Performance-based commissions are the backbone of affiliate marketing programs. They’re how you recruit new affiliates – bloggers, social media influencers, and other creators – to promote you. And they’re the incentive that keeps existing affiliates motivated.

When you run an affiliate program, you need to reward affiliates with a commission every time they help you make a sale via their affiliate link.

But how much should you pay your affiliates? Here’s how to set an affiliate marketing commission rate that both attracts affiliates and protects your bottom line.

What is a typical affiliate commission rate?

The average affiliate commission rate is between 5% and 30%.

Keep in mind that commission rates can vary greatly across different industries. And usually, companies with digital products can afford higher commissions as production costs are lower than with physical products.

Here are some other average affiliate commission rates, based on data from several different sources:

| Ecommerce (all physical products) | 5% – 20% |

| SaaS | 15% – 25% |

| Other digital products (ex. hosting services, online courses) | 20% – 50% |

| Financial services | 20% – 40% |

| Health/Wellness | 5% – 30% |

| Travel | 5% – 20% |

Generally, 15% to 20% is considered a fair and attractive commission rate for most affiliate sales. But the right commission rate for your business depends on who your affiliates are, who you’re competing with for affiliates, and what you can afford to pay out.

Types of affiliates

You could have two main types of affiliates in your program. Recruit one or both types based on your needs and budget.

Creators with an existing following: These are bloggers, social media personalities, and experts who already have a trusted audience built in, who place their affiliate links in their content. Many of these affiliates are using affiliate links as a key income stream, so they’ll often choose brands to represent based on their earning potential (who offers the best commission, and what brands are most appealing to their audience).

Non-competing businesses: Sometimes, related businesses might partner up with you and agree to serve as your affiliates, earning commissions whenever they refer a new customer your way. They’ll share their affiliate link on their business website. For instance, an HVAC business or contractor might refer new business to a plumber, and get paid whenever their referrals become new plumbing clients. If you’re a service-based business, these affiliates may be a better fit for you, especially if they’re already making referrals naturally. They might not need as high of a commission to make a referral, since affiliate commissions aren’t the main way they make money.

How to set the right affiliate commission rate?

Setting a good affiliate commission rate takes work. You need a commission that attracts high-quality affiliate partners and encourages them to keep sending you customers, and that you can afford to keep paying consistently.

If your affiliate commission is too low, it will be difficult to form affiliate partnerships, and content creators may partner with your competitors instead. But if your commission is too high, it could eat into your profits.

Fortunately, there’s a formula.

Free Download: It’s easy to find the right commission with our affiliate commission calculator!

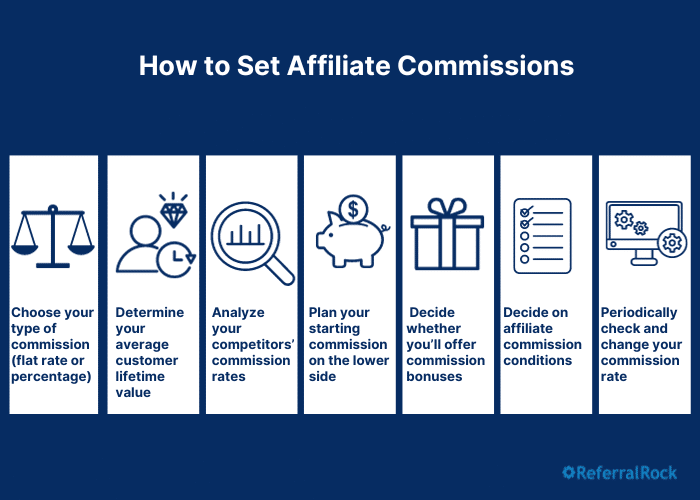

Follow these steps, and you’ll be well on your way to setting a competitive yet sustainable affiliate commission rate.

1. Choose your basic type of affiliate commission.

Choosing the reward itself is an easy decision – cash is king. A cash payment is a must for rewarding affiliates, as it enables affiliates to earn passive income.

But you’ll need to weigh percentage commissions vs. flat rate commissions. Do you want your commission rate to be a percentage of each sale an affiliate helps you make, or a set dollar amount for each sale? This is the first real step in determining your commission rate.

Percentage commissions are most common in affiliate programs. If you sell a variety of products, percentage commissions may motivate affiliates to promote the products that lead to a higher average order value. (After all, the higher the order value, the higher the commission earned on the order.)

But if you sell only a few specific products, each with a set price, then flat fee commissions may work well for your business. You might also opt for a fixed amount to simplify your program when you first start it, or if your affiliates come from non-competing related businesses. Telling an affiliate “For every person you send us, we’ll give you $50” feels cleaner, versus leaving the affiliate to calculate a commission. Of course, content creators who use affiliate programs as a main income stream don’t mind calculating a percentage commission.

2. Determine your average customer lifetime value.

How much can you afford to pay affiliates? This depends on your profit margins. However, profit margins can be difficult to determine and prone to fluctuations.

To simplify things, use your average customer lifetime value (CLV) as a guiding metric.

CLV is how much money the average customer brings in throughout their time as your customer, minus the average costs of acquiring a customer. The longer your customer sticks with your business, the higher your average customer lifetime value becomes.

Knowing your CLV will help you figure out a commission rate that’s affordable and sustainable for your business.

We’ve included the basic CLV calculation below.

Average CLV = Average annual profit earned from a customer * Average number of years someone has been a customer – Initial cost of customer acquisition per customer

Your affiliate commission must be well below your average CLV to be sustainable. If it’s equal to your CLV, you’ll only break even, and that’s not why you’re starting an affiliate program. (Using a percentage of each purchase as your affiliate commission will help make your program more sustainable.)

Remember that affiliate commission rates are part of your costs to acquire new customers, so the commission must not exceed your average customer acquisition cost. However, if you have a high customer retention rate, you can afford to offer higher affiliate commissions.

3. Analyze your competitors’ commission rates.

Some of your direct competitors are likely already recruiting affiliates. And even if they aren’t, other companies that attract a similar target audience to yours are still competing for the same affiliates as you are.

Find at least two direct competitors with successful affiliate programs. You can also find at least one business you don’t directly compete with, but markets to the same niche and audience as you (and possibly attracts similar affiliates).

Analyze the commission rates of their affiliate programs, then set an attractive, competitive commission of your own.

Examine how each of the competing programs you identified structures their affiliate commissions.

- What action triggers the payout of an affiliate commission (a sale, a generated lead, or something else)?

- Are the affiliate commissions a percentage of the sale, or a set amount for every completed sale?

- How does each competitor’s commission rate stack up? Does it seem high, low, or reasonable, relative to the price of their products and to other competitor’s programs?

- Does the competitor offer any bonuses for top-performing affiliates?

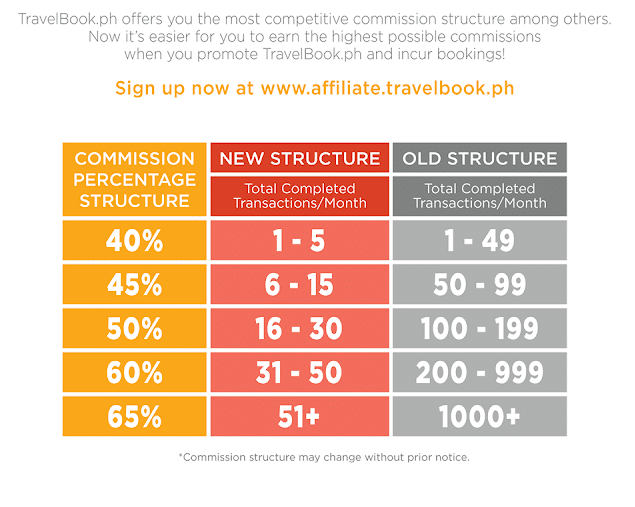

- Does the competitor offer tiered affiliate commissions (higher commissions for affiliates that bring in more sales)?

Keep these insights in mind when structuring your own affiliate commission. You want your commission to be competitive, compared to your direct competitors and any other brands that could potentially attract the same affiliates.

For instance, if most competitor affiliate programs offer a 15% commission, your program probably won’t be successful if your affiliate commission is only 10%.

4. Consider setting your starting commission on the lower side.

Now that you’ve analyzed your customer lifetime value and other brands’ affiliate programs, it’s time to set your own affiliate commission rate.

Find a range of commission rates that’s both enticing compared to competitors and affordable for your business. Then, it’s best to start with a base rate on the lower end of that range.

Why? This gives you room to increase your commission later on, while also putting your business needs first.

Affiliates won’t be upset if you increase your commission rate later – it only adds to their earnings. But if you start with a high commission rate that you are later forced to decrease, you’ll probably lose several affiliates (and have a harder time recruiting new ones).

Plus, starting with lower affiliate commission rates gives you freedom to test out bonuses or higher commission tiers for your best affiliates (more on these in the next section).

And since a lower commission rate means extra profits for your brand, you’ll have more room to set up promotions for your affiliates to offer their audiences.

You’ll also be able to launch other types of marketing campaigns (like a referral program) without breaking the bank.

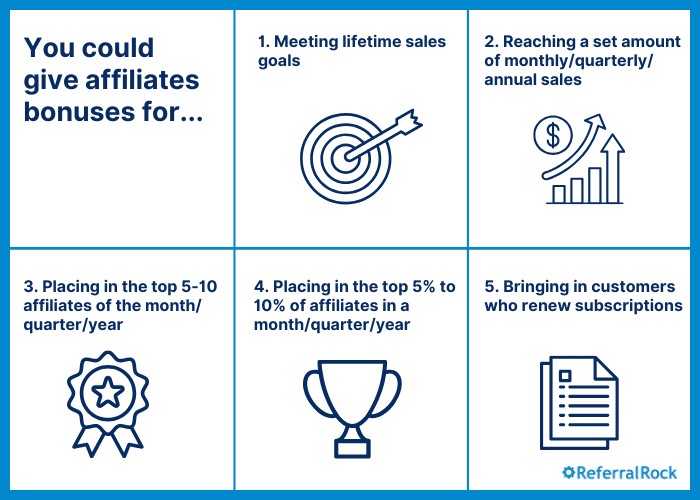

5. Decide whether you’ll offer commission bonuses.

Commission bonuses are great ways to recognize your best affiliates’ performance, and keep your program interesting and enticing for all affiliates.

There are many ways to apply commission bonuses:

- One-time bonuses (or valuable gifts) for affiliates who meet certain lifetime revenue goals.

- A tiered commission structure, where affiliates who make certain amounts of lifetime sales unlock a permanent higher commission rate.

- Competitive bonuses for creators within the top 5%-10% of your affiliates.

- “Streak bonuses,” where reaching a given amount of monthly or quarterly sales unlocks a limited-time commission rate boost, or a meaningful gift.

- Recurring commissions (also called lifetime commissions), where affiliates earn an extra commission whenever a customer who originally purchased via their affiliate link renews or upgrades their original product/service.

- This structure incentivizes affiliates to bring in potential customers with the best product fit.

- It works well if your software business is looking to run a SaaS affiliate program.

- It’s also great if you sell an online course, web hosting service, or other subscription-based digital product that depends on renewals.

6. Decide on affiliate commission conditions.

Setting a commission rate is only part of planning your affiliate commissions. You also need to establish the conditions or requirements affiliates have to meet in order to earn the commissions.

What do affiliates need to accomplish to earn a commission?

Usually, a business only pays a commission when a sale is made through a given affiliate’s link.

Many programs also state that affiliates only keep their commission if the product isn’t returned or the service isn’t cancelled within a certain time period. This makes your affiliate program low-risk: You only pay when your business knows it has received a return on investment.

If you’re a B2B business with a longer sales cycle, you may want to pay affiliates for both generating leads and sales through your B2B affiliate program. This staggered structure helps keep them motivated as potential buyers research your product or service.

If you decide to reward affiliates for bringing in leads, only pay for qualified leads, such as leads who request a demo or fill out a high-intent lead form. Set a smaller, fixed commission rate for the lead, and a larger commission rate (preferably percentage-based) for completed purchases.

Never reward affiliates with a commission for impressions or clicks, as this will leave you vulnerable to fraud. It’s easy for unethical affiliates to game this type of commission system.

Will you use affiliate tracking cookies?

How long will your affiliates be eligible for a commission after someone clicks their link?

Will affiliates only receive a commission if leads from their affiliate link make a purchase on that same visit? Or will they earn a commission for a certain period after someone clicks their affiliate link?

If you want to attribute a purchase to an affiliate days, weeks, or months after the lead visits your site via their affiliate link – and reward a commission on that purchase – you need to use affiliate cookies.

For B2Bs with a longer sales cycle, affiliate cookies are especially important, as leads usually do more research before returning to a site for a purchase.

Decide how long you want an affiliate cookie to last. Some affiliate programs set it to last for a week, two weeks, a month, or even longer.

It’s best to keep your cookie settings competitive with other affiliate programs in your niche. Your affiliate program software allows you to easily set up cookies for your preferred time frame.

7. Periodically check and change your commission rate.

To keep affiliates engaged and motivated, it’s best to revisit your commission rate regularly.

Check in on your competitors’ affiliate programs often, to ensure you’re staying ahead of the competition. After all, if a competitor’s commission rate greatly surpasses yours, it might lure some of your affiliates straight to that competitor.

Any commission rate change doesn’t have to be permanent, either. You could identify a month or quarter where you can afford to offer a temporary commission bonus, or where a temporary bonus could potentially increase total sales by the greatest amount.

This “surprise” bonus is a great way to capture attention, ramp up affiliates’ marketing efforts, and boost conversion rates during a slower month. You could offer a flat-rate bonus (e.g., a $200 bonus for every affiliate who brings in $2,000 in sales during July) or a temporary commission boost (e.g., an extra 5% commission on sales made in December).

Why you need affiliate software for affiliate commissions

Seeking the freedom to set any commission rates you want? The right affiliate marketing tool is key.

Don’t forfeit control (and money) to an affiliate network. Affiliate networks charge you extra fees whenever affiliates make sales, and that’s on top of the commissions you pay affiliates. On top of that, affiliates can shop around across the network to find brands that let them make the most money. This gives a disadvantage to brands that can’t afford to pay higher rates, particularly smaller retailers.

A better affiliate marketing strategy is to run your own program with affiliate software, as software gives you full control over affiliate commissions. And since you won’t be required to pay extra fees when affiliates make sales, software lets you offer more to affiliates (and put more money back into your business).

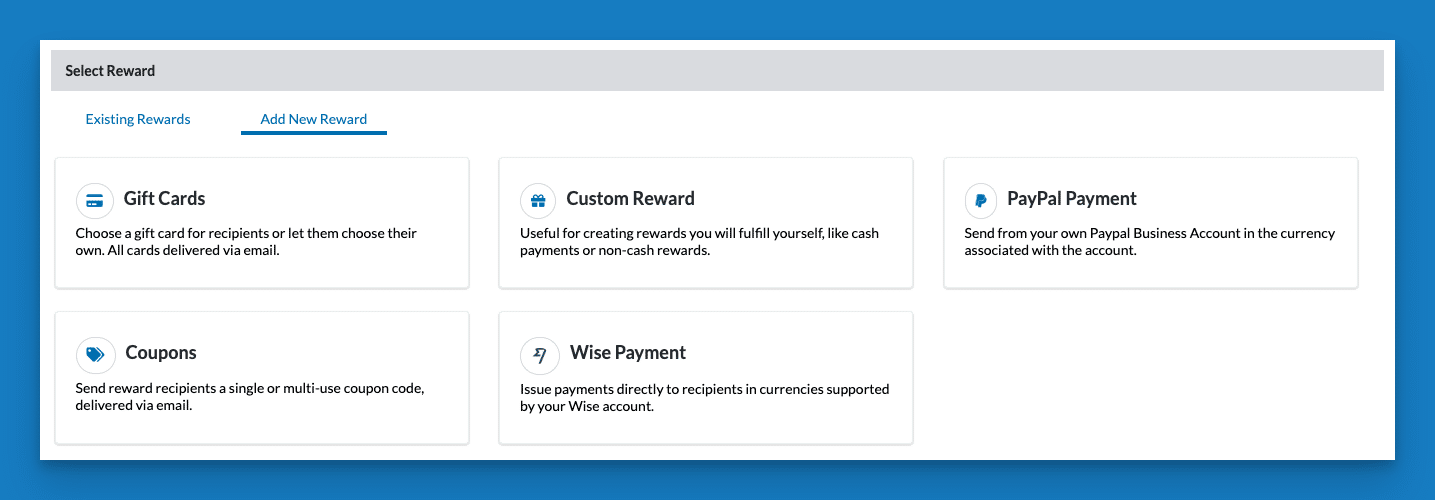

How to set affiliate commissions with Referral Rock

Referral Rock affiliate software is flexible enough to handle any type of commission, including tiered commissions, recurring commissions, bonuses, and multi-step commissions for leads and sales. Automate commission payouts whenever they’re earned, streamline affiliate management, and keep affiliates happy.

Here’s how to set affiliate commissions in Referral Rock’s Reward Builder:

- Set a commission type. For cash commissions, choose from Paypal payments, Wise payments, or custom cash rewards.

- Choose from a fixed amount or percentage of a sale, then enter the commission value.

- Decide when the commission is paid (for a lead, for a sale, or recurring when someone renews a subscription).

Affiliate commission rate FAQ

Still have questions on affiliate commissions? We’re here to help.

What’s the difference between affiliate commissions and referral fees?

Affiliate commissions are considered a type of referral fee or finder’s fee. After all, commissions are a cash fee, paid out whenever an affiliate refers new business to your brand.

Keep in mind, though, that affiliate commissions are paid out to content creators or partners at non-competing businesses, while referral fees could also get paid out to customers (who use a referral program), ambassadors, or other types of partners.

What is a good commission rate for an affiliate?

Average affiliate commission rates are between 5% and 30%. But a good commission rate is any rate that keeps up with your competitors’ affiliate programs, while still being sustainable for your business to pay out. It helps to check other affiliate programs’ commissions within your niche and industry before setting your own commission.

What are alternatives to affiliate commissions?

Instead of recruiting content creators or non-competing business affiliates and paying out cash commissions when they help you make a sale, you could start a referral program and give customers rewards for sending referrals.

With referral programs, you can offer discounts, store credits, gift cards, free products, and/or tangible gifts as rewards instead of (or in addition to) cash.

Free Download: Effortlessly find the right amount to pay affiliates with our affiliate commission calculator!

Wrapping up

Follow these steps to set an affiliate commission rate, and you’re on your way to motivating affiliates to keep promoting your products or services. Be sure to pay out commissions in a timely manner, no matter what rate and conditions you set.

Affiliate software, like Referral Rock, is an essential part of your affiliate marketing strategy. Software will automate payouts and make sure your affiliate commission rates are paid on time.