The reasons why customer referral programs work are clear: thanks to trusted recommendations, this type of word-of-mouth marketing brings in paying customers who are more likely to stick with you. Look at these great examples:

- Dropbox’s SaaS referral program resulted in four million users in 15 months and increased sign-ups by 60%.

- Paypal’s referral program increased daily growth by 7–10%, resulting in a user database of over 100 million.

- Catapult’s program generated over 4,500 referrals in the first six months

- Coolbot’s referral program resulted in 10 times the ROI in just a few months.

But is your referral program actually growing revenue?

To determine whether your program is a success, relative to the money you’ve invested in it, you’ll need to know your referral program ROI — something that’s easy to calculate with the right referral tracking in place.

Here’s your guide to measuring and improving your referral marketing program ROI (plus, how to estimate it if you aren’t running a program yet).

How to calculate referral program ROI

Referral marketing ROI, or return on investment, shows how profitable your referral program is – it’s the revenue generated from referred customers, minus the costs of running the referral program.

There are four main ways you can calculate referral program ROI:

- Program revenue minus costs

- Percentage of growth

- Using an ROI calculator

- Measuring customer lifetime value (CLV)

To calculate basic referral ROI (1 and 2 above), you’ll need two key figures:

- Total revenue generated from your referral program in a given time period (e.g. month/quarter/year)

- Total costs of running your referral program (how much you spend on referral marketing software and referral reward payouts)

If your program’s sales revenue is higher than your spend, then your ROI is positive.

To go deeper with your ROI calculation (3 and 4), you’ll need to collect more data, including Customer Lifetime Value — more on that below.

Whichever calculation you use, it’s a good idea to compare your referral program ROI with other channels’ ROI to see which campaigns are performing best.

Method 1: Program revenue minus costs

There are two calculations you can use to find your referral program ROI quickly. One shows ROI as a dollar amount, and the other as a percentage of growth or loss.

To calculate ROI as a dollar amount, simply add up the referral program’s revenue over a given period, then subtract the costs of running the program over that same period.

For example, say you make $50,000 revenue from referral sales in a year. Your total program costs that year are $10,500, as you paid out $8,000 in rewards in the year and your referral software costs $2500 per year.

Your ROI is $39,500 ($50,000 – $10,500 = 39,500).

Method 2: Percentage of growth

To calculate ROI as a percentage of growth, use this formula:

(Referral revenue – referral program costs) / referral program costs x 100 = ROI.

If you make $50,000 in revenue from the program in a year, and your program costs that year were $10,500, then your ROI is:

($50,000 – $10,500) / $8,500 x 100

$39,500/$10,500 = 3.76

3.76 x 100 = 376% growth

Method 3: Use a more detailed ROI calculator

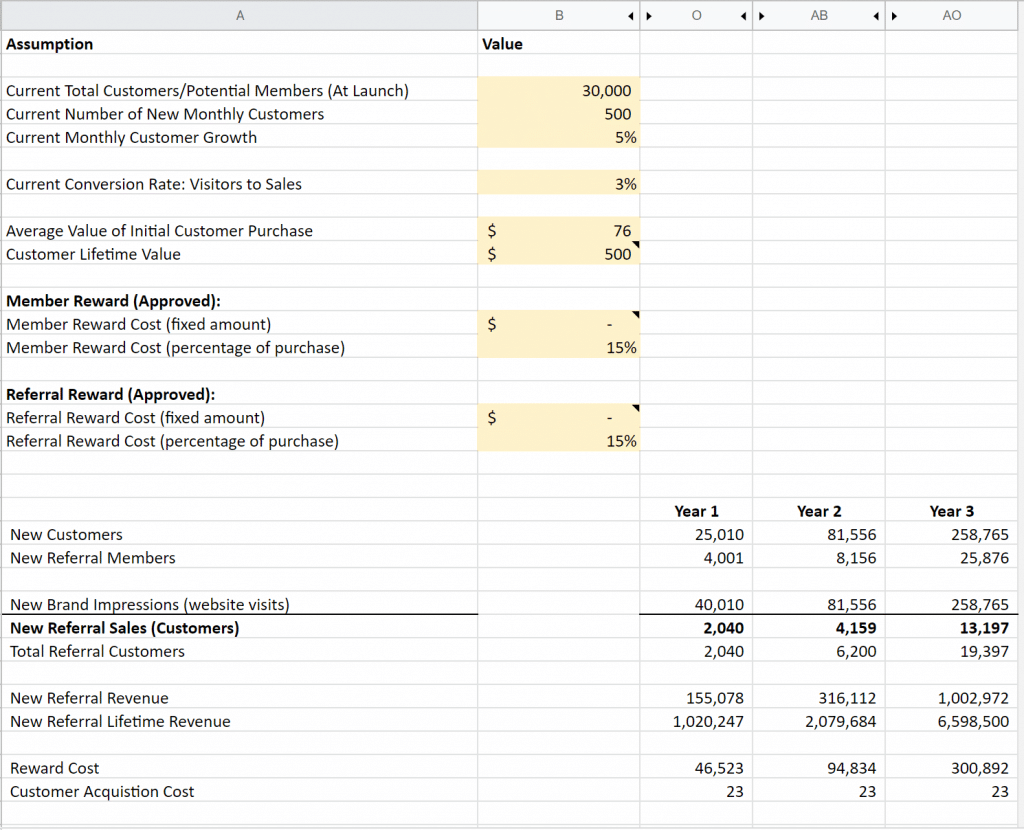

You can use our spreadsheet calculator to calculate your referral marketing ROI in more detail, and in a way that lets you see the total value you stand to generate. After inputting your customer data, you can see the projected ROI that a referral program can bring to your business.

To use these calculator, you’ll need to know a few more data points, including your current number of customers, monthly customer growth, and average value of initial customer purchase.

Method 4: Calculate customer lifetime value

Another way to prove that your referral program is yielding a positive ROI is by measuring the customer lifetime Value (CLV) of referrals vs. customers acquired through other marketing strategies.

CLV is defined as the profit a business makes from a given customer, throughout their entire time as a customer.

Referred customers have, on average, a 25% higher CLV than other customers.

To use CLV to check referral program ROI, check the CLV of referred customers vs. non-referred customers.

Comparing CLV metrics will help compare the cost to other marketing funnels available to you. And if you find referrals’ CLV is higher, lower, or the same as the CLV of your other marketing channels, this could also help to inform the amount of rewards you’re willing to pay for a referral.

How do you calculate CLV?

There are two main methods that you can use to calculate customer lifetime value.

A. The basic method of calculating CLV

To estimate CLV in the simplest way, subtract the acquisition cost of an individual customer from the revenue your company has earned from that customer.

Total customer revenue – customer acquisition cost = CLV

B. Calculating customer value and average lifespan

Although this second method for calculating CLV takes longer, it’s a bit more accurate than the basic formula.

Step 1: Divide your company’s total revenue over a period of time by the number of purchases made over that period. This will give you the average purchase value.

Step 2: Divide the number of purchases over the period of time mentioned in step 1 by the number of unique customers who purchased during that time period. This will give you the average purchase frequency rate.

Step 3: Multiply the average purchase value by the average purchase frequency rate. This should give you customer value.

Step 4: How many years does a customer buy from your company? This should be the average customer lifespan.

Step 5: Finally, multiply customer value by the average customer lifespan.

This should give you the total average amount that your company can expect to make from a customer – your average customer lifetime value.

Other referral program metrics you can track

These other metrics are also useful in figuring out your referral program’s overall impact and health. Here’s how to check them.

1. Participation rate

Participation rate refers to the percentage of customers who have shared your brand through the referral program. This metric is also called the share rate.

Why measure the participation rate? It helps to monitor how well-targeted your referral program promotional strategy is. If your participation rate is lower than you expect, you might need to change your promotion channels or switch up your rewards.

2. Active engagement rate

This metric shows the percentage of your customers who regularly engage with your referral program. To calculate the active engagement rate, look at customers who have earned or spent the rewards in your store or on your website within a stipulated amount of time, as a percentage of total customers.

3. Conversion rate

The conversion rate is the percentage of referred friends who purchase from your business, based on the number of all referred friends who click a referral link.

For example, if 5,000 friends click a referral link and 500 of these friends end up purchasing, your conversion rate is 10%.

4. Referral rate

Referral rate measures the percentage of total purchases made that come from referred customers. This rate is usually calculated per month or year.

For example, if two out of every 100 purchases came from customer referrals last month, then your referral rate for that month would be 2%.

5. Brand awareness

Aside from calculating ROI on converted referrals, you also might want to consider other benefits to running a referral program, including increased brand awareness.

Referred leads are exposed to your brand when they click the link their friend sends them (whether or not they purchase right away). Now that they know what your brand can help with, they might come back and purchase later.

Measuring traffic generated from your program shows you if the messages and offers shared by your referring customers bring people to your website.

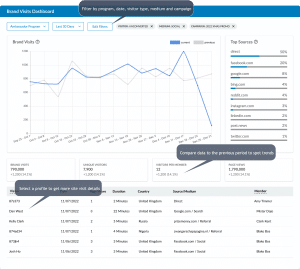

When you have the ability to track how many website visits your program generates — and see how those sessions convert — you can do a lot more to optimize your program and show its full impact. A recent dive into our data revealed that:

- On average, referral programs run on Referral Rock drove 1,388 referral visits (website sessions) per month on average.

- On average, referrals who do convert take just 25.6 hours (just over a day) to go from website visit –> paying customer

Referral Rock tracks the brand awareness you generate right on your dashboard, so you’ll always have full visibility of this important metric. You can check the number of referral visits (total referral link clicks) and the number of unique visitors who come through a referral link.

Estimating a future referral program’s ROI and break-even

What if you haven’t started a referral program yet? How can you measure the ROI you stand to generate?

Use our Referral Program Opportunity Calculator to estimate the amount of new revenue you could generate from a referral program before you invest in referral software.

And how many successful referrals do you need to break even on a referral program investment?

Say, for example:

- The cost of the software you plan to use is $400/month

- You plan to pay $20 as each referral incentive/reward

- You anticipate that the average revenue per referred customer will be $80

To estimate when you’ll break even on your program, you can use a calculation like this:

Cost of program / (value of referral – amount paid per referral) = break-even

400/(80-20) = 6.6

This means you’ll need 7 customers a month (84 customers a year) from referrals to break even on your program.

Calculating your reward cost

The rewards in a referral program should compensate customers for the effort they put in to make referrals.

Of course, you shouldn’t leave the potential new customer out of things, as rewarding newly referred leads helps increase your program’s customer acquisition rate.

Although the value of the reward should match the effort the individual puts into making a referral or becoming a referred customer, it should also be cost-effective for your business to offer. How to strike this balance? Here’s one way to decide how much to reward.

Deciding on reward cost: Using your CLV

To calculate the value of your reward, consider both the existing customer and the newly referred customer.

Normally, you’ll consider your average customer lifetime value, and then select a reward that reflects the value of a customer but that is still cost-effective. For instance, you might want to give a reward that’s valued at 10% of your CLV; if your average CLV is $750, you’ll select a $75 reward.

Deciding on reward cost: If you plan to offer a discount

But what if the reward is a discount (a percentage off of a purchase)? Here’s how to determine your overall reward cost.

Let’s say that:

- You want to give a 10% discount to both referring customers and newly referred customers.

- Your product or service has a plan that costs $50/month

Use this formula:

Reward cost = (number of months) x [(reward value for advocate x purchase cost) + (reward value for referred friend x purchase cost)]

12* ((0.1*$50) + (0.1*$50))

12* ((5+5))

12* 10 = 120

$120 is the reward cost.

Now, check this against your CLV to determine if this is a cost-effective reward.

If you want to calculate the value of a discount on a single fixed purchase, omit the “number of months” part of the calculation.

Deciding on reward cost: Based on ROI and program value

How much can you afford to reward each referral?

Let’s say that your referral program would bring in 300 new customers (out of 3,000 total people referred).

- The program has a conversion rate of 10%.

- The desired ROI from the program is 5x.

- The program generates a value of $50,000 per year in revenue.

- The maximum amount you want to spend on the referral program is $5,000.

- The LTV is $2000 for each customer.

- Theprojected cost of running the referral program, including software, is $2,000 per year.

There are several steps to calculate the aggregate amount:

Step 1: Calculate the expected referral program ROI

50,000/5,000= 10. This means that you’re generating a 10x ROI with the current spending on the program.

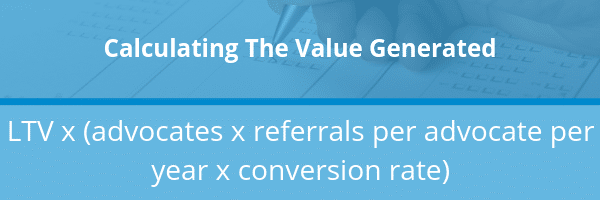

Step 2: Calculate the total value

2000 x (300 x 10 x 0.1) = $600,000. This is the total value you stand to generate from the program.

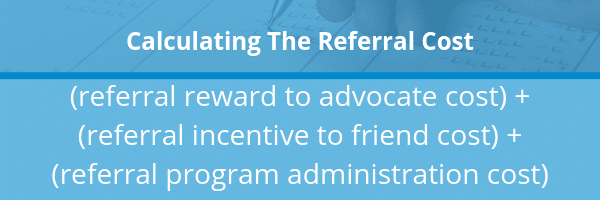

Step 3: Calculate the referral cost

If the referral program generated a value of $50,000 in a year and the desired ROI was 5x, then the maximum amount you can spend on your referral program that year is:

$50,000/5 = $10,000

If the maximum referral program cost is $10,000

Then: reward for advocate + reward for friend + administration cost of 2000 cannot exceed $10,000 per year.

If you’re spending $2,000 on administration costs, then you have $8,000 total to split between advocate rewards and referred friend rewards,

Since 300 new customers resulted from the referral program:

$8,000 (amount you can spend on rewards) /300 (new customers) = $26.66.

So, you might give $15 to each advocate per referral, and $10 to each newly referred friend.

Remember, the reward value should match the effort that customers will put into getting you new referrals.

See what a referral program could do for your business

Calculating your referral marketing ROI shows you whether your program is achieving the goals you set, or whether you need to take steps to better optimize your program.

If your program revenue is more than the costs of acquiring a new customer, or you find that referred customers have a higher customer lifetime value, then your ROI is positive.

For the best possible referral program ROI, choose a referral software (like Referral Rock!) that automates reward payouts and program promotions, then set rewards that reflect the value of a customer’s referral and that still respect your bottom line.

Interested in learning more about referral program tracking and automation? Check out these resources:

- How To Set Up And Track Referrals

- How To Automate Your Referral Program

- What Is A Referral Link And Do I Really Need One?