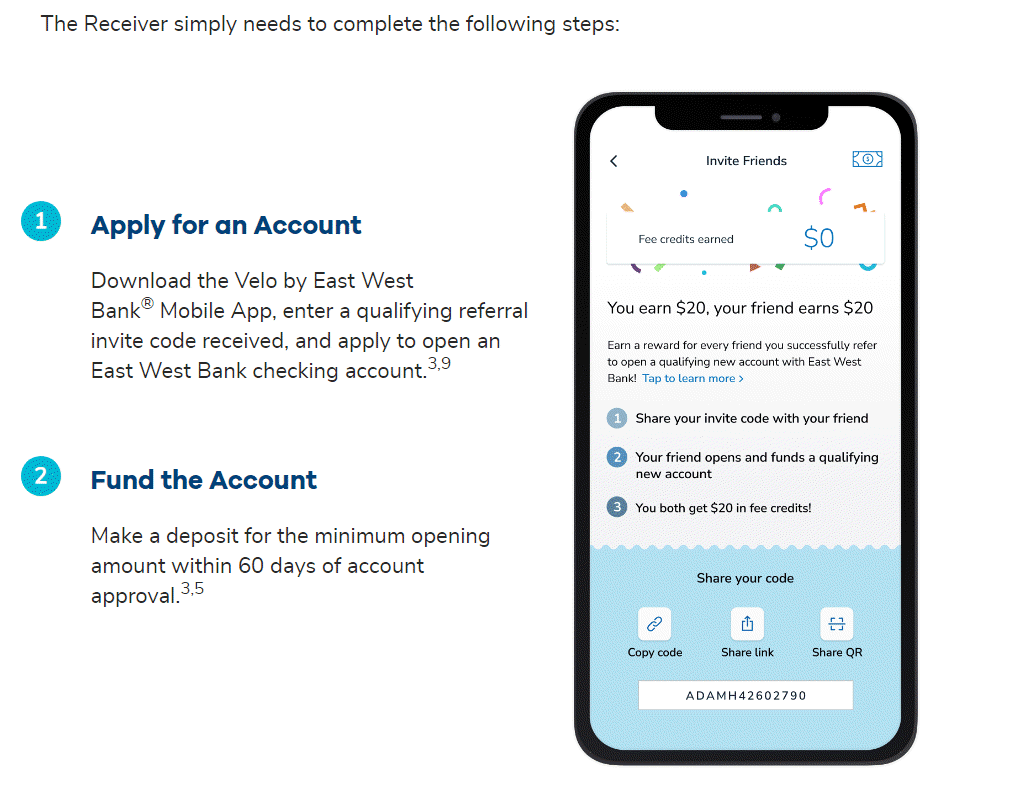

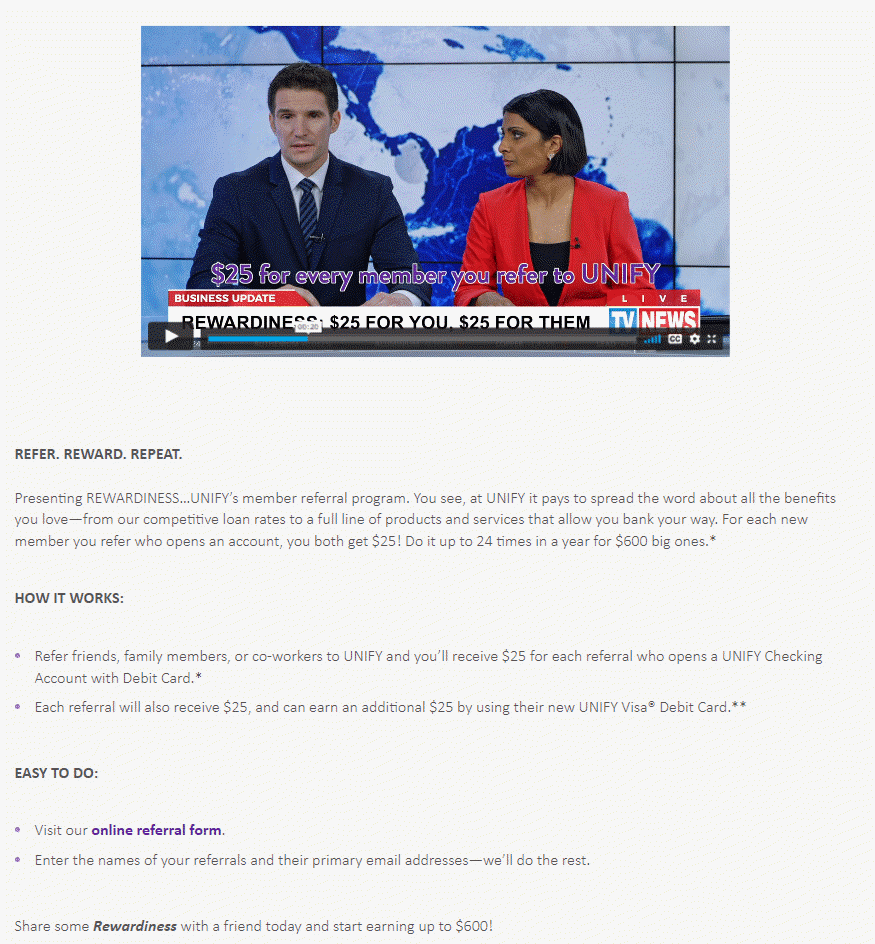

9. UNIFY Financial Credit Union

UNIFY Financial Credit Union draws customers in with a unique referral program catchphrase – “Rewardiness” – which they define as “the sense of accomplishment knowing your friends’ finances are in good hands.” This emotional appeal combines altruism with friendship to drive referrals. Consider combining a catchy slogan or phrase with an appeal to helping friends, as UNIFY did, to encourage more referrals.

The slogan and community-mindedness aren’t the only ways UNIFY’s program excels, though. A simple yet effective rewards structure (“For each new member you refer who opens an account, you both get $25!”), and a set of easy-to-follow steps go a long way in motivating customers to share UNIFY. Customers can even refer multiple friends in one click, by entering all their emails at once.

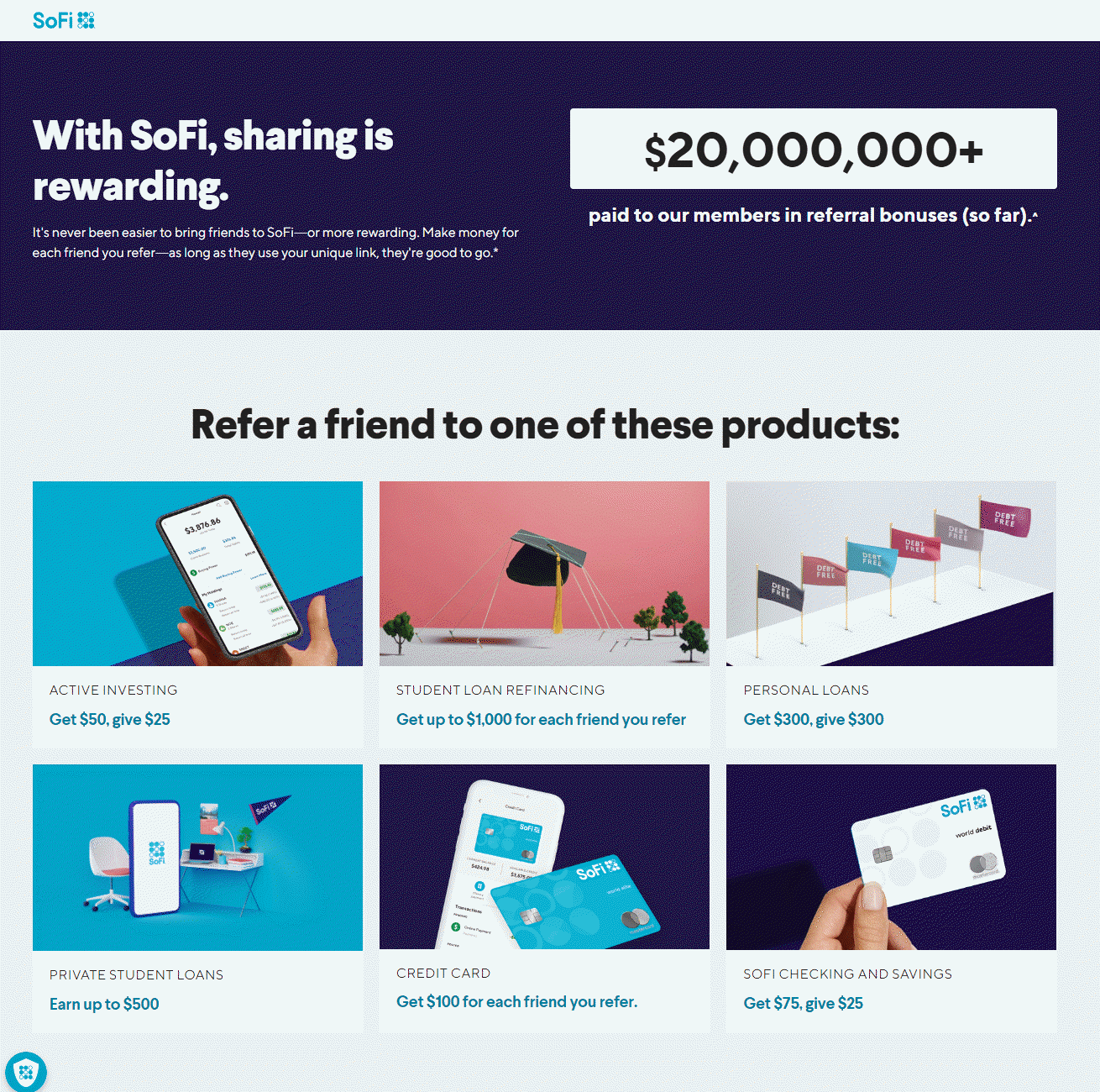

10. SoFi

Sharing really is rewarding with SoFi’s bank refer-a-friend program, as SoFi has paid over $20 million in cash bonuses across all of their different referral programs. SoFi customers can refer their friends to individual services of their choosing, including new personal checking accounts, savings accounts, a credit card, investment options, and loans, based on what they think their friends would benefit from most. And that amount displayed at the top of the page reassures customers that the rewards are real and attainable.

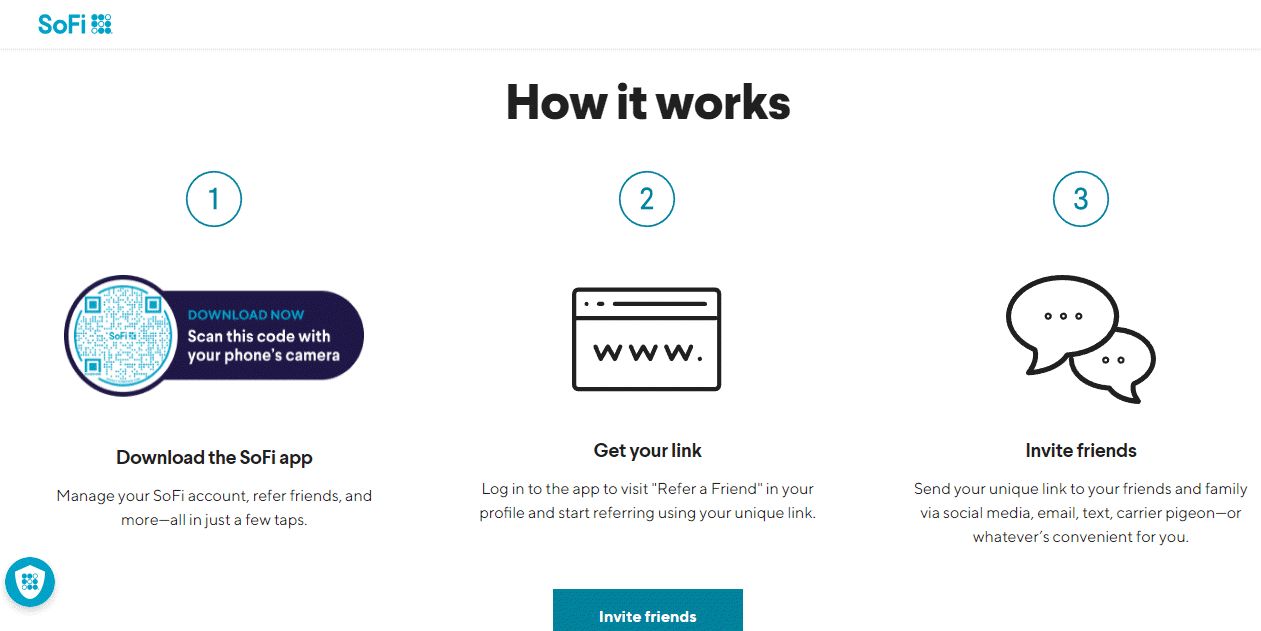

Via the SoFi app, customers can copy their unique referral link in just a few taps, then share in the method that’s most convenient for them (including email, SMS, and social media).

Referring friends is as easy as 1-2-3 thanks to SoFi’s quick explanation of how to participate in the program. And if customers have any more questions about the referral process, they can follow the link to the program’s FAQ page.

5 benefits of bank refer-a-friend programs

You’ve seen the inspiring examples. But are you still wondering why you should start a referral program for your bank?

These benefits show why you can’t afford to miss out on bank refer-a-friend programs:

1. Effectively acquire new customers

Let’s be real: people trust their friends’ banking recommendations infinitely more than they trust your marketing messages, no matter how clever your copywriters are.

Referral programs tap into the most powerful form of marketing—genuine word of mouth. When a friend says “This bank has saved me so much in fees,” people listen. And act.

That means referred leads are significantly more likely to open an account than cold prospects who stumble across your marketing campaigns.

2. Reduce acquisition costs

The numbers don’t lie: According to The Financial Brand, the average cost to acquire a new banking customer through traditional methods is a whopping $250-$400.

With referral programs? That cost plummets to $110-$175 per acquisition.

That’s not just savings—it’s a dramatic efficiency improvement that directly impacts your bottom line.

3. Boost brand awareness

Every time a customer shares your referral program, they’re putting your brand in front of people who likely haven’t considered you before. And since it’s coming from someone they trust, they’re much more receptive to learning about you.

This organic exposure builds brand awareness in a way that feels natural and trustworthy—not like you’re interrupting their day with yet another ad.

4. Increase customer loyalty

Since referred customers trust the peers who shared your bank with them, referral programs bring in customers who are more likely to stay with your bank for longer periods of time.

- Plus, by rewarding these customer advocates, you’re encouraging their loyalty, as well.

- This means that, in the long run, you’ll end up with customers who have a higher customer lifetime value.

5. Let you harness word of mouth as a channel

Your customers are already talking about you (hopefully good things!). A referral program lets you track the word of mouth, measure, and optimize this natural behavior.

Instead of hoping word of mouth happens organically, you can actively encourage it, measure its impact, and use data to improve your approach over time.

Before you start a bank referral program

Although these benefits are enticing, not every bank is ready for a referral program right away.

Before you start a bank refer-a-friend program, make sure you’ve taken the proper action steps. Having these elements nailed down will help ensure your referral program is a success.

This might seem obvious, but it’s worth emphasizing: you need existing customers who actually like you enough to recommend you. If your satisfaction scores are subpar, focus on improving your customer experience first.

Your referral program is only as strong as the network of advocates willing to participate. Without a reasonable number of satisfied customers, you won’t see meaningful results.

You’ll also need to know the details about your target audience (your existing customers, who will do the referring).

- What are their demographics?

- What platforms do they usually use to get information about your bank? (i.e., specific websites, social media, TV, radio, print media)

- What platforms do they use to communicate with friends? (i.e., email, social media, text)

- What motivates them to sign up? (i.e., convenience? Lower costs? A commitment to community responsibility?)

- What sort of rewards would encourage them to refer their friends?

Knowing your existing customers will also help you understand the leads you want to attract. Most of them may have similar traits, so creating buyer personas may aid you in this process.

In addition, make sure you provide great customer service. A stellar customer experience is the main reason customers will be driven to recommend your bank. You can survey your customers about their experience first, to determine if they are willing to recommend you to others.

6 best bank referral program tips and strategies

As shown in the examples above, the design, rewards structure, and promotion of a bank referral program are the three places that make or break your program. The following program tips and best practices will help you create and run a bank referral program that works.

1. Create an ongoing bank referral program

There’s a reason why the bank referral program examples we highlighted are ongoing, not time-sensitive.

You might have seen other banks give referral bonuses for a limited time. Or, you might have tried this strategy yourself before. Don’t make this common mistake.

People will naturally refer friends to your bank when they know their referral will benefit a friend. Word of mouth happens organically, and you’ll want to capture the benefits whenever you can.

But if you only capture and reward referrals for a short time, and then deactivate the rewards structure, this won’t be worth the time and investment it takes to set up a referral program.

An ongoing bank refer-a-friend program, on the other hand, allows you the opportunity to motivate multiple referrals from the same customer over longer periods and to build true advocates. You’ll also gain long-term, actionable data related to word of mouth.

2. Make sharing easy

The easier your program is to use, the more people will participate. Every extra click, form field, or moment of confusion dramatically reduces conversion rates. Sharing should take very few clicks or taps from access to reward.

Be sure to include these links in all emails where you mention your referral program, including transactional emails and account update emails.

Learn more about how Referral Rock offers a streamlined referral experience to your customers >

The program’s terms must also be simple. Include concise benefits of sharing (both rewards and intrinsic benefits) on your program landing page. Condense the instructions into 3-4 simple steps, and include a clear referral call to action to get customers to take the next step.

In addition, enable customers to share on multiple channels. This way, they can share your bank in the ways they normally communicate with their friends.

For instance, don’t limit your customer’s sharing options to just referral emails. Instead, give them the option to send referrals via social media, email, text message, and other mediums.

The best way to broaden your customer’s sharing options is with a referral link – one that customers can copy and paste anywhere.

We also recommend pre-drafting messages for the customer to send to their friend, so they don’t have to think about what to say. Make sure the message sounds conversational and like the customer wrote it.

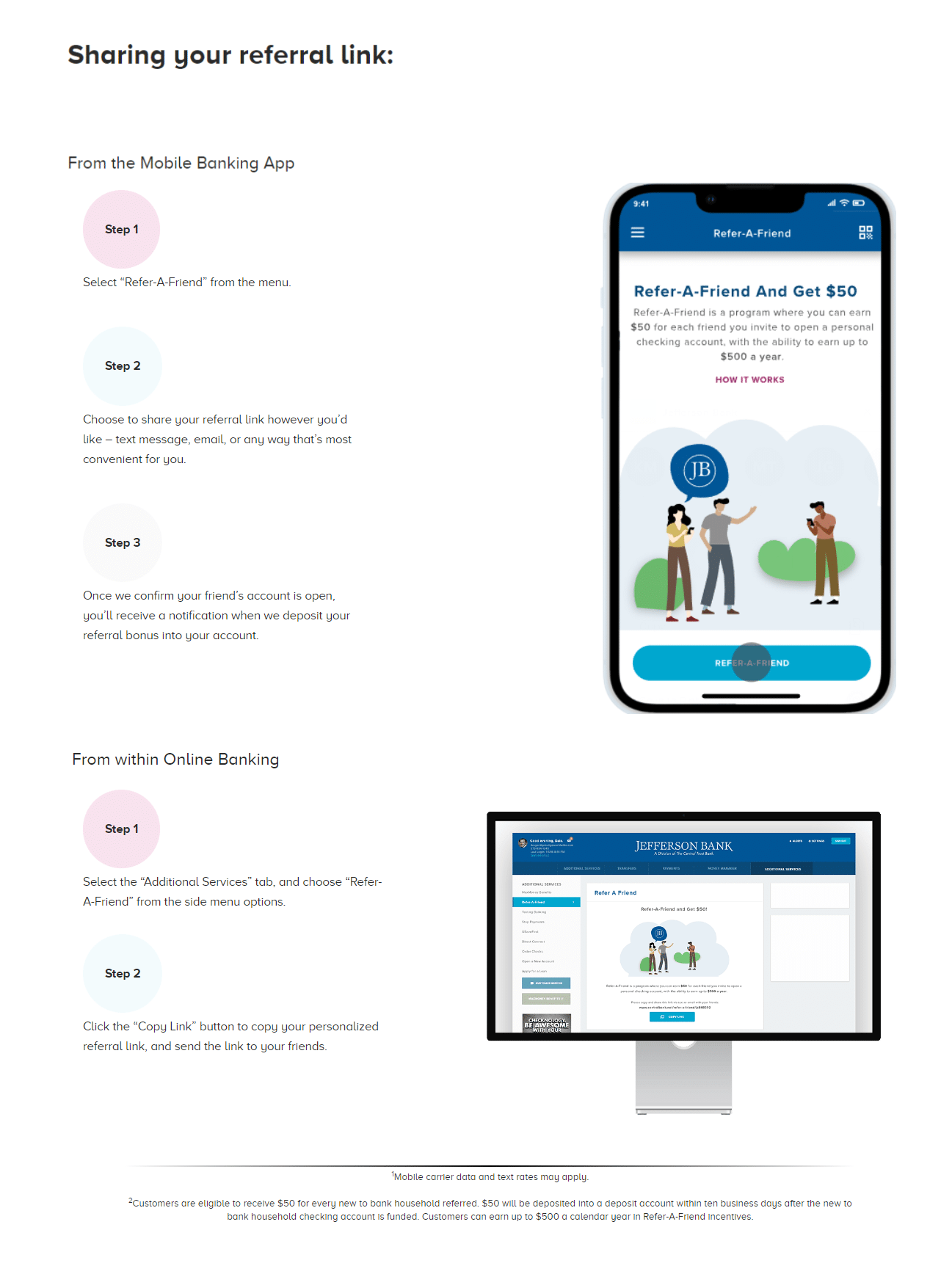

Jefferson Bank makes sharing easy, from both mobile and desktop. They show how simple the referral process is by breaking it down into steps, and let customers easily share their referral link from anywhere.

3. Offer enticing, meaningful rewards

Don’t skimp on referral program rewards.

Your program perks need to strike the perfect balance: enticing enough to motivate sharing, but sustainable enough to maintain long-term. Set too low of a reward and your customers won’t be motivated. But be sure the reward fits your budget, too.

The best bank referral programs give double-sided referral rewards to motivate everyone involved. Give rewards to both the referrer and their friend – to the referrer as a reward for sending a new customer your way, and to the friend after they make their first deposit.

Simplify the reward earning process too. If customers have to meet complex requirements to receive their reward, they’ll likely lose interest.

It’s also important for the referral offers to be meaningful.

- Usually, bank referral rewards consist of a bonus deposit for the referrer’s existing account, and an extra initial deposit to the referred friend’s new account. This connects back to your bank.

- For standard deposit accounts, $50 each for the referrer and friend often works well.

- Some banks choose to offer gift cards (or prepaid Visa/Mastercard gift cards), as these also let the awardee spend the money on whatever they please. These options work well for business bank account referrals, when the referrer isn’t the one who owns the account.

If it aligns with your audience’s values, a charitable or altruistic reward may also work for your bank. Starling Bank rewards referrals by planting trees in the referrer’s name.

4. Decide on your reward structure

The best practice is to reward the referrer immediately after someone they refer opens a new account, and to make that reward available for every successful referral a customer makes.

But depending on the actions you want new customers to take, you could also pay a second reward to the referrer after the new customer makes qualifying direct deposits over a certain amount, meets certain balance requirements, registers their first debit card purchase, uses their card within a certain number of days of account opening, or remains in good standing for a certain number of days.

A structure like this, where you reward customers at different stages (when they open an account and when they generate value), is called a multi-step referral program.

You don’t need to go with a multi-step program, though, as there are other motivating structures that may work better for your bank. You might instead use tiered rewards to motivate multiple referrals. These increase in value after a member makes a certain number of referrals, who go on to open accounts with you.

Or, consider giving different levels of referral rewards based on the account type. You may decide that referrals for higher-level accounts (like business checking accounts) merit larger rewards, as compared to the standard referral reward for basic accounts.

Referral Rock is flexible enough to handle any reward structure you desire, including tiered rewards, multi-step rewards, and differing-value rewards based on account values.

Here’s more on how Referral Rock can help you optimize rewards >

5. Promote, promote, promote

Even if you create a program that follows all the other best practices, it won’t work if no one knows about it.

The more program members you have, the more chances you have to bring in successful referrals (and more revenue.) So, promote your program, and the rewards on offer, within all your customer touchpoints.

The best promotional channels are the ones customers see regularly. Here are some ideas for promoting your program:

- Post signs in your branch, and on your ATMs, that advertise your program.

- Create a website banner or hero image that customers can easily find on your homepage. Link it directly to your referral landing page.

- Consider other subtle ways to promote your program on your website. For example, some banks add a link to their footer or menu. As long as customers can see it, and find it, they’ll be more likely to join your program.

- Add links to your referral program within your online banking portal so regular patrons can easily access it.

- Post about your referral program on your social media account. If you have multiple branches, make sure each branch promotes the program on their local social media accounts.

- Personally invite customers to join your referral program when they are happiest, such as right after a significant deposit, after a positive review, or after an account anniversary.

- Send mass emails about your program to all customers at once. We recommend sending dedicated emails monthly to quarterly, to reach newer customers and keep the program at the top of all customers’ minds.

- Promote your referral program in transactional emails, balance updates, newsletters, and other “regular” emails you send, with a short referral call to action.

- Lead into your referral program using your regular customer surveys. If someone gives you good feedback, direct them to your program.

- Use Referral Rock’s Monthly Summary emails to help keep members engaged. These share a personalized overview of each member’s activity every month.

Pro tip: Continually promote your program so your customers will instinctively use it when they want to tell their friends about your bank.

Banks with the most successful referral programs know a program doesn’t run itself. They’re promoting their programs consistently, on multiple channels. Referral program promotion is a long-term investment.

Find more referral program promotion strategies here.

6. Automate the process with the right referral software

Manual tracking of referrals is a recipe for frustration, errors, and missed opportunities. The right referral software transforms your program from an administrative headache into a streamlined growth engine.

Referral software tools allow you to track the amount of referrals your customers generate, track which customers your referrals are coming from, and quickly distribute rewards. You’ll also have plenty of data on your referral program that you can use to measure success and refine your program structure.

Plus, referral software generates unique referral links for customers to easily share your program via social media and email.

Referral Rock software streamlines program design, tracking, rewarding, and promotion, making it a key tool for any bank that wants to run a successful referral program.

With Referral Rock, you can:

- Fully customize rewards: Select any reward type and structure you wish, including tiered and multi-step rewards.

- Track referrals seamlessly: Unique referral links for each customer let you track exactly where each referral came from. Plus, customers can track referrals they send with their own personal dashboards.

- Automate reward payouts: Send incentives right when they’re earned to keep customers happy. Automate multi-step payouts by connecting with your CRM.

- Automate promotions: Strategic, automated promotional emails keep customers engaged, and the passwordless links inside make sharing even easier.

- Integrate with key tools: Seamlessly integrate Referral Rock with over 50 tools, including your CRM.

- Collect program data: Measure your program’s success at a glance, and make informed adjustments and improvements.

- Set up quickly: Referral Rock lets you set up your program in days (not months), with expert support at every step.

Wrapping things up

The secret to referral program success isn’t complicated—it’s consistency, visibility, and attention to customer experience. By focusing on your customers’ needs and removing friction from the referral process, you can transform casual customers into enthusiastic advocates.

Remember that the word of mouth about your bank is already happening. A well-designed referral program simply gives you the tools to harness, measure, and amplify it.

Whether you’re ready to build a comprehensive program from scratch or want to start with something simpler, Referral Rock can help you accelerate the word-of-mouth you’re already getting and turn it into a sustainable growth channel.