For your referral program to deliver the best results, you’ll need to offer advocates something in return for their referrals. Often, this incentive is a monetary payout known as a referral fee.

Today, we’ll cover everything you need to know about paying referral fees to individuals, including:

- What’s considered a referral fee

- How to set referral fees for your referral or affiliate program

- Whether referral fees will work for your business

What is a referral fee?

Referral fees are cash commissions that you pay to people who refer new customers to your business. They reward individuals for bringing you new customers through word of mouth.

Referral fees are sometimes called finder’s fees, referral commissions, or affiliate commissions. They are used throughout a wide range of industries, including real estate, insurance, and SaaS. Sometimes, businesses pay referral fees in exchange for a qualified lead. But more often, a referral fee is tied directly to a sale.

Referral fee fundamentals

The idea behind paying referral fees to individuals is similar to paying real estate agents for finding apartments that haven’t been placed on the market yet. A real estate professional has the experience and contacts to find these apartments, which you might never have known about on your own.

As a business, you can offer similar payments – referral fees or finder’s fees – to customers, creators, partners, and fans who bring you quality leads and sales.

These individuals create connections that your business otherwise wouldn’t have. Every time they bring you new business, you pay a referral fee in exchange for their assistance in the sale.

Free Download: Figure out the best referral fee for your business with our free referral fee calculator!

Referral fees in referral and affiliate programs

Within the context of a referral program or affiliate program, the referral fee is the reward you give advocates (existing customers, affiliates, brand ambassadors, or partners) when they bring in a qualified lead or new customer. These fees are paid in cash.

(It’s also common for referral programs to pay out other cash-adjacent rewards, such as store credits or gift cards. But these are not considered referral fees in the traditional sense.)

Referral fees encourage advocates to keep reliably sending new customers your way. And since these fees are only paid out when you see real results (qualified leads and sales), the referral program covers the cost of the referral fee.

What about a referral program’s new customer reward? Is that a referral fee?

In addition to paying referral fees, we also recommend giving a reward to referred friends, to encourage them to make a purchase. This helps sharers earn their own referral fee, as it makes their referrals more willing to complete the action needed for the payout. It might also make people more willing to share in the first place, as they’ll love the opportunity to help out the people in their networks!

While the friend reward is an important part of a referral program incentive, it isn’t considered a “referral fee.” This reward is still paid for by the referral program, though, as it’s only paid out when the referred friend becomes a lead or makes a purchase.

So, be sure to account for a friend reward when budgeting for your program, and when deciding on the referral fee paid to sharers.

Our free referral fee calculator makes this easy, as it has a space to figure in the friend reward!

Are referral fees effective?

Why would a business want to cut into their margins and offer others a referral fee? It’s simple: Trust. People will always trust the recommendations of their peers far more than other forms of advertising. But your existing customers, partners, and fans need a reason to send referrals. What’s in it for them?

Referral fees motivate people to share your brand, and the amount of new customers gained through referral marketing efforts are often worth their weight in gold. These new customers have a basis of trust with your brand, and are more likely to stay loyal to your business.

By offering referral fees, a business can access client networks that are normally tough to tap into. If an existing customer has a whole network of people who would be perfect customers, it makes sense to enlist them as a salesperson, and pay them a referral fee when they generate more customers.

Percentage vs. flat referral fees

Many referral fees are calculated as a percentage of a purchase a referred customer makes. Or, you can also offer a flat fee, which works well if your margins are thin, or if you also employ a sales team or person (in addition to the referrer).

Should you offer your referral fee as a flat amount, or as a percentage of a sale? Here are our recommendations:

Percentage structure

Percentage referral fees, also called percentage commissions, recognize the value of a referral in proportion to the purchase that referral made. They encourage people to bring in referrals who will make bigger purchases.

You’re also able to use language such as “get up to $X,XXX when your referral makes a purchase.” This messaging can showcase the higher total fee potential, so it grabs referrers’ attention.

Consider percentage rewards if you have several different levels of pricing plans, or if purchase amounts vary widely.

Percentage-of-sale rewards are more common for affiliate programs and less common for customer referral programs. Compared to a flat fee, it can also be harder to come up with a percentage-of-sale amount that makes sense across products and services. So, many companies start with a fixed amount to make it easier to predict payout costs.

Flat fee

If you offer a small selection of products or service levels, a flat fee might make more sense. As with percentage fees, we recommend setting the flat fees based on the value of a sale. This means you’ll pay out bigger referral fees when referrals buy higher-priced products or plans.

Scaled flat fee rewards are also a good fit for businesses with a set menu of services, each with different price, time, and complexity levels (say, repairs vs. installations).

Based on our own data, flat fees are much more common across referral programs than percentage commissions are. 92% of Referral Rock programs reward a fixed amount, and only 8% reward a percentage of a sale.

What’s a typical referral fee?

While typical percentage referral fees generally range from 5%-35% of the transaction value, that’s a wide range, and some companies offer even more due to a competitive market. It’s more important to select a referral fee that’s competitive, yet sustainable for your bottom line.

Free Download: Simplify the process and find the right referral fee with our free referral fee calculator!

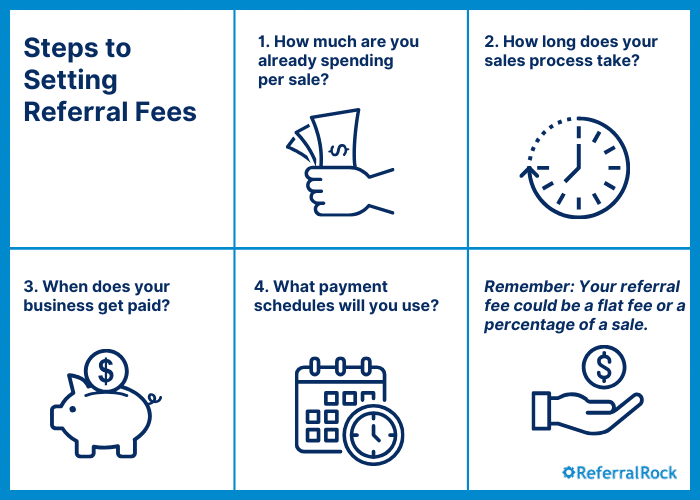

There are a few approaches to figuring out your referral fee. Here are four variables to consider when deciding on a fee for your company’s referral program:

1. How much does it cost to acquire a new customer?

Determining how much you already spend on a customer is crucial, as that will give you a benchmark on how much you’ll spend for your referral fee.

First, you’ll need to determine what a new customer is worth to you. Then, figure out the amount that makes sense to spend for your business to acquire each customer.

Consider these points of data, if you have them:

- Customer Lifetime Value (LTV)

- Average Purchase Price

- Return on Ad Spend (ROAS)

- Customer Acquistion Costs (CAC)

- Payback Period (how long it takes for your business to recover the CAC)

- Gross Profit Margin

Use all this data to create a range of what you’re willing to spend to acquire a new referral. Set your minimum and maximum amounts.

Remember that the money spent on referrals will replace some of the money you spend on ads, so paying referral fees tends to be less expensive than other marketing methods. Of course, you also need to pay out a fee that truly reflects the value of a sale, to motivate people to keep sending referrals your way.

If there is a substantial cost of doing business for the sale, you should set a lower referral fee percentage, or choose a reasonable flat fee. You might also consider offering other types of incentives in your referral program if your CAC seems high.

2. How long does your sales process take?

Some sales processes take a long time to close. Whether your company is paying referral fees to individuals or other businesses, it’s always important to think about the length of a typical sales cycle. Can someone simply buy right away, or does the purchasing process involve multiple steps (including lead qualification)?

For relatively long cycles, will a customer be able to earn a referral fee at any time the person decides to purchase, even if it’s several months later? These conditions must be fair to both the referrer and your brand.

For longer sales processes, consider multi-step referral fees: a smaller fee when a referral is qualified (say, they request a demo or sign up for a trial), and then a larger payment when that referral is approved (say, they make their first purchase).

Multi-step fees motivate members to send in referrals even if it takes a while for their referral to convert to a customer. Essentially, this means “splitting up” the referral fee and paying part of it earlier.

Businesses that can especially benefit from multi-step referral fees include sales-led B2B and SaaS companies, staffing agencies, and higher-value services that require a more “consultative” approach (i.e. HVAC installation, landscaping, plumbing, construction contracting).

3. When does your business get paid?

You should only pay out your referral fee when you see results: when your business makes a sale (or in some cases, gains a qualified lead).

To help determine the conditions of your fee, think about the answers to these payment questions:

- When and how does your business get paid?

- How are funds received for the sale? Upfront or in several installments?

- Do you offer a recurring service?

- What’s your policy for refunds or money-back guarantees?

When cash is received helps you plan out your payment schedule. No matter what you decide, ensure you are making money in all cases.

4. What reward structures will you use?

Depending on how you want to drive referrals, there are many different payment structures you could use for referral fees. It all comes down to what will best motivate your referrers.

Consider these incentive structures:

- Gateway rewards (Higher amounts for the first successful referral, to motivate new referrers to get started)

- Tiered/stacked rewards (Increasing the fee amount based on the amount of referrals made, to motivate multiple referrals from the same sharer)

- Multi-step rewards (A smaller referral fee for bringing in qualified leads, and a larger referral fee for bringing in sales, to keep motivation strong during long sales processes)

- Multiplier rewards (The higher the sale amount, the higher the referral fee to reflect the value of the sale for your business)

- Contests, where you reward your highest performers within a certain time period with an extra referral fee

For more on setting up these (and other) reward structures, check out our support article.

Will referral fees work for your business?

Offering a monetary incentive won’t always be enough to attract attention and shares. Referral fees will only work if you have the following in place:

- Your brand’s products or services are seen as valuable.

- Your customer service is top-notch.

- And your brand is generating positive buzz.

You want to show customers that your business is worth the effort before asking them to help spread the word. A referral fee just won’t work if people aren’t excited about your products and services.

After all, why would someone share something if they don’t believe in it? It would only damage their reputation and social standing, which is something no referral fee is worth.

First make sure you have a strong brand and product you’re proud of, as well as a group of loyal customers, and then you can offer fees to help grow your business.

Do you need a referral fee agreement?

A referral fee agreement (also called a referral fee arrangement or finder’s fee agreement) is a formal contract between a referrer and the business owner that establishes the referral fee percentage or amount, expectations, conditions, and everything else referrers need to know about getting paid for sharing.

You don’t have to outline a written agreement if you’re running a traditional customer referral program. Instead, give a brief explanation of how customers can earn the referral fees, and quick access to your program’s other terms, on your referral program’s page or portal.

But if you’re working with afffiliates, ambassadors, or other more formalized referral partners, you should write a referral contract to clarify expectations on both sides.

This contract helps show that your company values a professional appearance, and lets you define those rules of professional conduct. Plus, the money involved can be significant, so a referral fee agreement can protect you in case something goes wrong.

What should be included in this type of agreement?

Role of the referrer:

- Do they forward leads to sales immediately?

- Or do they also perform marketing and sales tasks?

What is a successful referral?:

- Does a referral have make a purchase within a certain time period?

- Or must the purchase be worth a certain amount?

Compensation:

- How will the referral fee be calculated?

- Is it a flat fee or a percentage?

Payment conditions and fee schedules:

- When and how will you pay the referral fees?

- Do you have any detailed referral fee structures (like a bonus opportunity)?

- How will you handle return and refund policies?

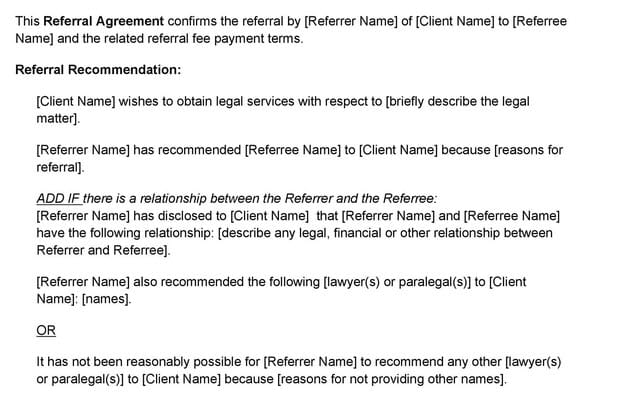

Below is an example of a referral fee agreement:

What are the tax implications of referral fees?

Before deciding to implement offer fees, you must also be aware of the tax responsibilities associated with these fees.

Note: These apply to referral fees within the United States. If you are based in a different country, check your country’s laws regarding taxes and referral fees.

- If a referrer receives $600 or more in referral fees within a calendar year, they must pay taxes on the amount they receive.

- If you pay a referrer more than $600 in a calendar year, it’s your responsibility to collect a W-9 form from them and issue a 1099 to them.

Are referral fees legal?

Yes, referral fees are legal, but only within certain industries.

Most industries also don’t pose any requirements in order for a company to implement referral fees.

However, since referral fees are not legal for all industries, you’ll need to do some research to make sure you don’t set up an illicit system.

Highly regulated industries, such as real estate, insurance, financial services, and automotive industries sometimes have state or national laws, or license rules. Sometimes, these regulations do not permit referral fees, and other times, they outright prohibit referral fees.

For example, in real estate, agents can legally pay referral fees to licensed middlemen, but state and federal laws usually prohibit paying real estate referral fees to people without a real estate license.

It’s best to make sure your specific industry allows referral fees before going any further in the process.

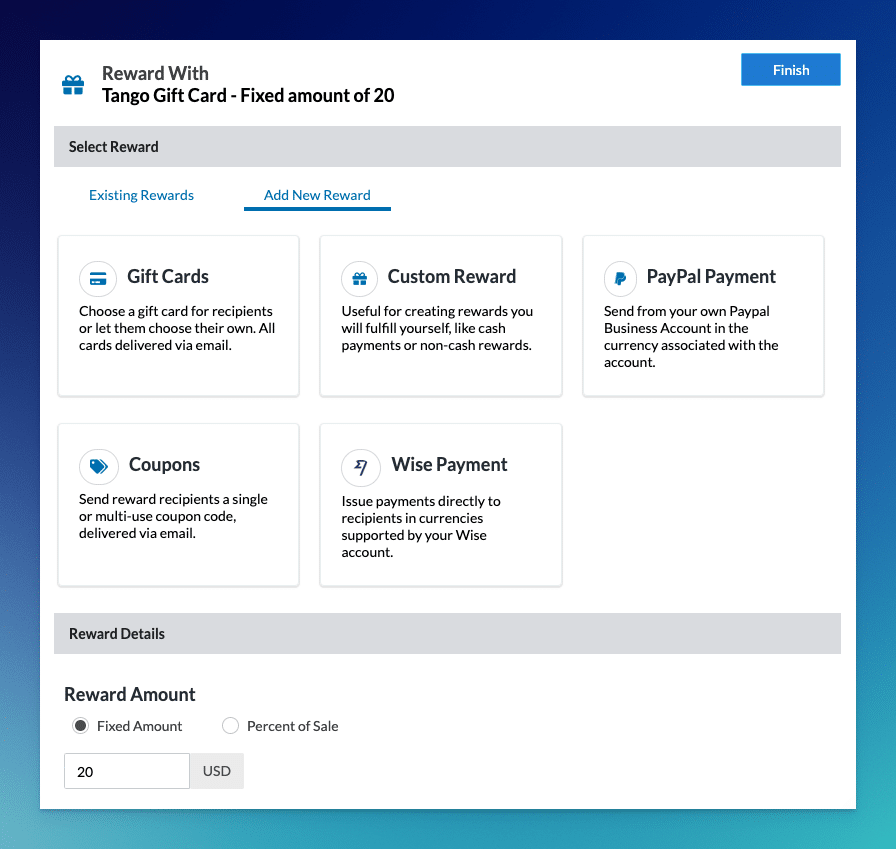

How do referral fees work in Referral Rock?

Referral Rock referral software lets you pay out referral fees in cash, or as gift cards if you choose. You can adjust your fee amount and type of payout as needed, for maximum flexibility.

Use our Reward Builder to set up the referral fees of your choice. Select the type and amount of the fee you’d like to offer, and choose whether you’d like to offer a flat fee or a percentage of a sale.

Choose from:

- PayPal cash payments

- Wise cash payments

- Custom cash payments

- Gift cards

- Coupons

- Custom tangible rewards

Set yourself up for success with the right referral fee

A referral fee encourages people to spread the message about a business, and then rewards them in cash (or a cash equivalent) for a job well done.

Make sure to choose your referral fees carefully, based on the cost of your goods, your total sales price, how long it typically takes to close a sale, and other tax and legal implications. If you can set up a referral fee that’s attractive to others, and is reasonable for your business, you’re on your way to see the benefits.

If you’re interested in paying referral fees to gain new clients, these resources may also help you create a reliable referral system:

- Referral Marketing 101: How To Create a Referral Program That Wins More Customers [+6 Examples]

- How To Build a B2B Referral Program [The Ultimate Guide]

- The Complete Guide to Creating A Referral Network

- How to Form Successful Referral Partnerships

- Level Up Your Partnership Incentives: Beyond Referral Fees