“Do more audience research!”

“Listen to communities. Be part of the conversation!”

“Go where your customers are talking… Have you tried Reddit?”

Like us, you’ve probably heard all that advice over and over again. It’s not bad advice, it’s actually really good advice. But if we’re being honest, we haven’t taken much action on it, because our gut told us our category was a bit too niche.

We understand that Google’s landscape is changing, and community conversations are taking priority over brands’ content in search results. Plus, users are increasingly searching for answers – and products – on social and in forums, instead of starting with a traditional Google search. Some are even bypassing Google all together (maybe you’ve heard of this whole AI thing going on).

Here at Referral Rock, we decided to do a proper gut check to see for ourselves. We were hoping to understand where communities are having conversations about us and our category.

With our goal of being the clear market leader in referral software, it’s good to know what the pulse of the market is like.

Now on to our journey into the world of “social listening tools” and “brand mentions,” where we cover the software we tried and how we approached using them:

Setting the stage: Who we are & what we hoped to find

Referral Rock is a B2B SaaS that competes in the “referral software” category. In other words, without the fun acronyms, we sell a subscription-based software service to businesses to help them run “refer a friend” programs.

Let’s get real about our business:

- We solve a problem, but it’s not a hair-on-fire problem you see businesses needing to solve ASAP

- People understand what we do, but we’re often put in the “cool, I’ll do that later” bucket

- We’re a “considered purchase,” not an “impulse purchase” (people don’t just see an ad and click “buy,” as you would with many consumer purchases)

- People do search for referral related terms, but most of them are quite general and informational

There’s no single market leader in our industry for “referral software.” And even though we can run several types of programs that generate word of mouth, our SaaS is still very niche. We’re not in a market large enough to have its own communities and job titles, like the email marketing or CRM categories.

Our goal for social listening is to see what is being talked about and get an idea of our “share of voice” – see if there are opportunities for us to be part of conversations that exist, while trying to focus on “in market” potential buyers vs. the broader “need for awareness” stage.

What are we listening for?

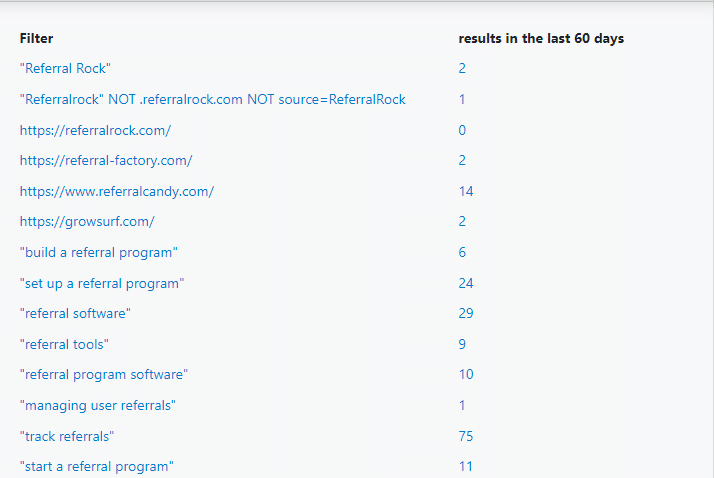

The conventional advice when looking for “in market” buyers is to monitor conversations with our brand name, as well as competitor names.

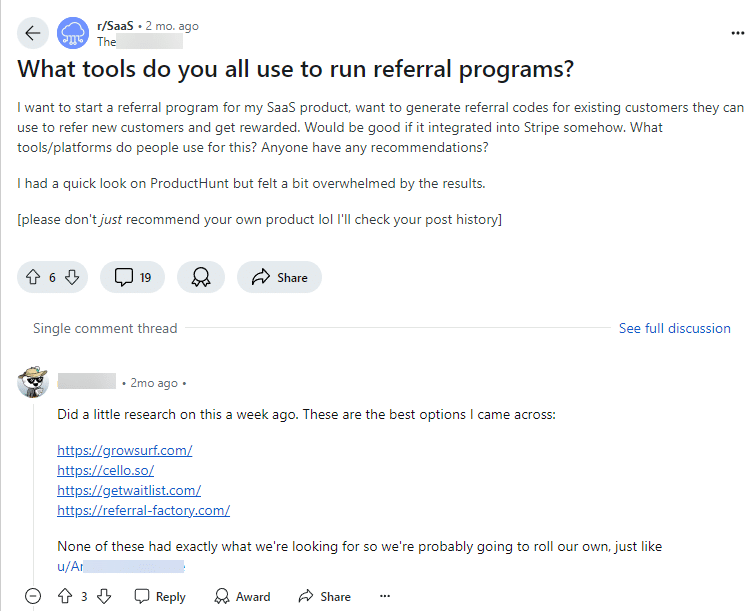

But since our business is a smaller, niche B2B SaaS, we figured that the most valuable conversations for our business wouldn’t mention Referral Rock (or any referral SaaS) directly. Rather, they’d indicate strong buyer intent – interest in building a referral program or finding referral software/referral tools.

Examples of the terms we looked for:

- “build a referral program”

- “set up a referral program”

- “referral software”

- “referral tools”

- “referral program software”

- “track referrals”

Where are we listening?

There are three main types of communities a brand can do social listening across: public communities, niche public forums, and private communities.

Public communities include social media, public forums and communities with a wide audience, blogs, and conversations across the wider web.

Niche public forums are public communities divided by interest or question, such as Quora, Stack Exchange, Product Hunt, and subreddits on Reddit.

Private communities include Slack groups, Indie Hackers, Dev.to, and other closed forums that the public can’t access without a login.

We planned to use both a public facing tool and private community tool to gauge how many conversations were really out there in each type of space.

Researching social listening tools

Given our business type and niche, we figured we’d need a tool that could monitor multiple conversation categories at the same time (both brand name and buyer intent mentions). Ideally, this tool would also let us monitor several similar, but distinct, keywords without us wasting too many keywords from our allotment.

We also considered the platforms each tool serves with an understanding that the prime conversations about our niche don’t take place on Instagram or TikTok. Instead, we predicted that most of the conversations we’d want to monitor (both with and without brand names) would take place in niche forums and public communities, such as Reddit, X and Facebook.

| Tool | Price starts at (monthly) | Checks public sites | Checks public social | Checks niche public forums | Checks private sites | Mentions/ month | Keywords |

| BrandMentions | $79 | Websites, blogs, forums, news | Facebook, X, Instagram, LinkedIn, YouTube | Quora, Reddit | no | 5k | 15 |

| Mentionlytics | $41 | News, blogs, forums, websites | X, TikTok, LinkedIn, Facebook, Instagram, YouTube | no | 5K | 3 | |

| Brand24 | $79 | News, blogs, forums | Facebook, Instagram, X | no | 2k | 3 | |

| Mention | $41 | News, blogs, forums | Instagram, X | no | 5k | 2 | |

| Awario | $29 | News, blogs, forums, websites | X, YouTube, Facebook, Instagram | no | 30k | 3 topics with unlimited KWs | |

| Buska | $69 | Websites, blogs, Google News | LinkedIn, Facebook, Instagram, X, YouTube, TikTok, Pinterest | Reddit, Product Hunt | Indie Hackers | unlimited | 10 |

| Syften | $40 | Forums, blogs, news | X (Twitter) | Reddit, Stack Exchange, Product Hunt, Hacker News, (Quora only on $100 plan) | Slack, Indie Hackers, Steemit, Lobster, Dev.to | ? | 20 |

Based on our initial criteria for public communities and budget, we chose to start with Awario.

For private communities and niche forums, we chose Syften – there aren’t many other tools that match its breadth of monitoring these spaces.

Starting our social listening experiment

Now that we knew which tools we wanted to use for social listening, how would we use the tools? And how did we plan on responding to relevant mentions?

Our main goal was to find people who could benefit from our software, based on pain points they were facing (or explicitly expressed interest in referral software). We would then share how our solution can help mitigate their pain points, in an organic way, by inserting our name into conversation replies.

We also planned to find our share of voice (how much we are talked about vs. how much other close competitors are talked about).

But with many competitors in the market, and many suited to only some of the use cases we cover, we thought share of voice would be difficult to track.

- Given that we only had three “projects” available through Awario, and chose to focus most on buyer intent keywords, we didn’t apply this idea while using Awario.

- We were able to check share of voice more closely with Syften, but largely using the URLs of our website and competing websites.

- Just using competitors’ names wasn’t helpful; this returned lots of irrelevant mentions, like people sharing their referral codes.

- There also weren’t many conversations as a whole where people in our target audience mentioned any referral software by name.

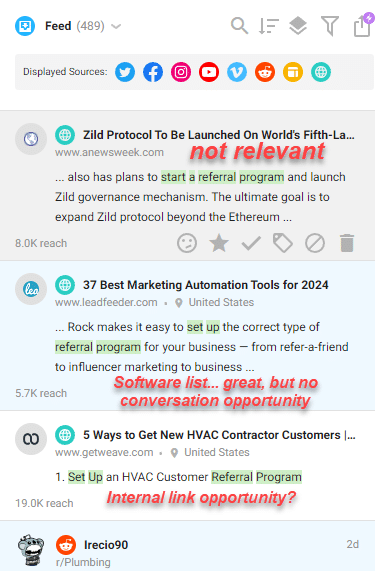

During our first week with Awario, we found yet another possible opportunity to use brand mentions. The idea was to find non-competing articles focused on marketing tips in a given industry, where referral programs are mentioned as a tip.

We thought maybe we could reach out and see if we could get a backlink. (For instance, if we found an HVAC marketing article where referrals are mentioned, we could suggest that they add a backlink to our HVAC referral program article.) But since we already have another reliable method for sourcing backlinks, this idea was ultimately scrapped.

What we learned about social listening in our category

After using these social listening tools for 2 months, we learned a few things about our category and what we would do differently. Here’s an overview of our findings after using Awario and Syften:

Hard to filter out the irrelevant mentions

There are two main types of referral marketing conversations on the web, each intended for a different audience. The first, the one we’re interested in, is focused on businesses that want to build a referral program. But the second type, and the one we don’t care about, advertises how consumers can join referral programs and make the most money possible (or involves consumers themselves sharing their referral codes).

Even with Awario’s feature that let us exclude irrelevant keywords of our choice, it was still hard to keep those irrelevant conversations from showing up in our feed. As both types of conversations used a similar set of keywords, it didn’t make sense to exclude very many terms. I tried excluding websites instead when it was clear they had the “make money” angle, but with so many sites out there, this felt like playing Whac-A-Mole.

Note: Putting a keyword in quotes means Awario searches for, or excludes, the exact keyword. If you don’t enclose it in quotes, Awario will also search for, or exclude, instances where the words are close to each other and in any order.

With Syften, the designers of that tool recommended that we focus on monitoring direct mentions of our URL and competitor URLs. They explained that direct backlinks in niche and private communities are the best sign of a relevant mention. We went that route, but still wanted to experiment with buyer intent keywords – would Syften be better at cutting through the noise?

Well… there still weren’t many relevant conversations out there, at least not many that mentioned referral software directly. And although a lot of the noise got cut out with the right filters, there were still several irrelevant conversations to sort through.

If your product or service has wide appeal (for instance, you’re selling an email tool or CRM), you might still do ok with monitoring buyer intent keywords. But we hardly found any true buyer intent as we were constantly sifting through the noise.

We realized LinkedIn wasn’t covered

Another thing to keep in mind is that Awario and Syften don’t identify LinkedIn mentions. So, you’ll need to check for mentions right in LinkedIn. The same goes for several other brand mention tools – they either don’t check LinkedIn, or you’ll need to pay more comparatively per month for a tool that does.

We didn’t expect many buyer intent conversations on LinkedIn despite being a B2B SaaS, so we didn’t think excluding LinkedIn would be an issue. But we had some strong buyer intent mentions during this time that we found through LinkedIn itself, including one that mentioned us as an option under consideration. You’re probably better off checking LinkedIn’s own mentions tab, although this only picks up mentions of your brand name. You’ll have to search for buyer intent keywords manually.

Again, none of these problems are the tool’s fault; it comes down to our market position and how niche we are. The problems we had with Awario likely extend to all businesses in our niche, as well as any B2B SaaS with a smaller market size.

There wasn’t a lot for us to listen to

Unfortunately, there weren’t many mentions involving buyer intent keywords, either. Referral marketing software has a smaller, more focused market than, say, email marketing. So, relevant conversations aren’t as common.

It’s not talked about much in public, and it isn’t talked about much in niche or private settings, either.

This also helped us realize these tools weren’t the best at giving us an accurate understanding of our “share of voice” as there wasn’t enough data.

Reddit results didn’t seem great

As much buzz as there has been about Reddit, these tools fell a bit flat. My guess is that they are focused on the “brand mention” side of the equation and surfacing areas where brands want to respond where they are mentioned in social media or blog posts.

A different type of social listening tool – one focused on finding relevant Reddit audiences first – might help us unearth conversations we should enter. And instead of looking for conversations about referrals, we might look for those about general word of mouth, or about acquiring new customers.

An emerging Reddit search tool called Gummysearch might be a good fit to try next, as it starts with curating relevant audiences and then lets you search for keywords as you wish. But once we’ve found the best subreddits to track, we might be ok with monitoring and searching them regularly on our own.

What I’d consider if you’re not in a smaller niche

Mention monitoring may work better with a wider market. Some larger SaaS businesses with a wide market, like MailChimp, might benefit from monitoring mentions of their brand name, to keep their finger on the pulse of their share of voice. But as we predicted, there weren’t many relevant conversations out there that mentioned our brand name, in any space (public, niche, or private).

How we’re proceeding

We’ve decided to cease using both Awario and Syften. Since these tools scan history (which we didn’t get much out of) and are good at surfacing new conversations (that there just aren’t many of), we didn’t feel it’s worth our time and attention to keep listening.

We’re happy we spent to time to understand these tools. Even if we didn’t find using these tools to be useful to us, knowing that helps us to understand where we want to go from here.

Considering Reddit for more community involvement

People aren’t talking about referral software much, but there are still lots of communities who could benefit from our product. We might shift our focus to a different type of community monitoring, and go “up the funnel.” This will involve finding communities with entrepreneurs and marketers who could benefit from running a referral program.

Rather than waiting for the mention or the referral-related discussion, we can then insert ourselves into the conversation first and get them thinking about referral software.

Overall this tactic plays more in the “awareness” vs. “in market” area of the funnel, which we honestly haven’t done a lot of. But maybe we should.

Considering other tools for share of voice

As mentioned in our findings, we may shift gears to other types of software (like SimilarWeb) to get an idea of our share of voice vs competitors. This will also help us monitor our goals in becoming the clear market leader in referral software.