Loyalty programs are one of the best ways to motivate customers to keep buying from you. As you’ve probably seen, there are many types of loyalty programs your business can choose from. Choosing the right type of loyalty program to motivate your customers is key to offering them the most value.

But which type will best fit your business and keep the focus on your customers? A cash back program? A points program? Or something else?

Let’s dive into the most common types of loyalty programs, so you can find the one best for your company. We break down best practices for each type of loyalty program, as well as the pros and cons of each.

1. Points system

Best for: New businesses and simple purchases. Points systems work well for most business types, as long as your customers purchase from you frequently.

Points programs are the most common loyalty rewards programs by far – and the first kind of loyalty program to ever spring up.

In a points system loyalty program, customers earn points for performing brand-building actions. Usually, these programs reward customers for making purchases, but many also reward behaviors such as social media sharing and reviewing products. Once they’ve accumulated enough points, customers can redeem their points for an incentive.

Points system best practices

If you create a points system, you’ll want to make sure it’s simple to understand. Outline all the ways your customers can earn points, and list how many points are needed to earn each available reward. Most experts recommend a $1 spent = 1 point structure, as it’s the easiest to keep track of. However, any points-earning structure based on each $1 spent (ex. $1 = 10 points) works well.

Stay away from confusing structures, like “You get 20 points for every $15 and spending $500 earns you a free makeup kit.” This makes things harder for your customers and makes them a lot less likely to believe your program is worth joining.

Customers love choice, so offering a rewards menu, where customers choose what they’ll spend their points on, is a solid loyalty program best practice.

Also, make sure rewards feel attainable, to keep customers motivated. Think about offering several rewards of multiple values: lower-value ones for less points and more enticing ones for more points. This also gives customers a choice of how to spend points.

Dunkin’s DD Perks program awards 5 points for every $1 spent

Pros and cons of points programs

| Pros | Cons |

|

|

2. Tiered rewards

Best for: Businesses where purchases are infrequent, like companies in the travel industry

A tiered rewards program has multiple levels, or tiers, of rewards for customers to advance through. Customers who join this type of rewards program earn basic perks just for joining. As customers continue to make purchases, they earn points. Earn enough points, and a customer moves into a new tier and becomes eligible for higher rewards. Tiers are permanent and rewards activate automatically.

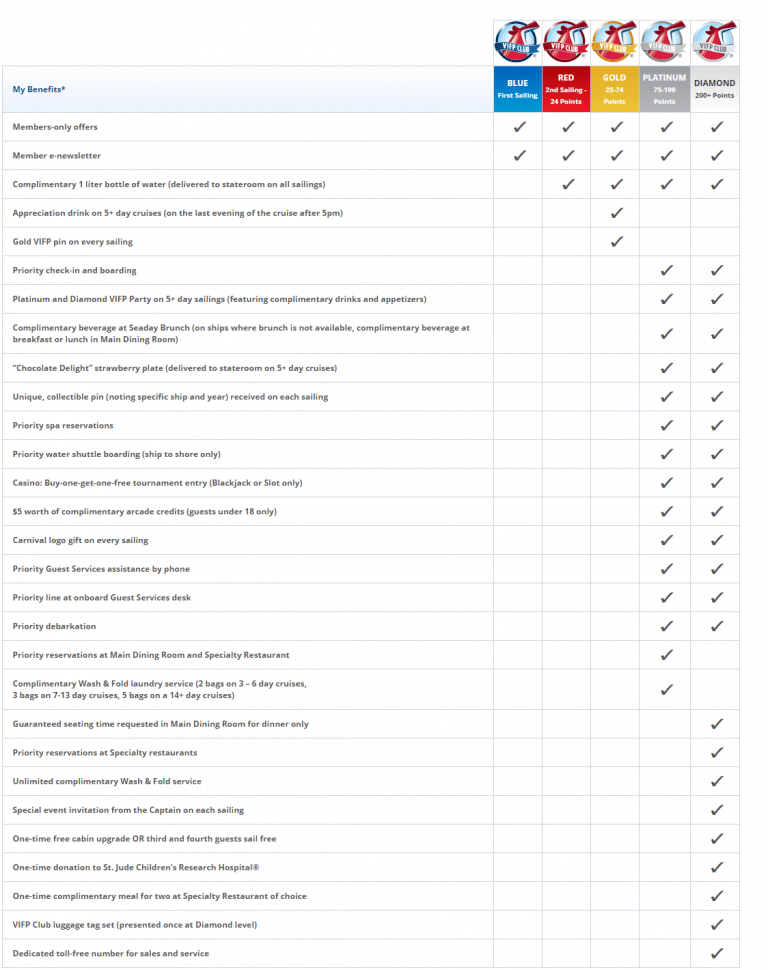

An example of a tiered program would be a cruise line rewards program, like Carnival’s VIFP program seen below.

Tiered program best practices

Follow these steps to design the best tiered program possible.

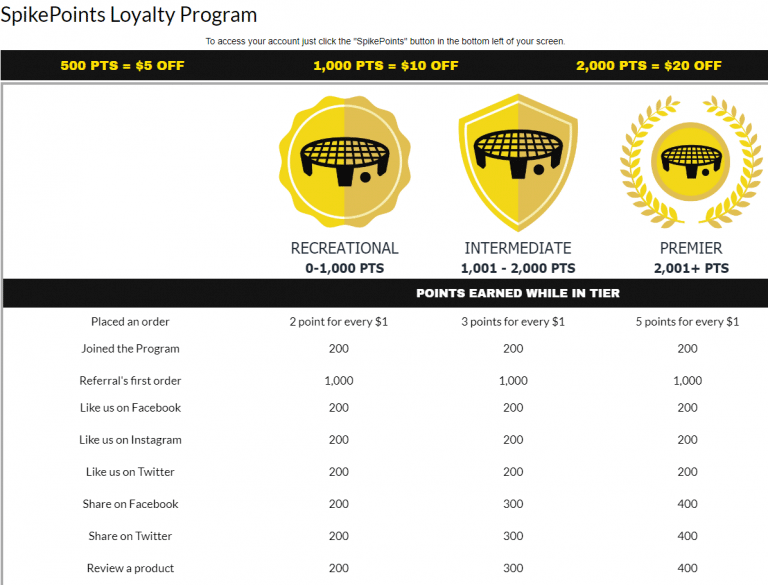

- Clearly define each tier, what customers must do to advance, and what rewards or perks are available in each tier.

- As customers reach higher tiers, award them more points per purchase.

- Consider awarding high-tier customers more points for social sharing and writing reviews This helps mobilize your most committed customers as brand advocates.

- Use a progress bar to show customers how close they are to advancing to the next tier.

- Roll out the red carpet for people who have reached the highest tier. For example, give them first access to new products before they hit your store, or invite them to exclusive events.

Spikeball’s tiered program clearly defines tiers, gives more points at higher tiers, and gives VIP customers more points for reviews.

Pros and cons of tiered programs

| Pros | Cons |

|

|

3. Threshold rewards

Best for: Retail or e-commerce stores where customers purchase frequently

A threshold program is a bit different from tiered rewards. In a threshold rewards program, customers can advance through levels, and earn VIP perks, after making a certain amount of purchases in a given timeframe.

However, these perk levels aren’t permanent. They last for a short time (a few months to a calendar year), and require a certain number of purchases within a timeframe to obtain (or re-earn).

Threshold program best practices

Threshold rewards programs share several best practices with tiered programs, but also have a few unique best practices of their own.

- Clearly define all the thresholds, what customers must do to reach the next threshold, and what rewards or perks are available in each threshold.

- Let customers know how close they are to reaching the next threshold. Think about showing this through an engaging points ticker or progress bar.

- Let customers know how long threshold perks will last, when they will reset, and how much they must spend to stay within a certain threshold.

- When customers advance to higher thresholds, award them more points for each purchase.

- Mobilize top customers as advocates through your program. Give high-ranking customers more points for review writing, social media sharing, and other advocacy actions.

- Treat people who reach the highest threshold like the VIPs they are. You could let them be the first to try new products, or treat them to exclusive events and experiences.

Pros and cons of threshold rewards

| Pros | Cons |

|

|

4. Cash/credit back

Best for: Retail and ecommerce; any business where purchases are frequent

In this program, when a customer spends a certain amount of money, they earn cash or store credits they can redeem at a later date. Kohl’s Cash is a prime example of this.

Cash back program best practices

Your cash back program must be extremely clear about how much customers need to spend to earn cash back, and how much cash back they earn at each level of spending. Take a cue from Kohl’s Cash: “Get $10 Kohl’s Cash for every $50 spent.”

Also, if customers can only spend their cash back during certain periods, make sure to specify that as well. Best practice, though, allows customers to use cash back rewards anytime, while limiting other sales so the loyalty rewards feel special.

Pros and cons of cash back programs

| Pros | Cons |

|

|

5. Punch card/virtual punch card

Best for: Food and drink establishments, small retail businesses, any other business where each purchase is relatively low in cost

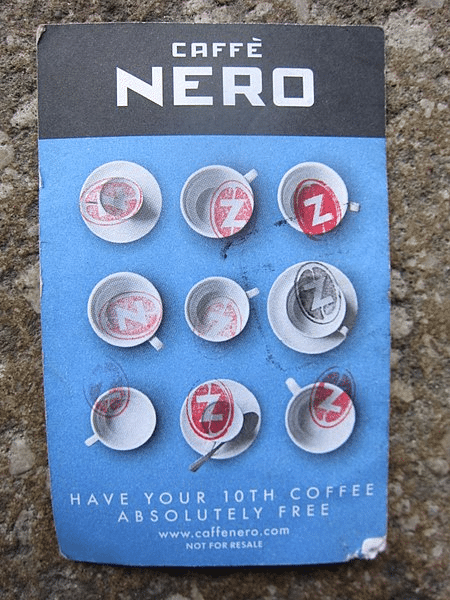

A punchcard is the simplest loyalty program option. Every purchase, or spend of a given amount, earns the customer a punch or stamp on the card. After a set amount of punches, the customer can redeem the filled punch card for a reward. This type of loyalty program can either be run physically (with a print card that customers must remember to bring to each store visit) or digitally (via an app). You’ve probably seen this program in businesses that sell food and drinks. (Think: “Buy 9 drinks, get the 10th free.”)

Punch card program best practices

Punch card programs are already very simple, so they’re easy to keep running smoothly. If you can, use virtual punch cards. That way, people don’t have to worry about remembering a physical card every time they come to your store. People always have their phones, so a punch card app is way more convenient. Plus, it lessens the possibility of fraud.

Also, be sure to include any crucial terms and conditions (like whether the reward can be redeemed at the same time as other coupons) on the physical or virtual card. And if you do use a physical card, try to use a unique stamp or marker to help prevent fraud.

Pros and cons of punch card programs

| Pros | Cons |

|

|

6. Gamified program

Best for: Any business looking to ramp up engagement; businesses looking for the most customizable program. This structure can work well for subscription services and B2B businesses, in a way that other loyalty programs don’t, thanks to the flexibility.

This type of loyalty program turns brand engagement into a game, using elements from a customer’s favorite mobile games and apps. Exact structures vary from program to program because it’s one of the most customizable types of loyalty programs. But common methods include:

- Running sweepstakes where purchases earn entries into drawings

- Leaderboards where customers can compare their performance to others.

- Engaging levels with names and descriptions that really motivate customers to keep purchasing (along with other game elements, so it’s distinct from a tiered program)

- Achievement-based programs where completing multi-step challenges earns rewards and virtual badges

Customers are already familiar with badge and achievement structures in the mobile games they play– and it keeps them addicted. So you’d do well to steal this idea for your gamified loyalty program.

Examples of branded challenges for achievements include:

- Trying new products

- Creating multiple reviews in a certain timeframe

- Reading your blog posts to find answers in a “scavenger hunt”

- Completing an educational course related to your brand

- Completing quizzes, like “Which product is the best for you?”

- Answering questions to help out other customers

The challenges you create will vary depending on what best fits your brand.

Gamified program best practices

Gamified programs are all about driving engagement. So, make sure that all elements of your program are engaging and on-brand. Make it super easy for customers to see when they have enough points to earn a reward, like by using an engaging progress bar.

Also, the rules of your loyalty “game” need to be easy to understand, and rewards need to be accessible. If your program’s too complicated, people won’t join. And if the only rewards you offer are a select few contest prizes, members will probably lose motivation.

The best gamified loyalty programs have a variety of ways available to earn points, including creating and engaging with branded content on social media, and writing reviews.

Pros and cons of gamified programs

| Pros | Cons |

|

|

7. Pay-to-join programs

Best for: Larger businesses with the scale to offer solid perks for a price

Customers pay a flat fee for membership in this type of loyalty program, which grants instant access to a set of VIP perks. Usually, memberships last for a year, but some pay-to-join programs offer lifetime membership. The most well-known example of a pay-to-join loyalty program is Amazon Prime. People who join gain access to free one- and two-day shipping, exclusive products, and exclusive content to stream for a year.

Pay-to-join best practices

Creating a pay-to-join loyalty program? One best practice reigns supreme. You’ll need to show your customers how the value of your loyalty program outweighs the upfront cost.

Think about Amazon Prime’s suite of features. The cost for Prime may seem steep, at around $155per year, but the features that come included have convinced customers that Prime is well worth it. From the classic fast, free shipping, to free music and video streaming, to a suite of exclusive products, to Prime Day deals and more, avid Amazon shoppers love Prime. And their thirst to get the most out of their membership leads them to choose Amazon more often, instead of going to the big brick-and-mortars.

Pros and cons of pay-to-join programs

| Pros | Cons |

|

|

8. Hybrid programs

Hybrid loyalty programs mix multiple loyalty program types, such as the ones listed above, together. The best practices you should follow for a hybrid program depend on the structures you combine. Since you’re mixing program types, you need to be extra careful not to over-complicate your program. Pay attention to the pros and cons of each program type you choose, because mixing programs often magnifies both the advantages and disadvantages.

Key takeaways

From points programs, to tiered programs, to pay-to-join, and all those in between, you’ve got plenty of types of loyalty programs to choose from to motivate customers to stick with you. Be sure to pick the one that will offer the most value to your customers, and that best meshes with the needs of your business. If you’d like to see examples of some of these program types in action, be sure to check out our article on loyalty program examples!