If you’re here, then you’re probably aware of affiliate marketing—the process of content creators (affiliates) placing links to your website within their own content and earning commissions whenever someone clicks on the link and makes a purchase. It’s an excellent marketing strategy to get more exposure for your business and generate more revenue.

But unfortunately, not every affiliate operates under a high standard of ethics – recruit an unethical affiliate, and you could become a victim of affiliate fraud.

Affiliate fraud is when shady affiliates abuse their power as influencers and try to cheat the system. This unscrupulous act can lead to revenue losses and make it harder for your customers to find you. So, taking the necessary steps to prevent affiliate abuse is essential.

In this article, we’ll cover what affiliate abuse is, the different ways it can happen, and what you can do to prevent affiliate fraud.

What is affiliate abuse?

Affiliate abuse, also known as affiliate fraud, is when an affiliate uses illicit and unethical methods to get a brand to pay them commissions that they haven’t earned. Affiliate abuse can include any violation of an affiliate agreement—from falsifying data and exaggerating sales to using hidden links for the program.

If you’re a victim of affiliate abuse, you’ll end up paying out commissions without generating meaningful leads and sales—which can quickly hurt your company’s bottom line.

Affiliate abuse is a big problem in the affiliate space because of those looking to make some quick cash. The fraudulent affiliates hurt the reputation of affiliate marketing as a whole. Even though the majority of all affiliates are honest and reputable, the few unethical affiliates cast all affiliates in a bad light.

Common types of affiliate abuse

Affiliate abuse is a serious problem in the affiliate marketing industry. Here are some common types of affiliate abuse:

1. Purchase fraud

This is when an affiliate makes lots of purchases from your site via their own affiliate link, but using stolen credit card information or other shady means. Their aim is to get you to pay out commissions without them doing any work – or even spending any of their own money.

Another variation of purchase fraud takes place when an affiliate purchases large quantities of products with their own money, but then tries to return them so they get a refund and an affiliate commission.

If an affiliate abuses their account by making fraudulent purchases, they’ll cost you money rather than generating revenue for you. Basically, they’re sending you fake clicks, leads, and sales that won’t help your business grow.

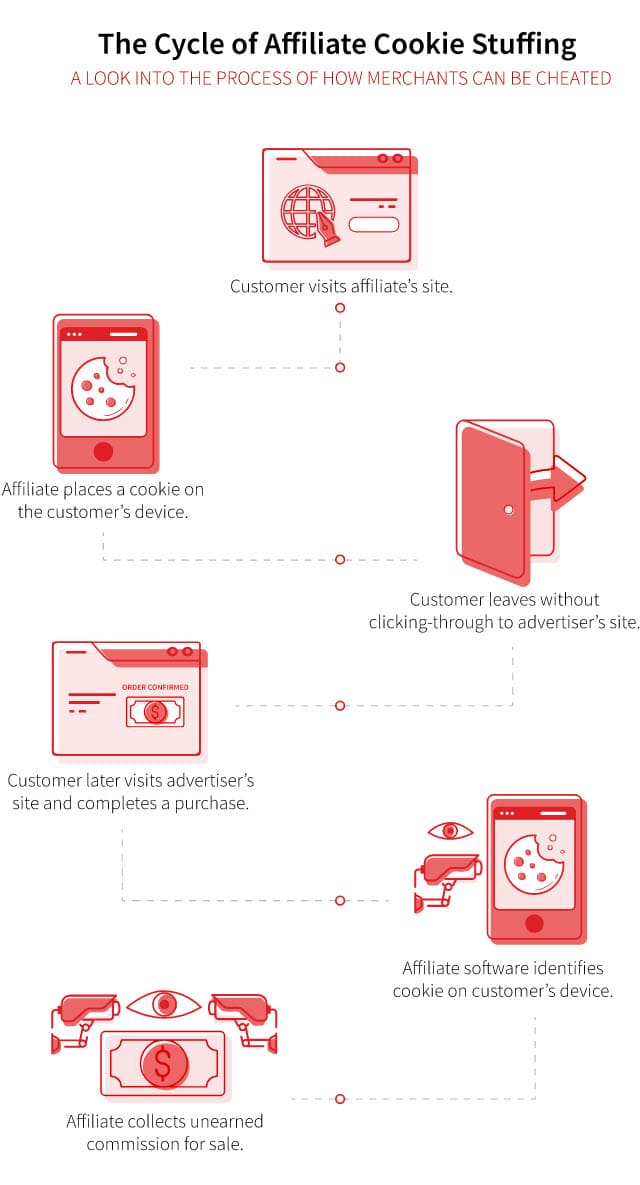

2. Cookie-stuffing

Cookie-stuffing is when an affiliate secretly installs fraudulent affiliate tracking cookies that let them earn commissions on products they didn’t help sell. Sometimes, cookie-stuffing is referred to as click fraud due to the fake attribution.

In other words, they drop their trackable affiliate link info into someone’s browser, even though the person browsing didn’t actually click through to your website from related affiliate content. If that person visits your site later on and purchases, the fraudulent affiliate gets a commission, even though their content didn’t actually lead to the traffic or the sale.

This could cause legitimate affiliates to lose out on commissions, since the fraudster’s cookies would override the legitimate affiliate’s tracking info.

3. Redirect fraud

Redirect fraud occurs when a fraudster earns commissions on a purchase made by hijacking and redirecting traffic from another site to their own. Traffic from legitimate affiliate sites can be diverted to the scammer’s site, so the fraudster earns commissions rather than the legitimate affiliate.

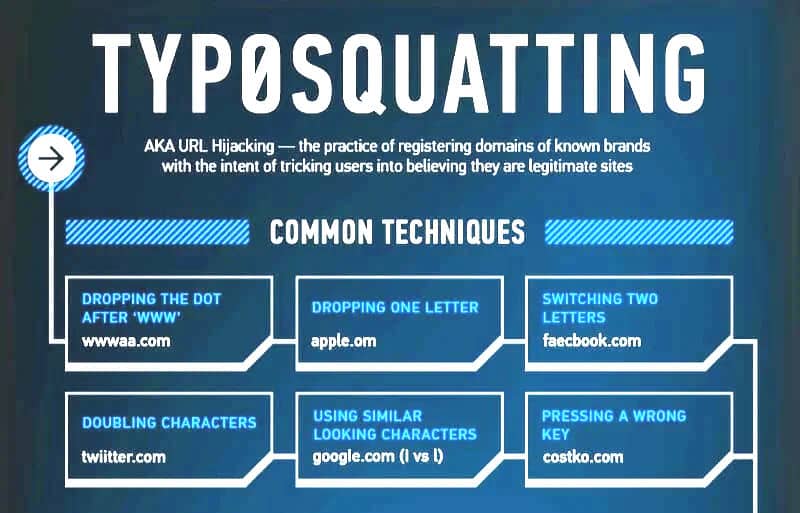

Fraudulent affiliates could also apply “typosquatting,” where they deliberately buy domain names that are just a few letters off from yours from different providers. Their hope is that someone will mistype your URL and end up at the fake site. For example, if your site is “yourwebsite.com,” the typosquatter might buy the domain “yourebsite.com.”

Then, they set up a fake cookie that contains their affiliate ID from your program, and redirect people to your website using their affiliate links. As a result, they can get commissions for sending you customers without actually doing the work.

They might also use bots or DNS poisoning. This is where scammers change the IP address associated with a legitimate affiliate’s domain name, so it points to their fraudulent site instead of the ethical affiliate’s.

4. Paid ad fraud

Paid ad fraud occurs when an affiliate pays for ads on your brand name keywords to drive more traffic and sales, even though you told them that this practice is against the rules of your program.

Sometimes they’ll falsely claim that you have authorized them to run ads using your brand name keywords, or that they were only running ads for other brands but accidentally ran an ad with your brand name.

5. Misrepresentation fraud

Misrepresentation fraud is another common type of affiliate abuse. It occurs when an affiliate drives traffic and sales by making deliberate false claims about your products or services.

For example, an affiliate might say that you offer free shipping when you do not. Or, they might say that your product does something which, in reality, it does not. Any form of misrepresentation calls for fraud prevention.

Any other violation of your affiliate terms and conditions is also misrepresentation fraud, since they aren’t following the procedures you want them to follow or representing you the way you expect.

How to stop affiliate abuse?

Identifying and preventing affiliate abuse starts with screening potential affiliates, and making your terms clear. Most importantly, though, it involves carefully looking at your affiliate data to see if anything suspicious is happening. Data protection impact assessments will help to minimize the risks.

Here’s how to stop affiliate fraud from happening:

Carefully screen affiliates before accepting them

Screening potential affiliates is the first step in preventing affiliate marketing fraud. If you don’t screen, you risk accepting affiliates who will try to game the system and steal from you.

It would be best to screen affiliates via the questions on an affiliate application, personal email outreach, or a Zoom interview. Make sure that your affiliates align with your audience, have a niche that matches yours, and have a quality, authentic website or social media account.

Additionally, it is important to use online business intelligence tools (like Alexa, Ahrefs, SEMRush, and SimilarWeb) to investigate potential affiliates’ traffic sources, traffic volume, and how they operate their channels.

Note that affiliates who focus on a narrow range of traffic sources (one to two) tend to be more reliable; affiliates with a broad variety of traffic sources may be more likely to cheat the system. This may seem surprising, but with affiliate marketing, it’s better to pick affiliates who have mastered and focused on the nuances of a single platform. It’s hard for someone to deliver proper ROI legitimately when they are juggling lots of channels.

Ask potential affiliates to share their reach and engagement numbers, including their follower count, number of comments, views, and more. Confirm that they know the marketing basics and can distinguish between ethical and unethical strategies.

It is also a good idea to ask potential affiliates about their experience with affiliate marketing and how they would promote your product if selected.

Create and enforce a clear affiliate agreement

An affiliate agreement outlines all the terms and conditions of your affiliate marketing program. It outlines what is and isn’t allowed when promoting affiliate links, and what you consider ethical and unethical practices. It also spells out what they can and can’t say about your brand.

In your agreement, it’s best practice to define specific activities that parties will not be allowed to do and how to resolve any disputes that arise. This will ensure that your brand is protected as much as possible.

Remember, this is a legally binding contract that affiliates must sign before starting to promote your brand. If an affiliate violates the terms of the agreement, you can cite the relevant clause and revoke the commissions that were earned fraudulently. You may also terminate the contract altogether if necessary.

Finally, ensure you revise your agreement frequently, and immediately notify affiliates of what has been updated. Then, get new digital signatures from affiliates to confirm compliance with the changes.

Only pay commissions for meaningful results

Only pay affiliate commissions on completed sales. Don’t offer commissions for views, clicks, or leads—this makes it easier for affiliates to game the system with fraudulent activities. Be sure to clearly define what constitutes a sale, and specify how long affiliates can earn commissions on a sale before their tracking cookie expires.

It’s also wise to define a time limit by which any product may be returned. Having a clear chargeback or refund policy will help prevent fraudulent affiliates from being able to purchase products and then return them for refunds.

Know how to spot possible fraud in your affiliate data

When running an affiliate program, you should be able to identify signs of fraudulent activities in your data. Sudden drastic spikes in traffic or conversion rates from one affiliate, an unrealistic influx of purchases made through one affiliate link in a day, and redirects that could be hiding the real traffic source (especially if you don’t recognize where they’re coming from) are all red flags.

A spike of purchases made by a single IP address is also a cause for concern; it indicates that one person is making all those purchases, possibly with stolen credit cards or other fraudulent methods.

If you closely track your affiliate data, you can better identify what looks suspicious (like when a typically low-performing affiliate suddenly brings abnormally high sales in a day). Attention to your program’s metrics will help you recognize what’s “normal” for every affiliate.

Affiliate software can provide in-depth data regarding all your affiliates’ performance, allowing you to spot irregularities and flag suspicious activity. Business intelligence tools can also be useful for affiliate fraud detection, when used along with affiliate software. These fraud prevention tools will help you analyze if the traffic an affiliate is generating is consistent with the realistic amount of traffic for the affiliate’s site – or if the numbers seem to be inflated.

If you find fraud, document the evidence and take action

Once you’ve identified that there may be affiliate fraud, you need to gather evidence quickly. This will help you build a case against the affiliate and make it easier to take action against them. It’s advisable to take screenshots of all evidence and issue a warning to the affiliate. Be sure to cite the appropriate part of your agreement, as they can dispute the claim otherwise.

Ordinarily, the first time suspicious activity occurs will lead to a warning. This way, if the alleged “fraud” was actually due to a glitch, the affiliate has a chance to make things right. However, a second violation, or any egregious violation, should result in immediate termination from the program. Using affiliate software will quickly let you block and remove shady affiliates from your program.

Use affiliate software to prevent fraud

Affiliate software can help you nip fraud in the bud when it occurs – and help stop it before it starts. It will collect and grant you access to robust data on your affiliate program’s performance. This way, you can identify abnormal data patterns that could indicate fraud, in real time, and flag this behavior. Plus, affiliate software will let you stop affiliates from getting credit for fraudulent self-referrals, and blocklist the domains of fraudulent affiliates permanently.

Affiliate software is a much better solution for combatting affiliate fraud, compared to an existing affiliate network. If you use an existing network, you won’t have access to the full suite of data you need to check affiliates’ sales patterns, because the networks own this data and can withhold whatever data they want.

Wrapping up

You now know what affiliate abuse is and how to spot it. And more importantly, you know how to prevent affiliate abuse from happening in the first place. Create and enforce a clear affiliate agreement, collect and use your data wisely, and use the right tool to manage affiliates and stop any fraud you find.

Combat affiliate fraud and run a scalable affiliate program with Referral Rock affiliate software. We’ll give you all the data you need to refine your program and protect your bottom line. Learn more, or request a demo.