Mortgage referral programs can help your lending service or mortgage brokerage grow its network of borrowers through trusted recommendations.

In this article, we’ll cover:

- The benefits of starting a mortgage loan referral program

- How to know if you’re ready to start one

- Best practices for mortgage referral programs

Let’s dive in!

What are mortgage referral programs?

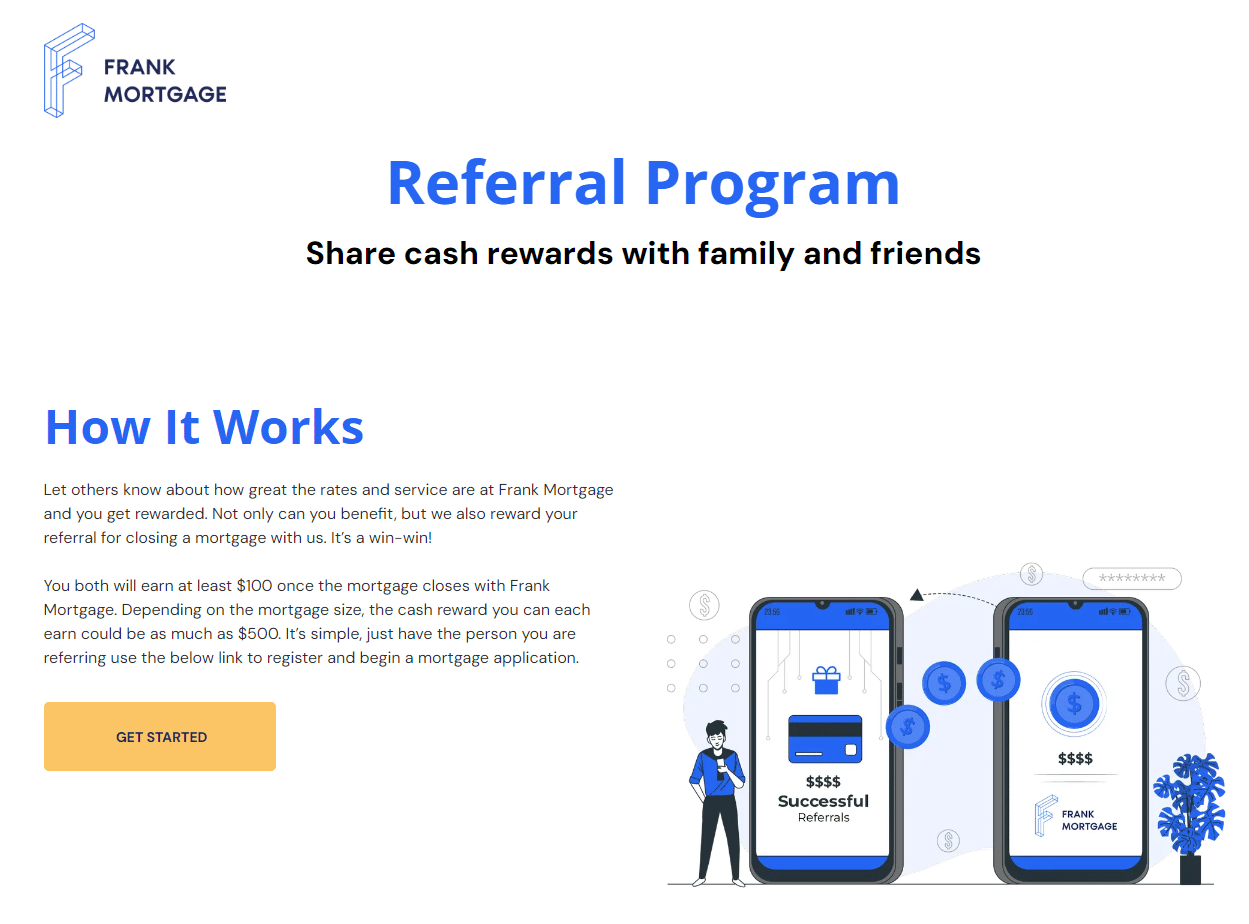

Mortgage referral programs encourage people to refer potential new borrowers, in exchange for cash commissions or other rewards. Often, these referral programs also offer cash incentives to the referred lead, applied towards the new mortgage loan, to encourage them to take out the loan.

It’s a win-win-win: people searching for a mortgage lender or mortgage broker get a recommendation from a trusted source, current borrowers can earn money towards their mortgage payment (or other incentives) in exchange for recommending you, and you gain new mortgage leads who are primed to borrow from you.

Why start a mortgage referral program?

Enhances your visibility: Referral programs enable borrowers to share information about your mortgage loans or brokerage services, leading to a swift and effective boost in brand visibility. When individuals seek a mortgage, they often don’t have specific lenders in mind. However, if they receive a recommendation from a friend, your services will be top of mind and easily recalled.

Builds trust: Referrals from peers are trusted far more than advertisements or messages from your brand. According to a Nielsen study, 84% of people consider referrals to be the most reliable and impactful form of advertising.

Consistently generates borrowers: Due to this trust, referred leads are more inclined to choose your services. People prefer to sign on with a lender that they’ve seen peers selecting. This results in warm, pre-qualified leads who are more likely to sign with you. Referrals have conversion rates that are four times higher than cold leads from other channels.

Simplifies referral tracking: A referral program allows you to instantly monitor the word-of-mouth generated by your borrowers, and use the insights to enhance your success. The most effective mortgage referral programs utilize automated software, making it easy to identify who made each referral.

Budget-friendly and low-risk: Mortgage referral programs attract new account holders at a lower expense compared to traditional mortgage marketing strategies. Additionally, you only incur costs when you achieve results, as incentives are provided only when a referral takes out a mortgage.

Referral software for mortgage lenders [Free Tools]

These referral tools for mortgage lenders are a free and easy way to help you start your referral program.

Free Tools + Services:

- Create your own referral codes - [Referral Code Generator]

- Track referrals manually - [Manual Referral Tracker - Spreadsheet]

- Build referral links - [Referral Link Generator]

- Get best practices and actionable guidance - [Referral Program Workbook]

- Readiness Assessment - [Free Consult]

- Online referral software - [Free Trial]

Want a automated referral system for your mortgage business? Uncover referrals in plain sight to smooth out business lulls, without losing focus on your real day to day work helping customers.

Check out our referral program software - done right.

Before you start a mortgage referral program

While the benefits of a mortgage loan referral program can be enticing, not everyone is in a position to kick one off. You’ll need to complete two key steps to ensure you’re worth referring in the first place.

First off, make sure to provide outstanding customer service. A fantastic customer experience is the main reason borrowers will want to recommend you – mortgage loans themselves are similar, so a stellar client experience will set you apart. You might want to consider surveying them about their experiences first to assess their willingness to refer you to others.

Next up, consider who in your network will promote your services to others. This includes current and previous buyers, but might also include people at non-competing but related businesses. For instance, local real estate agents might be willing to refer you as a trusted mortgage lender, especially if your mortgage business is well-established. And homebuilders and contractors will be happy to refer your mortgage loans, as this helps create qualified buyers and assists them in selling new homes.

Top mortgage referral program tips

Here’s our expert advice for starting a successful mortgage referral program:

Select impactful rewards

Rewards play a crucial role in motivating individuals to refer others to your mortgage services. They should be substantial enough to convey the value of a referral, yet affordable enough for you to provide consistently. Ensure that the reward aligns with your budget and is comparable to or less than your average borrower acquisition cost.

The most effective mortgage loan referral programs offer rewards for both parties involved. Provide incentives to the referrer for bringing in a new borrower, and also reward the new borrower once they close or make their initial payment.

What type of reward should you consider? In a mortgage referral program, cash is often the most appealing option for both parties. This commission-based model allows referrers to use the cash towards their loan payments, or for any other purchases they desire. And if the referrer isn’t a current borrower, cash is a great choice because it isn’t tied back to the mortgage.

Of course, if you’ve tailored a reward to current buyers, you might give them the option for the reward to go directly towards the next month’s payment.

Some lenders opt for gift cards, which give the recipient the flexibility to spend the money as they wish. This can be particularly effective when the referrer does not currently have a mortgage loan, or is a business partner.

Decide on your reward structure

It’s best to promptly reward the referrer as soon as one of their referrals closes (signs the mortgage contract), and continue to provide rewards for each successful referral they make.

Additionally, depending on the specific actions you want your new customers to undertake, you might think about giving a second reward to the referrer after the new borrower completes their first payment.

This method, which involves offering rewards at different stages (when an account is created and when value is realized), is referred to as a multi-step referral program.

However, you’re not limited to a multi-step approach. You could also create tiered rewards – incentives that increase in value after a member refers a certain number of new borrowers.

Another option is to provide varying levels of referral rewards – or different cash amounts – based on the value of a mortgage. With a percentage commission structure, referrals for higher-value mortgages yield bigger rewards.

Referral Rock is flexible enough to support any reward structure you decide on, including tiered rewards, multi-step rewards, and different rewards based on loan amounts.

Make sharing super-easy

To boost engagement in your referral program, ensure it’s easy to use and share.

- Outline the program in three to four simple steps for clarity.

- Highlight the benefits of sharing, including both rewards and intrinsic benefits.

- Clearly state when clients will receive their rewards to prevent any misunderstandings.

- Keep your program page tidy, avoiding excessive text or distractions.

- Make sure there’s a prominent call to action (CTA) that motivates sharing.

Additionally, aim to reduce the effort needed to make a referral.

- Provide multiple sharing options that align with how people typically communicate, such as through email, social media, and text messages.

- Supply a referral link that clients can easily copy and share anywhere – referral software can generate these links effortlessly.

- Pre-write a friendly message for clients to send to their friends, ensuring it feels personal and conversational.

- If you let people make mortgage payments via an app, integrate the program into the app for even easier sharing.

Referral Rock’s One Click Access links simplify the process even further, allowing people to start sharing immediately without filling out an enrollment form. No need for people to sign up for the referral program – they’re already part of it! Be sure to include these links in all your promotional emails for the program.

Promote your program

More participants in your program leads to increased referrals and revenue, so it’s crucial to promote your program and its benefits at every user touchpoint.

To enhance your promotional strategy, concentrate on the channels that your users interact with most often. Here are some suggestions to help you get the message out about your program:

- Integrate referral promotions directly into your mortgage payment portal. Include links to the program within your portal for easy access.

- Send out bulk emails to all users, focused on promoting your program, to attract new users and keep the program in their minds.

- Add brief promotions for your referral program in payment due emails, payment receipt emails, balance notifications, newsletters, and other routine communications.

- Place a noticeable banner or hero image on your website homepage that links directly to your referral landing page.

- Consider subtle promotion methods on your website, such as placing a link in the footer or menu. If users can easily find and access it, they are more likely to join your program.

- Share updates about your referral program on your social media platforms.

Re-engage your existing users

It’s also important to keep your referral program top of mind for users who have already signed up but may need a little nudge to keep sharing. One effective method is to use automated emails sent at key moments.

For instance, you could send a reminder email 3-5 days after someone joins your program, congratulate members via email whenever they earn a reward, and utilize Referral Rock’s Monthly Summary emails, which offer a personalized overview of each member’s referral activities every month.

You might also promote your offer when a user reaches a specific milestone, such as at the year mark of taking out the home loan, or after completely paying off their mortgage. Look for those “aha” moments when engagement is high, and users recognize the value of your service.

Additionally, keep sending out promotional emails about your referral program – at least once a month during the first year. After that, send these promotional emails at least quarterly, along with using other promotional strategies.

Keep a close eye on ROI

It’s essential to monitor, test, analyze, and refine your program. Marketers need to focus on important metrics – awareness, shares, reach, and referrals – to evaluate how well the referral program is performing, spot areas that need improvement, and understand its overall worth.

Additionally, it’s important to compare your costs with your revenue: the expenses for rewards and the operational costs of the program against the sales you generate. If the revenue from referrals exceeds your customer acquisition cost (CAC), you’re seeing a positive return on investment (ROI) from your referral program. This information should guide your future strategies.

Consider running a separate program for partners

As mentioned earlier, current and previous borrowers aren’t your only possible referral source. Representatives from related but non-competing businesses, like homebuilders and real estate agents (realtors), are also great sources of referrals.

If you plan on having different sources of referrals – borrowers and business reps – you might run two separate programs. After all, business reps will likely prefer different reward types (say, you might offer percentage commissions to business reps and gift cards to current and previous borrowers.) And with a business rep referral program, you can let these reps directly add referrals, and function as true, long-term referral partners.

Track referrals with the right software

With referral software tools, you can easily monitor how many referrals people are bringing in, identify the sources of those referrals, and swiftly distribute rewards. You’ll also gain valuable insights into your referral program, allowing you to assess its effectiveness and make necessary adjustments.

Referral Rock software simplifies the design, tracking, rewarding, and promotion of your program:

- Set up quickly: Referral Rock lets you set up your program in days (not months), with expert support at every step.

- Fully customize rewards: Choose any reward type and structure you wish, including multi-step and tiered rewards.

- Automate reward payouts: Send incentives right when they’re earned to keep customers happy. Automate multi-step payouts by connecting with your CRM.

- Streamline promotions: Strategic, automated promotional emails keep customers engaged, and the One Click Access links inside make sharing even easier.

- Integrate with key tools: Seamlessly integrate Referral Rock with over 50 tools, including your CRM.

- Track referrals seamlessly: Unique referral links for each customer let you track exactly where each referral came from. Plus, customers can track referrals they send with their own personal dashboards.

- Collect program data: Measure your program’s success at a glance, and make informed adjustments and improvements.

Create your own mortgage referral program

Establishing a mortgage referral program allows you to tap into the power of personal recommendations to bring in new borrowers. This type of program offers several advantages, such as straightforward tracking of referrals, heightened visibility for your services, the chance to gain loyal clients, cost efficiency, and minimal risk. Make sure to offer appealing rewards for referrals, consistently promote your program, and simplify the sharing process.

Find out more about how Referral Rock can help you build the best customer referral program >